Last Update07 May 25Fair value Increased 2.44%

Key Takeaways

- Expansion in specialty plastics and chemicals, combined with automation and cost-saving initiatives, positions Dow for higher margins and sustained revenue growth.

- Focus on sustainability, diversified markets, and operational efficiency enhances resilience and enables premium pricing despite changing global economic conditions.

- Reliance on traditional feedstocks, regulatory risks, market shifts toward sustainability, supply chain volatility, aging assets, and rising competition all threaten Dow’s long-term profitability and market position.

Catalysts

About Dow- Through its subsidiaries, provides various materials science solutions for packaging, infrastructure, mobility, and consumer applications in the United States, Canada, Europe, the Middle East, Africa, India, the Asia Pacific, and Latin America.

- Completion of new higher-margin capacity projects in Packaging & Specialty Plastics and Industrial Solutions by mid-2025 positions Dow to meet robust demand stemming from population growth, urbanization, and expanding infrastructure investments globally, which should lift both volumes and future revenue growth.

- Dow is leveraging its leadership in advanced and recyclable plastics—an increasingly regulated and in-demand area driven by sustainability initiatives and circular economy targets—allowing them to command premium pricing and improve net margins as end customers and regulators prioritize sustainable solutions.

- Substantial investment in automation, artificial intelligence, and data analytics across Dow’s global operations will enhance manufacturing efficiency and optimize supply chains, supporting sustained reductions in cost per unit and long-term margin expansion.

- Strategic ongoing cost reductions, asset rationalizations in Europe, and a $1 billion annual cost savings program by 2026 are set to structurally boost operating margins and free cash flow, increasing earnings resilience across economic cycles.

- Dow’s global geographic reach, feedstock flexibility, and specialty chemicals expansion—particularly in high-growth regions—provide resilience and open access to a diversified set of end-markets such as renewables, health and hygiene, and high-value packaging, supporting both topline growth and stability in earnings even as macro conditions fluctuate.

