Key Takeaways

- The merger with Worldpay creates a powerful omnichannel payments platform, boosting growth, increasing software-driven revenue, and enabling expansion in digital commerce globally.

- Focus shift to merchant solutions, divestiture of non-core assets, and greater investment drive innovation, margin growth, and strong cash flow for future shareholder returns.

- Disruptive payment trends, regulatory pressures, competition, and high debt levels threaten Global Payments’ traditional revenue streams, margins, and future financial flexibility.

Catalysts

About Global Payments- Provides payment technology and software solutions for card, check, and digital-based payments in the Americas, Europe, and the Asia-Pacific.

- The combination of Global Payments and Worldpay creates a pure-play global commerce solutions provider with unmatched scale and distribution, allowing the company to fully capitalize on the global shift from cash to digital payments, especially as cashless adoption accelerates in emerging and established markets. This increased scale is expected to drive sustained revenue growth and expand the company’s addressable market.

- Integration of Worldpay’s e-commerce, FX, alternative payment, and PayFac capabilities with Global Payments’ SMB focus and vertical-specific software creates a complete omnichannel platform, uniquely positioning the company to benefit from ongoing growth in e-commerce and digital commerce penetration. This is likely to increase both transaction volumes and high-margin software-driven revenue per client.

- The divestiture of Issuer Solutions and organizational streamlining sharpen the company’s focus on the higher-growth merchant business, supporting both top-line acceleration and at least $600 million in annual run-rate cost synergies, which are expected to drive sustained margin expansion and improved long-term earnings growth.

- Amplified investment capacity, with over $1 billion reinvested annually into innovation, enables rapid development of next-generation solutions in embedded finance, commerce enablement, AI-driven analytics, and enhanced security—key competitive differentiators as merchants seek integrated payment and value-added solutions, supporting both revenue growth and client retention.

- The combined company’s global merchant base, deeply entrenched distribution channels, and long-term contracts will accelerate cross-selling opportunities and revenue synergies of at least $200 million per year, underpinning high single-digit revenue growth and mid-teens EPS growth, and supporting bull-case projections for substantial free cash flow generation and capital returns to shareholders over the next several years.

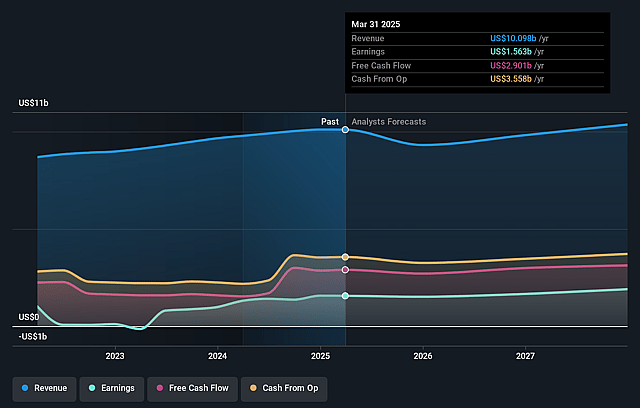

Global Payments Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Global Payments compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Global Payments's revenue will grow by 2.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 15.5% today to 22.9% in 3 years time.

- The bullish analysts expect earnings to reach $2.5 billion (and earnings per share of $11.87) by about July 2028, up from $1.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 17.1x on those 2028 earnings, up from 13.0x today. This future PE is lower than the current PE for the US Diversified Financial industry at 17.9x.

- Analysts expect the number of shares outstanding to decline by 4.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.8%, as per the Simply Wall St company report.

Global Payments Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid adoption of central bank digital currencies and government-backed payment systems could bypass traditional third-party processors like Global Payments, leading to long-term declines in transaction volumes and fee-based revenue as merchants and consumers are incentivized to use alternative rails.

- Heightened regulatory scrutiny and evolving requirements for data privacy, transaction security, and cross-border payment compliance may increase ongoing compliance and operational costs, reducing operating margins and exposing the company to potential fines and reputational risks.

- Market share and revenue growth are at risk from the proliferation of alternative payment methods such as mobile wallets, embedded finance, and cryptocurrencies, which may erode the relevance of Global Payments’ legacy card-based and merchant acquiring businesses as preferences among merchants and consumers shift.

- Industry consolidation and the emergence of large merchants building proprietary payment solutions or exerting greater negotiating power could force Global Payments to undercut fees or pursue expensive acquisitions, leading to compressed net margins and potentially weaker overall earnings despite revenue synergy targets.

- Elevated debt levels from recent and pending acquisitions like Worldpay leave the company exposed to refinancing and interest rate risks, which could restrict its investment flexibility, increase interest expenses, and limit net income and free cash flow growth in a more challenging macro or credit environment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Global Payments is $154.27, which represents two standard deviations above the consensus price target of $98.73. This valuation is based on what can be assumed as the expectations of Global Payments's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $194.0, and the most bearish reporting a price target of just $64.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $10.8 billion, earnings will come to $2.5 billion, and it would be trading on a PE ratio of 17.1x, assuming you use a discount rate of 8.8%.

- Given the current share price of $83.23, the bullish analyst price target of $154.27 is 46.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.