Key Takeaways

- Rapid execution, integration synergies, and plant optimization position International Paper to capture share and outperform typical industry growth rates and margins.

- Emphasis on sustainable, value-added packaging enhances pricing power, cash flow stability, and resilience to cost fluctuations as demand shifts favorably.

- Digitalization, environmental pressures, competition from alternative materials, aging infrastructure, and eroding pricing power collectively threaten profitability and sustainable long-term growth.

Catalysts

About International Paper- Produces and sells renewable fiber-based packaging and pulp products in North America, Latin America, Europe, and North Africa.

- Analysts broadly agree that 80/20 execution and commercial wins will close the industry volume gap, but this may be understated, as early momentum indicates International Paper could not only match but significantly surpass market growth-potentially capturing outsized share from less agile competitors, creating a step change in revenues and market share.

- The consensus expects substantial cost and synergy benefits from the DS Smith integration, but the actual upside could be far greater; the rapid pace of plant closures, reorganization, and capital redeployment hints at accelerated margin expansion, enabling net margins to scale ahead of expectations as both organizations outperform integration targets.

- International Paper is positioned to outperform from multi-year investments in automation, mill upgrades, and supply-chain optimization, with a clear pathway to industry-leading cost-to-serve and reliability-translating to higher, more stable net margins and cash flows, even as input costs fluctuate.

- Growing global demand for sustainable, fiber-based packaging-driven by e-commerce adoption and consumer/regulatory tailwinds-is likely to shift pricing dynamics in favor of International Paper, granting the company premium pricing power and long-term revenue growth far above baseline industrial expectations.

- International Paper's sharpened focus on value-added packaging segments, including food-safe and e-commerce-ready boxes, amplifies its exposure to the fastest-growing niches in the market, increasing average selling prices and operating margins, while industry consolidation and rationalization reduce competitive pressures and stabilize earnings.

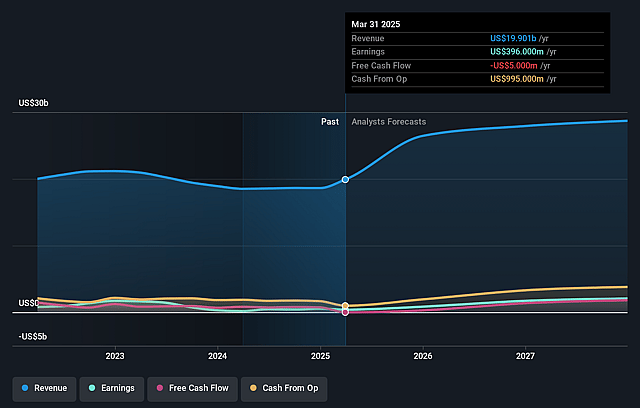

International Paper Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on International Paper compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming International Paper's revenue will grow by 12.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -0.1% today to 9.5% in 3 years time.

- The bullish analysts expect earnings to reach $2.9 billion (and earnings per share of $5.53) by about September 2028, up from $-27.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 17.2x on those 2028 earnings, up from -916.7x today. This future PE is lower than the current PE for the US Packaging industry at 22.2x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.2%, as per the Simply Wall St company report.

International Paper Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing decline in demand for printing and writing paper due to digitalization represents a structural headwind that reduces International Paper's historical revenue base and makes long-term volume growth in these categories unlikely.

- The momentum in e-commerce packaging may be reaching a plateau while competing materials like compostable plastics and reusable systems are gaining share, raising the risk of decreased demand for traditional corrugated packaging and undermining future revenues and earnings.

- International Paper faces heightened regulatory and consumer expectations around environmental concerns such as deforestation, carbon emissions, and recycling rates, which could result in significant compliance costs and reduced market opportunities, thereby pressuring net margins and limiting earnings growth.

- The company's aging mill infrastructure, persistent mill reliability issues, and the admitted need for accelerated reinvestment highlight high capital intensity and ongoing execution risk, likely requiring large and continual capital expenditures that may constrain free cash flow and reduce returns on invested capital.

- Excess capacity and over-competition in core segments, combined with recent price softness in Europe and difficulties securing or maintaining price increases, signal eroding pricing power and intensifying commoditization, which could compress net margins and limit sustainable earnings growth over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for International Paper is $63.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of International Paper's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $63.0, and the most bearish reporting a price target of just $42.1.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $30.8 billion, earnings will come to $2.9 billion, and it would be trading on a PE ratio of 17.2x, assuming you use a discount rate of 7.2%.

- Given the current share price of $46.88, the bullish analyst price target of $63.0 is 25.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.