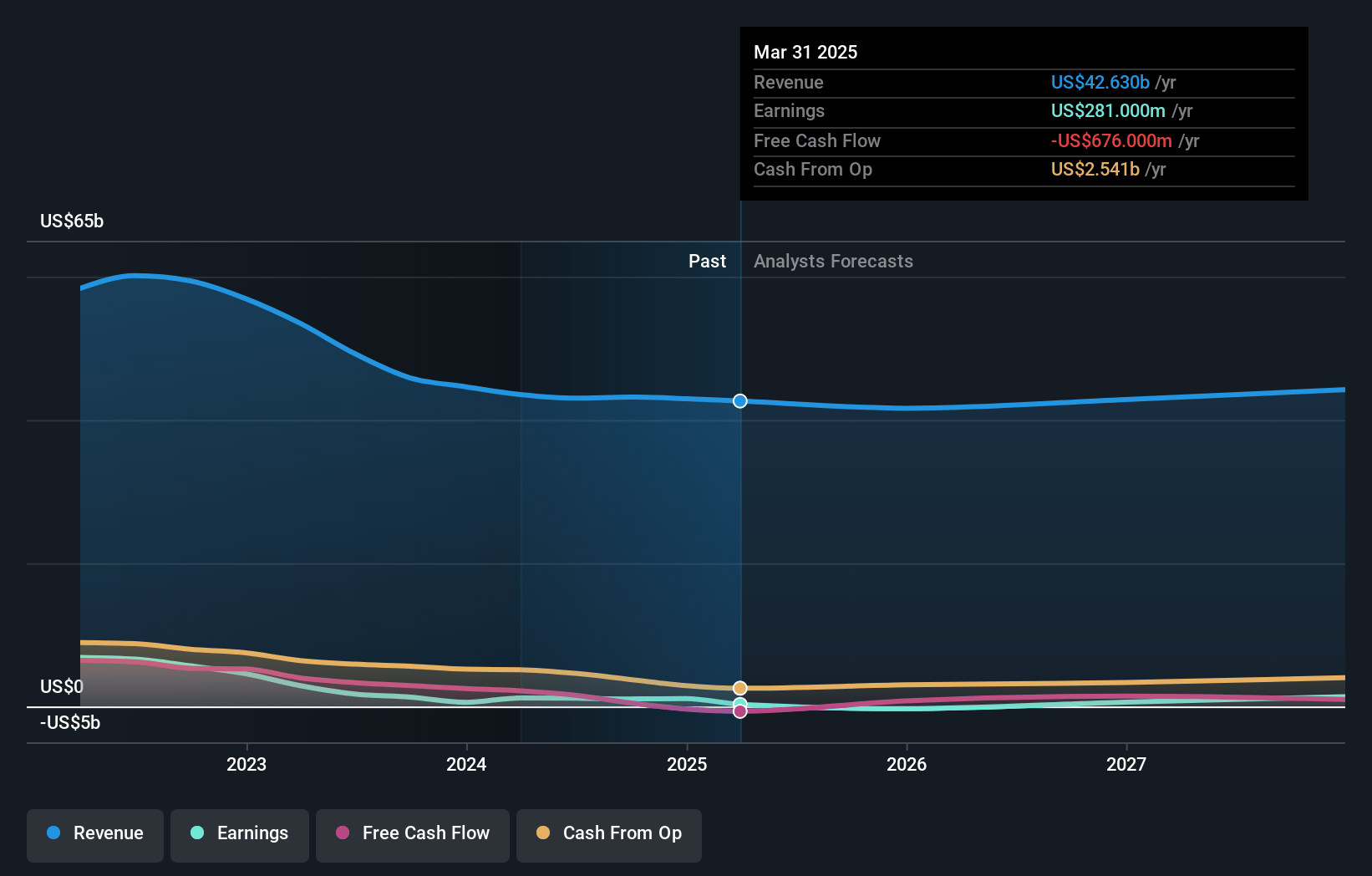

Dow Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Dow compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Dow's revenue will grow by 3.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 0.7% today to 4.7% in 3 years time.

