Last Update 30 Dec 25

SoFi Stock: When a Fintech Starts Behaving Like a Platform Bank

SoFi Technologies (NASDAQ: SOFI) has steadily evolved from a niche student-loan refinancer into something far more ambitious: a vertically integrated digital financial platform. What differentiates SoFi from earlier fintech waves is not just product breadth, but balance-sheet ownership. Unlike app-first competitors that rely on partners, SoFi increasingly operates like a bank—funding loans with deposits, managing credit risk, and monetizing customers across multiple financial needs.

The market’s challenge is deciding how to value SoFi: as a growth-oriented fintech, or as a regulated financial institution with platform characteristics.

From Product Stack to Financial Ecosystem

SoFi’s strategy is built around consolidation. Borrowing, saving, investing, spending, and now even crypto and payments live under one roof. The logic is simple: financial lives are fragmented, and users prefer fewer providers if trust and pricing are competitive.

This ecosystem approach drives cross-selling. A member who starts with checking may later take a personal loan, invest, or refinance debt. Each additional product increases lifetime value while lowering customer acquisition costs. Over time, this dynamic resembles a platform flywheel rather than a linear lending business.

Expert Insight: Unit Economics Improve With Balance-Sheet Control

According to Kevin Marshall from Amortization Calculator, SoFi’s most underappreciated advantage is its shift toward balance-sheet funding. He notes that controlling deposits rather than relying on wholesale funding gives SoFi flexibility in pricing, underwriting, and margin management.

Marshall emphasizes that when lending platforms own the funding source, amortization profiles and interest-rate sensitivity become strategic tools rather than constraints. In his view, this allows SoFi to optimize loan duration, risk exposure, and profitability more effectively than fintechs that depend on external capital markets.

This perspective reframes SoFi’s banking charter not as a regulatory burden, but as a structural upgrade.

Fee-Based Growth Reduces Cyclicality

While lending remains central, SoFi has intentionally expanded fee-based revenue streams through brokerage services, interchange, referrals, and its technology platform. These revenues carry lower capital intensity and diversify earnings away from pure credit exposure.

This matters in volatile rate environments. When lending demand slows or credit tightens, fee-based income can cushion results. Over time, the mix shift toward non-lending revenue improves margin stability and reduces reliance on any single macro condition.

Credit Quality and Risk Management

SoFi’s exposure to unsecured personal loans naturally attracts scrutiny during economic uncertainty. Management has responded by tightening underwriting standards, focusing on higher-income borrowers, and leveraging data-driven risk models.

Unlike legacy banks burdened with broad portfolios, SoFi’s credit book is relatively focused and transparent. That focus allows faster adjustment to changing conditions, though it also concentrates risk. Execution discipline remains critical.

Regulation: Constraint and Credibility

Operating as a bank imposes capital requirements, oversight, and compliance costs. However, regulation also confers legitimacy. For customers, FDIC-insured deposits and regulatory supervision enhance trust—an essential currency in finance.

For investors, regulation reduces existential risk. SoFi is not operating in a gray zone; it is playing by established rules. That clarity supports long-term franchise value, even if it tempers short-term growth.

Valuation and Market Expectations

SOFI’s valuation reflects its hybrid identity. It does not trade like a mature bank, nor like a pure software-driven fintech. The market is still deciding which narrative dominates.

The upside case depends on successful execution of the platform model: growing deposits, managing credit prudently, and expanding fee-based revenue. The downside case centers on credit cycles and margin compression. Expectations are no longer euphoric, which lowers the bar for positive surprises.

Conclusion

For investors, SOFI represents a fintech growing into a financial institution with platform characteristics. If SoFi continues to compound member value while managing risk conservatively, it may ultimately be valued not for what it once disrupted—but for what it has quietly built.

SoFi Technologies (SOFI) continues to ride the waves in the financial world, propelled by robust membership growth, product adoption, and diversification across its ecosystem.

In Q3 2024, the company declared a massive stock price increase over the past month, propelled by investors’ strong confidence in the company’s performance and general potential for further growth.

