Key Takeaways

- Central bank digital currencies and blockchain-based platforms are eroding the relevance of traditional payment processors, pressuring Global Payments’ market position and future revenue growth.

- Intensifying regulatory oversight, fintech competition, and integration risks from acquisitions threaten company margins, operational efficiency, and execution of global expansion strategies.

- Strategic focus on digital payments, technological innovation, and global expansion positions the company for sustainable revenue growth, improved margins, and strong long-term shareholder returns.

Catalysts

About Global Payments- Provides payment technology and software solutions for card, check, and digital-based payments in the Americas, Europe, and the Asia-Pacific.

- The accelerating development and adoption of central bank digital currencies and government-backed payment rails threaten to circumvent traditional card networks and payment processors, which could sharply reduce transaction volumes and fee-based revenue streams for Global Payments in coming years.

- The growing adoption of decentralized finance solutions and blockchain-based payment platforms among both merchants and consumers is set to undermine the relevance of established payment processors, risking a long-term decline in total addressable market and compressing organic revenue growth well below current forecasts.

- Regulatory scrutiny and tightening controls on payments data, privacy, and anti-trust are likely to drive up compliance costs, restrict select business models, and limit cross-border activities, placing ongoing pressure on net margins and raising execution risk for the company’s global expansion plans.

- Persistent industry disruption from fintech startups and Big Tech firms such as Apple, Google, Stripe, and Adyen is expected to accelerate fee compression and erode competitive differentiation, which will weigh on margins and threaten the sustainability of earnings growth even as Global Payments pursues scale advantages through consolidation.

- The large-scale integration of Worldpay following recent M&A activity raises the risk of operational misalignment, technological debt, and potential cultural clashes, which could hinder achievement of projected cost and revenue synergies, resulting in elevated operating costs and dampening the anticipated uplift in both EBITDA and net margins.

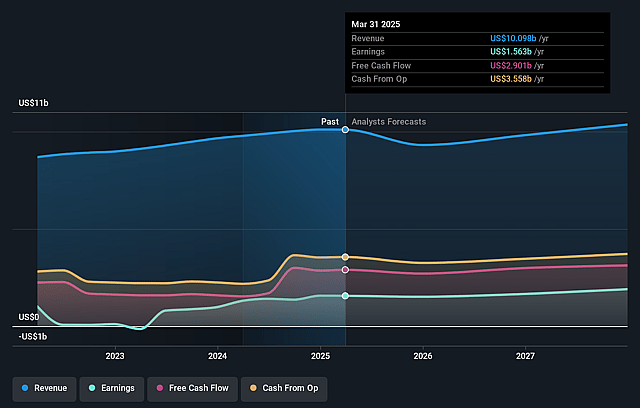

Global Payments Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Global Payments compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Global Payments's revenue will decrease by 0.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 15.5% today to 16.3% in 3 years time.

- The bearish analysts expect earnings to remain at the same level they are now, that being $1.6 billion (with an earnings per share of $7.47). The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.9x on those 2028 earnings, down from 13.1x today. This future PE is lower than the current PE for the US Diversified Financial industry at 17.5x.

- Analysts expect the number of shares outstanding to decline by 4.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.81%, as per the Simply Wall St company report.

Global Payments Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing global secular shift from cash to digital payments, combined with accelerated e-commerce and mobile wallet adoption, is likely to expand Global Payments’ addressable market, providing sustained transaction volume growth that could offset margin pressures and drive revenue higher over the long term.

- The company’s strategic refocus as a pure-play merchant commerce provider, together with the Worldpay acquisition, is expected to amplify innovation and scale, enabling increased cross-selling, expansion into new geographies like Japan, France, and the Nordics, and heightened penetration among enterprise and SMB merchants, which can directly support top-line revenue and earnings momentum.

- The successful execution of the Worldpay integration—bolstered by identified $600 million in cost synergies and $200 million in revenue synergies within three years—is positioned to materially expand net margins and enhance operating leverage, which could result in stronger-than-anticipated long-term earnings growth.

- Annual reinvestment of more than $1 billion into technology and product innovation, including harmonization of platforms, enhanced artificial intelligence, and advanced data analytics, is expected to boost product competitiveness, strengthen client retention, and potentially lower operating costs, all of which positively impact net margin and recurring revenue streams.

- The company’s increased scale, highly diversified client base across geographies and verticals, and stated commitment toward enhanced capital returns and disciplined leverage management (targeting 3x net leverage), provide a robust financial profile that increases resilience against economic downturns and positions Global Payments to sustainably grow free cash flow and drive substantial shareholder returns over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Global Payments is $64.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Global Payments's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $194.0, and the most bearish reporting a price target of just $64.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $9.9 billion, earnings will come to $1.6 billion, and it would be trading on a PE ratio of 10.9x, assuming you use a discount rate of 8.8%.

- Given the current share price of $83.9, the bearish analyst price target of $64.0 is 31.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.