Key Takeaways

- Ongoing shifts away from paper and regulatory pressures on packaging limit revenue growth, increase investment needs, and compress margins across the business.

- Heavy dependence on mature North American markets and lagging infrastructure investment weaken competitive positioning and threaten both earnings and dividend stability.

- The company's operational transformation, manufacturing investments, and commercial focus aim to drive margin expansion, sustained cash generation, and resilient growth amid robust demand trends.

Catalysts

About International Paper- Produces and sells renewable fiber-based packaging and pulp products in North America, Latin America, Europe, and North Africa.

- The persistent shift to digital communications and ongoing decline in demand for traditional paper products continues to pressure core legacy segments, resulting in a structural and likely permanent annual volume decline and ultimately capping the company's revenue potential in these areas.

- The global regulatory momentum away from single-use packaging and heightened scrutiny of deforestation will drive ongoing compliance costs and capital investment requirements, which may erode net margins and free cash flow even as International Paper pivots toward fiber-based solutions.

- Heavy reliance on the slow-growing North American market, paired with insufficient exposure to faster-growing international regions, will constrain topline revenue growth relative to industry peers as packaging demand shift accelerates toward emerging markets.

- Consistent underinvestment in manufacturing infrastructure and ongoing mill reliability issues signal a need for sustained and possibly escalating capital spending, putting durable pressure on free cash flow and threatening the company's ability to maintain current levels of dividend growth or manage debt load effectively.

- The packaging sector faces intensifying competition from alternative materials and low-cost international producers, while ongoing volatility in wood, pulp, and energy costs further threatens sector profitability and introduces margin compression risk that could persistently weigh on future earnings.

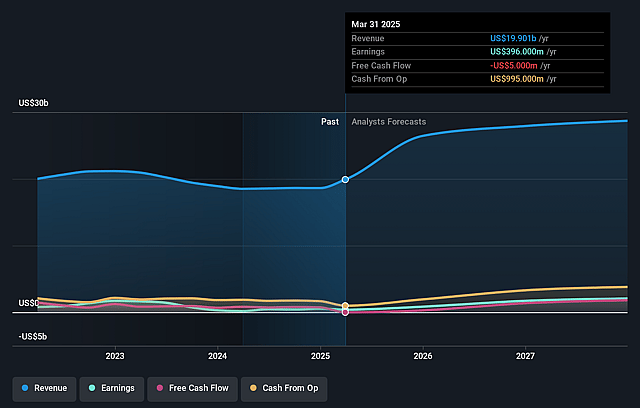

International Paper Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on International Paper compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming International Paper's revenue will grow by 6.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -0.1% today to 7.4% in 3 years time.

- The bearish analysts expect earnings to reach $1.9 billion (and earnings per share of $3.38) by about September 2028, up from $-27.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 17.3x on those 2028 earnings, up from -942.0x today. This future PE is lower than the current PE for the US Packaging industry at 22.2x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.17%, as per the Simply Wall St company report.

International Paper Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- International Paper is executing a multi-year transformation strategy focused on operational excellence, cost reduction, and portfolio optimization-including strategic divestitures, 80/20 deployment, and aggressive efforts to close the market share gap in North American packaging-which could drive sustained margin improvement and boost long-term earnings.

- The company is investing significantly in mill reliability, automation, and advanced manufacturing capabilities, which, as improvements accumulate, could enable higher utilization, cost leadership, and greater free cash flow over time, providing upside to net margins and cash generation as reliability issues are resolved.

- Strong secular demand factors-including global e-commerce growth, increased consumer preference for sustainable fiber-based packaging, and expanding emerging market consumption-support continued volume resilience for International Paper's core businesses, which may contribute to stable or rising revenues in the long term.

- Management's success in winning large, strategic accounts and restoring service and quality reputation in North America (and growing strategic wins in EMEA) points to the potential for ongoing commercial momentum, which is likely to support topline growth and profitability improvements.

- Continued focus on shareholder value, as evidenced by discipline around capital allocation (funding reinvestment from internal sources, not diluting shareholders), strategic asset consolidation, and maintaining a competitive dividend, could underpin total shareholder returns and support share price stability or growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for International Paper is $42.1, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of International Paper's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $63.0, and the most bearish reporting a price target of just $42.1.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $26.2 billion, earnings will come to $1.9 billion, and it would be trading on a PE ratio of 17.3x, assuming you use a discount rate of 7.2%.

- Given the current share price of $48.17, the bearish analyst price target of $42.1 is 14.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.