SoFi’s Membership Surge and Diversified Growth Fuel Upgraded Outlook

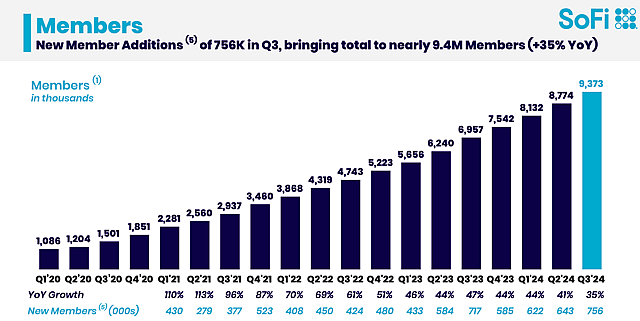

Membership growth remains a cornerstone of SoFi’s success. From Q1 2021 to Q3 2024, membership grew 75.81%, further supported by strong marketing and an ever-expanding suite of financial services. In Q3 2024 alone, SoFi added 756,000 new members, continuing its substantial quarterly gains. In concert with this, product adoption outpaces membership growth, a sign of increased engagement inside its FSPL or Financial Services Productivity Loop.

This has been supplemented by cross-selling services, including SoFi Money, SoFi Invest, and SoFi Relay, which has grown revenue per member while further diversifying the revenue base.

Net interest margin (NIM) has been one of the leading factors for SoFi’s profitability. Although NIM increased to 5.57% in Q3 2024 from 4.38% in Q1 2022, it has faced some headwinds lately, falling from its peak of 6.02% in Q4 2023. Such a trend would indicate pressure on interest income if interest rates continue lowering further. Despite this, SoFi has used its ecosystem pretty well to drive non-interest income and eliminate part of the risks of volatile margins.

SoFi’s expansion into non-lending products has indeed paid dividends. They saw considerable increases in product numbers for Money and Invest, where the number of users for SoFi Money surged by 54.05% YoY, and Relay users grew by 41.99% YoY at the end of Q3 2024. This diversification has made it less dependent on lending revenues, positioning the company as resilient when economic conditions change.

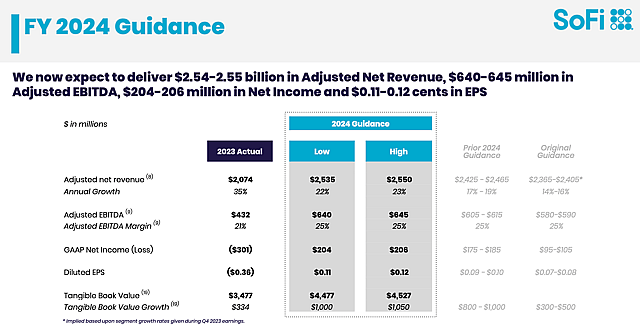

Sofi upped its annual revenue growth guidance 2024 to 22%-23% YoY from an initial projection of 14%-16%. This upward revision reflects confidence in maintaining growth in lending and non-lending segments. Financial services products to the number of lending products went up two-fold from 3.1x in 2021 to 6.2x in 2024, demonstrating the efforts toward a more balanced and diversified revenue model.

SoFi’s Growth Faces Margin and Market Challenges Ahead

SoFi’s impressive growth trajectory faces several potential risks that could impact its long-term outlook. Interest Margin Pressure One of the most important risks is that SoFi attains most of its profitability from NIM. If the Federal Reserve loosens further, it may see off significantly from SoFi’s net interest income. In Q3 2024, NIM compressed further to 5.57% from the Q4 peak of 6.02%. If the margin pressures persist, it could erode profitability, especially within the highly competitive fintech landscape.

The fintech space is highly competitive, where conservative financial institutions and lean startups fight for market share. SoFi’s ability to gain and retain customers while remaining competitive will be of the essence. Moreover, regulatory risks are high. Regulation changes concerning lending or consumer protection laws might raise compliance costs or dampen revenue opportunities.

According to digital finance expert Jason Wise, SoFi’s growth heavily relies on cross-selling its ecosystem of products. This strategy has been fruitful so far but could be subject to decreasing returns as the customer base expands. When the market is saturated or the effectiveness of cross-selling diminishes, it will eventually impact customer lifetime value and overall growth rates. Of course, broader economic challenges pose risks: A potential economic downturn could lead to reduced consumer spending, higher loan defaults, and lower demand for investment products.

Lastly, SoFi derives revenues from various sources, including newer non-lending products such as SoFi Money and SoFi Invest. This further complicates matters as these nascent offerings face intense competition with any associated margin pressures. In sum, while SoFi’s long-term potential remains sound, it must work through these risks to continue on this growth trajectory and create value for shareholders.

Takeaway

The bottom line is that SoFi’s recent performance underlines its continuing ability to produce sustained growth via innovation, diversification, and ecosystem expansion. At the same time, however, investors should look for possible short-term pullbacks with the stock now in overbought territory, compliments of recent strong performance and technical caution indications.

Have other thoughts on SoFi Technologies?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

The user yiannisz has a position in NasdaqGS:SOFI. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.