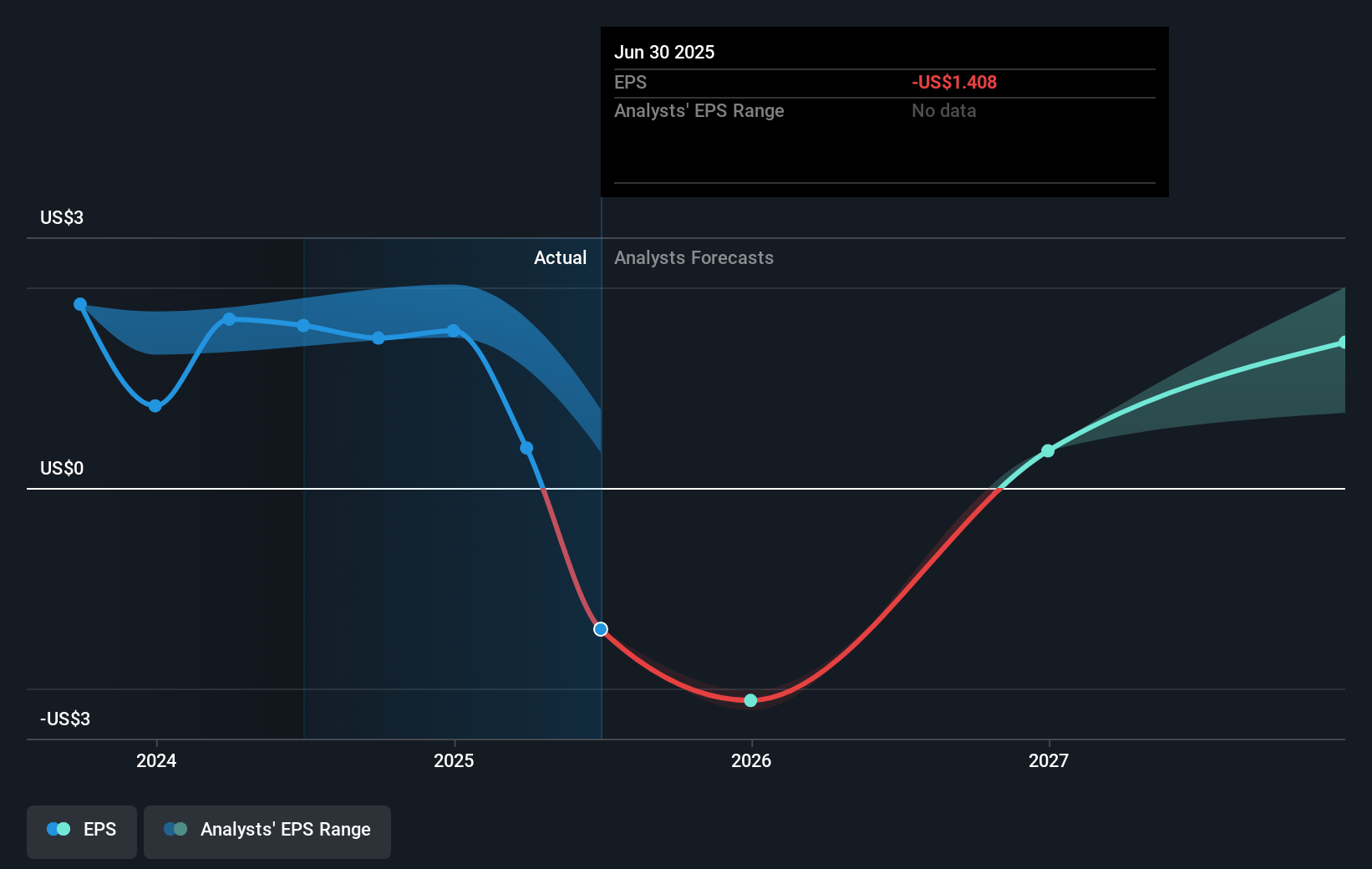

- The bullish analysts expect earnings to reach $2.2 billion (and earnings per share of $2.99) by about May 2028, up from $281.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 24.3x on those 2028 earnings, down from 72.4x today. This future PE is greater than the current PE for the US Chemicals industry at 20.2x.

- Analysts expect the number of shares outstanding to grow by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.47%, as per the Simply Wall St company report.

Dow Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Dow’s continued reliance on fossil-fuel-based feedstocks and delayed investment in its Path2Zero decarbonization project increase exposure to future regulatory, carbon taxation, and compliance costs, which could erode net margins and require higher capital expenditures.

- Secular shifts towards a circular economy and the growing demand for sustainable products threaten long-term demand for Dow’s virgin plastics and traditional chemicals, risking revenue declines in key polymer and packaging segments.

- Ongoing geopolitical tensions and evolving global trade dynamics, such as uncertainty over tariffs between the US and China, disrupt Dow’s supply chains and create volatile input costs, leading to unpredictable pressures on revenues and earnings.

- High capital intensity and an aging asset base, particularly in Europe, may require disproportionate reinvestment or lead to operational inefficiencies and shutdowns, increasing capital expenditures and potentially diminishing free cash flow and overall earnings.

- Increased competition from lower-cost producers in Asia and the Middle East, along with slow industry-wide adoption of advanced recycling and high-value specialty chemicals, could lead to pricing pressures and potential product obsolescence, undermining Dow’s future revenue base and market share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Dow is $57.9, which represents two standard deviations above the consensus price target of $37.27. This valuation is based on what can be assumed as the expectations of Dow's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $63.12, and the most bearish reporting a price target of just $27.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $46.6 billion, earnings will come to $2.2 billion, and it would be trading on a PE ratio of 24.3x, assuming you use a discount rate of 8.5%.

- Given the current share price of $28.8, the bullish analyst price target of $57.9 is 50.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.