Key Takeaways

- Moelis is positioned for rapid revenue and margin expansion driven by pent-up deal demand, global diversification, and growing preference for independent advisory services.

- Sector specialization and leadership in private capital advisory could become major long-term growth engines, supporting premium pricing and above-peer earnings growth.

- Heavy reliance on select sectors, high costs, and slow adaptation to industry shifts expose Moelis to significant risk from changing market, regulatory, and technological landscapes.

Catalysts

About Moelis- Operates as an investment banking advisory firm in North and South America, Europe, the Middle East, Asia, and Australia.

- Analyst consensus expects a rebound in deal activity post-volatility, but this likely understates the magnitude and speed of the snapback, as pent-up demand from delayed transactions combined with record new business origination and improved CEO confidence could produce an outsized surge in revenues and fee growth, rapidly outpacing current projections.

- While analysts see the Private Funds Advisory business as an incremental revenue contributor, this underestimates Moelis' potential to become the preeminent independent adviser for institutional and sponsor-driven private capital globally, with a first-mover advantage and senior talent influx positioning the segment to become a multi-cycle growth engine and meaningfully improve both revenue growth and net margins.

- Moelis' strategic international expansion-particularly in Europe, Japan, and high-growth emerging markets-is poised to drive substantial cross-border transaction flows and market share gains, with increasing globalization and capital flows translating into sustained, above-peer revenue growth and greater geographic diversification of earnings.

- The accelerating disintermediation of bulge-bracket banks, fueled by regulatory burdens and client demand for independent, conflict-free advice, will allow Moelis to capture an outsized share of the growing advisory fee pool, leading to durable gains in both revenues and structurally higher margins over time.

- Ongoing sector specialization-particularly the recent success of the tech and energy teams-enables Moelis to win high-complexity mandates in sectors undergoing rapid technological disruption, which supports premium pricing, increases the proportion of high-margin deals, and delivers structural upside to long-term earnings and return on equity.

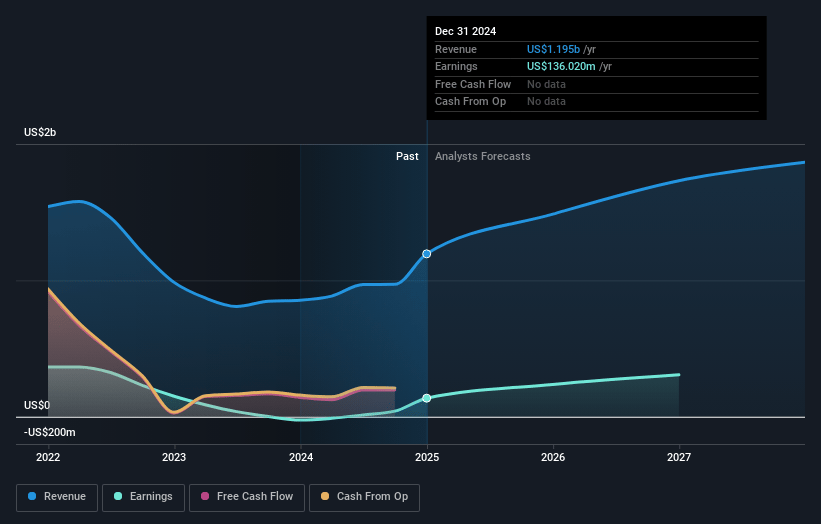

Moelis Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Moelis compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Moelis's revenue will grow by 21.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 13.2% today to 15.0% in 3 years time.

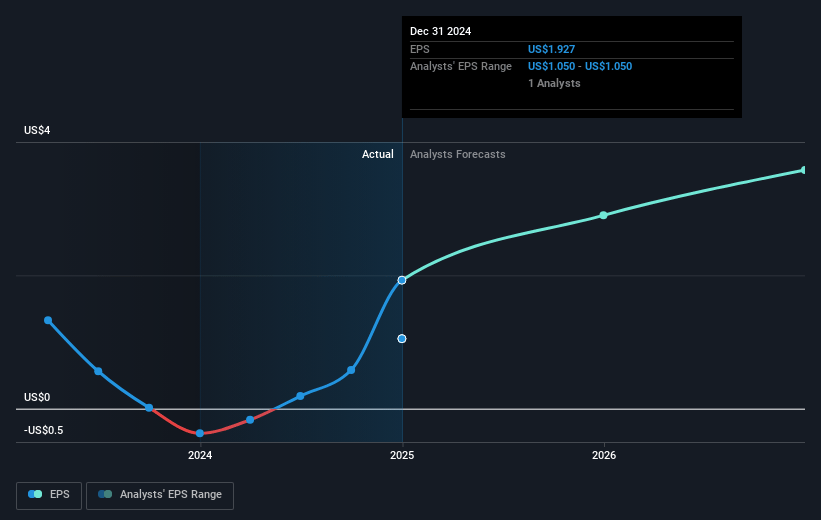

- The bullish analysts expect earnings to reach $348.6 million (and earnings per share of $3.77) by about July 2028, up from $169.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 23.2x on those 2028 earnings, down from 30.4x today. This future PE is lower than the current PE for the US Capital Markets industry at 27.7x.

- Analysts expect the number of shares outstanding to grow by 5.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.64%, as per the Simply Wall St company report.

Moelis Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Moelis faces industry-wide revenue headwinds as prolonged macroeconomic uncertainty, volatility in asset prices, higher interest rates, and shifting trade/tariff policies can diminish deal flow and cause both cancellations and delays in its M&A and capital markets pipelines, which could directly lower advisory revenue and future earnings.

- Technological change, such as the increasing adoption of generative AI and digital banking, threatens to disrupt traditional advisory models; if Moelis fails to effectively adapt, this could reduce its competitive advantage, erode market share, and compress both revenue and net margins over the long term.

- Moelis continues to report elevated compensation expense ratios, with recent quarters at or above 69 percent, and this structurally high cost base could further squeeze net margins if top-line growth falters or if industry fee compression accelerates, challenging future profitability.

- Moelis' growth strategy remains highly concentrated in certain sectors (like tech and energy) and geographies, and the firm is less diversified than larger investment banks; this leaves it vulnerable to downturns or regulatory shocks in particular markets, resulting in higher revenue volatility and uneven earnings.

- As the M&A landscape evolves, with more large corporations building in-house advisory teams and private companies eschewing IPOs for private capital, the firm's addressable client base may structurally decline, posing long-term risks to revenue sustainability and future earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Moelis is $69.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Moelis's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $69.0, and the most bearish reporting a price target of just $52.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $2.3 billion, earnings will come to $348.6 million, and it would be trading on a PE ratio of 23.2x, assuming you use a discount rate of 7.6%.

- Given the current share price of $69.47, the bullish analyst price target of $69.0 is 0.7% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.