Key Takeaways

- Structural shifts toward renewables, regulatory pressures, and investor scrutiny threaten revenue growth, limit financing options, and increase operational and financial risks.

- Limited operational control and industry consolidation place further pressure on margins, bargaining power, and the company’s ability to maintain stable long-term returns.

- Strong operational efficiency, strategic diversification, and disciplined financial management position Granite Ridge Resources for resilient growth, stable cash flows, and enhanced long-term shareholder value.

Catalysts

About Granite Ridge Resources- Operates as a non-operated oil and natural gas exploration and production company.

- Global policy momentum and accelerating cost declines in renewable energy technologies threaten to permanently erode demand for oil and gas, which will lower long-term hydrocarbon asset values and could reduce Granite Ridge Resources’ future revenue base significantly.

- Escalating ESG investor scrutiny and tightening capital markets for fossil fuel companies will likely raise the company's borrowing costs and restrict the ability to finance new acquisitions or developments, directly pressuring both future investment-driven growth and net margins.

- As a non-operator, Granite Ridge faces persistent limitations in controlling costs and operational efficiency, making it more vulnerable to margin compression as regulatory and cost pressures mount across the industry.

- Natural reservoir decline and reserve depletion mean that, without successful and increasingly expensive acquisitions, production volumes could structurally decline over the coming years, resulting in falling topline revenues and weakened earnings power.

- Ongoing consolidation among larger industry players is expected to reduce smaller companies’ negotiating leverage and exacerbate competitive disadvantages, which may negatively impact Granite Ridge’s realized prices, margin sustainability, and capacity to deliver stable long-term shareholder returns.

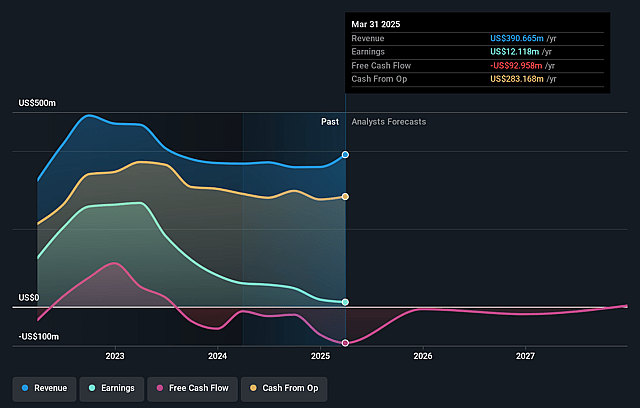

Granite Ridge Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Granite Ridge Resources compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Granite Ridge Resources's revenue will grow by 14.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 3.1% today to 23.4% in 3 years time.

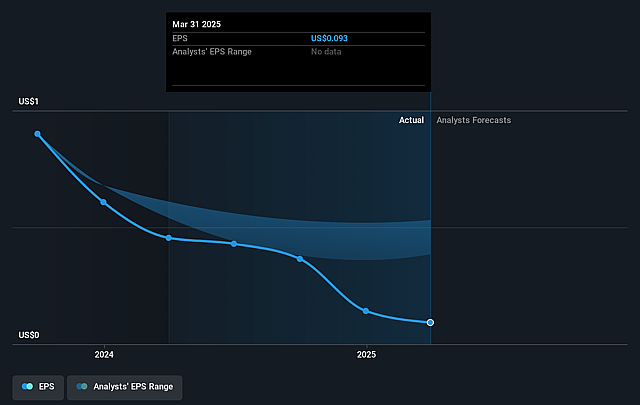

- The bearish analysts expect earnings to reach $135.3 million (and earnings per share of $1.04) by about July 2028, up from $12.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 6.5x on those 2028 earnings, down from 67.9x today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.4x.

- Analysts expect the number of shares outstanding to grow by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.67%, as per the Simply Wall St company report.

Granite Ridge Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Granite Ridge Resources has consistently demonstrated strong operational execution, with a 23 percent year-over-year increase in production and robust well performance across diversified basins, which can translate into sustained top-line revenue growth and improved earnings over the long term.

- The company’s focus on geographic and hydrocarbon diversity, including a balanced oil and gas portfolio and flexible Operated Partnership models, enhances resilience against commodity price volatility and helps stabilize cash flows and net margins through different market cycles.

- Repeatable reductions in lease operating expenses per barrel of oil equivalent, driven by increased scale and operational efficiency, directly improve operating margins and position the company for stronger earnings growth over time.

- Active capital discipline, conservative leverage (with a low net-debt-to-EBITDAX ratio), and a strong hedge book provide significant financial flexibility, allowing Granite Ridge to maintain or potentially grow dividends and reinvest for accretive growth, thereby supporting shareholder value.

- The ability to capitalize on opportunistic acquisitions, maintain a growing inventory across premier U.S. basins, and the proven success in partnering with top-tier operators all position Granite Ridge to achieve higher long-term returns on capital, supporting sustained revenue, margin strength, and potential increases in share price.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Granite Ridge Resources is $5.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Granite Ridge Resources's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $5.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $578.3 million, earnings will come to $135.3 million, and it would be trading on a PE ratio of 6.5x, assuming you use a discount rate of 6.7%.

- Given the current share price of $6.28, the bearish analyst price target of $5.5 is 14.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.