Key Takeaways

- Diversified assets and an efficient, non-operator model position the company for stable cash flow, expanding margins, and superior capital returns as industry fundamentals strengthen.

- Strategic presence in top-tier US shale basins, along with drilling advancements, supports sustained production and enhances long-term earnings growth potential.

- Reliance on hydrocarbon assets, high dividend payouts, regulatory pressures, and partner risk could constrain Granite Ridge’s long-term growth, margins, and financial flexibility.

Catalysts

About Granite Ridge Resources- Operates as a non-operated oil and natural gas exploration and production company.

- Surging global energy consumption, particularly from fast-growing economies, is expected to underpin structurally higher oil and gas prices; Granite Ridge’s balanced and diversified hydrocarbon mix positions it to capture increasing realized revenue as demand and commodity prices rise.

- Underinvestment in new global oil supply and supply-side constraints, amplified by decarbonization trends outside the US, favor well-run domestic producers—enabling Granite Ridge to maintain higher net margins and enjoy premium pricing as long-term fundamentals continue to tighten supply.

- The expanding use of oil and gas as critical feedstocks in the chemical and industrial sectors is creating a durable baseline for demand growth, supporting Granite Ridge’s stable cash flows and enhancing earnings visibility over a multi-year horizon.

- Granite Ridge’s asset-light, non-operator model—paired with disciplined capital allocation and a portfolio of high-quality, low-decline wells—enables superior capital efficiency and consistent free cash flow generation; as scale increases and costs decline further, net margins and return on equity are likely to expand.

- The company’s strategic positioning in top-tier US basins with resilient shale resources, combined with advancements in drilling efficiency and a robust project pipeline, is set to drive sustained production growth, elevating both revenue and long-term earnings potential.

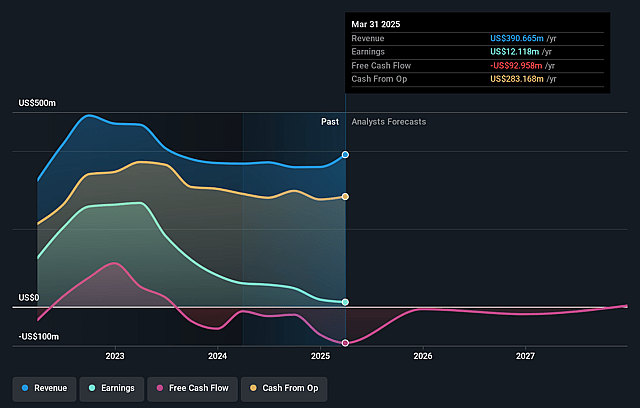

Granite Ridge Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Granite Ridge Resources compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Granite Ridge Resources's revenue will grow by 13.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.1% today to 20.9% in 3 years time.

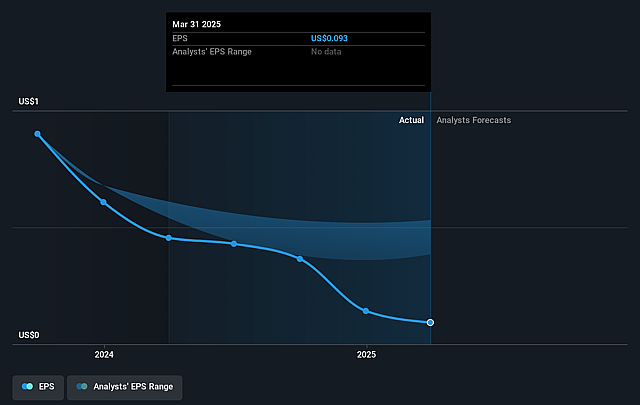

- The bullish analysts expect earnings to reach $118.6 million (and earnings per share of $0.91) by about July 2028, up from $12.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.2x on those 2028 earnings, down from 56.8x today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.3x.

- Analysts expect the number of shares outstanding to grow by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.8%, as per the Simply Wall St company report.

Granite Ridge Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating global transition away from fossil fuels and toward renewable energy, along with increasing carbon regulation and ESG investment mandates, poses a long-term structural headwind that may suppress hydrocarbon prices and reduce Granite Ridge’s revenue opportunities over time.

- Persistent volatility in commodity prices, particularly oil, combined with the company’s guidance that its base plan is only cash flow neutral (excluding dividends) at current prices, raises the risk of negative free cash flow, higher leverage, and potentially pressured earnings or dividend sustainability if prices decline further.

- Granite Ridge’s strategy of allocating a significant portion of capital toward high dividend payouts, alongside its willingness to borrow in order to fund those dividends during less favorable hydrocarbon price environments, may restrict future reinvestment capability and long-term earnings growth.

- As a non-operator on a sizable portion of its asset base and newly increasing commitment to Operated Partnerships, Granite Ridge remains exposed to the operational risks and capital discipline of its partners, meaning underperformance or misalignment could compress margins and impact production growth, with potential consequences for net income.

- The company’s heavy focus on U.S. shale, especially the Permian and Delaware basins, exposes Granite Ridge to rising drilling, labor, and regulatory costs (including increased scrutiny regarding water use, methane emissions, and other environmental risks), which could erode net operating margins and threaten the economic viability of new projects in the future.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Granite Ridge Resources is $9.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Granite Ridge Resources's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $9.0, and the most bearish reporting a price target of just $5.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $567.9 million, earnings will come to $118.6 million, and it would be trading on a PE ratio of 12.2x, assuming you use a discount rate of 6.8%.

- Given the current share price of $5.25, the bullish analyst price target of $9.0 is 41.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.