Last Update07 May 25Fair value Decreased 12%

Key Takeaways

- Heavy reliance on traditional menu and urban markets, along with limited digital capability, exposes Shake Shack to market share loss and traffic declines.

- Rising regulatory, labor, and input cost pressures threaten the company’s margins and increase risk of long-term earnings volatility.

- Operational enhancements, strategic expansion, menu innovation, digital engagement, and capital efficiency are driving revenue growth, margin improvement, and long-term profitability for the brand.

Catalysts

About Shake Shack- Owns, operates, and licenses Shake Shack restaurants (Shacks) in the United States and internationally.

- Ongoing shifts in consumer preferences toward plant-based and alternative protein diets risk eroding Shake Shack's core customer base, threatening to slow same-store sales growth and reduce long-term total revenue potential, especially as the company remains heavily reliant on beef and traditional menu offerings despite mentioning only limited moves toward new proteins.

- Persistent public and regulatory scrutiny over health and nutrition may drive the imposition of new taxes or mandatory labeling requirements on high-calorie, processed, or red-meat–centric foods, likely increasing Shake Shack’s compliance costs and potentially depressing consumer demand, which would exert sustained pressure on net margins.

- Accelerating digital ordering trends are expected to disproportionately favor larger quick-service chains with more robust digital infrastructure, leaving Shake Shack facing rising competitive pressure that could restrict both market share and pricing power; as more ordering activity shifts online, the company risks lagging in customer acquisition, ultimately constraining top-line revenue growth.

- Continued high exposure to expensive urban markets, combined with the shift to remote or hybrid work, leaves Shake Shack vulnerable to prolonged traffic weakness and declining same-store sales in its largest revenue-contributing geographies such as New York and California; this geographical risk heightens the likelihood of comp underperformance relative to peers and compresses earnings growth.

- Industry-wide threats such as persistent wage inflation, ongoing labor shortages, increasing occupancy costs, and volatile commodity prices—particularly for beef, which makes up 30 to 35 percent of the company's food costs—are anticipated to outweigh operational improvements and margin initiatives, leading to greater risk of margin compression and unpredictable earnings, especially as the company accelerates unit expansion amid a challenging cost environment.

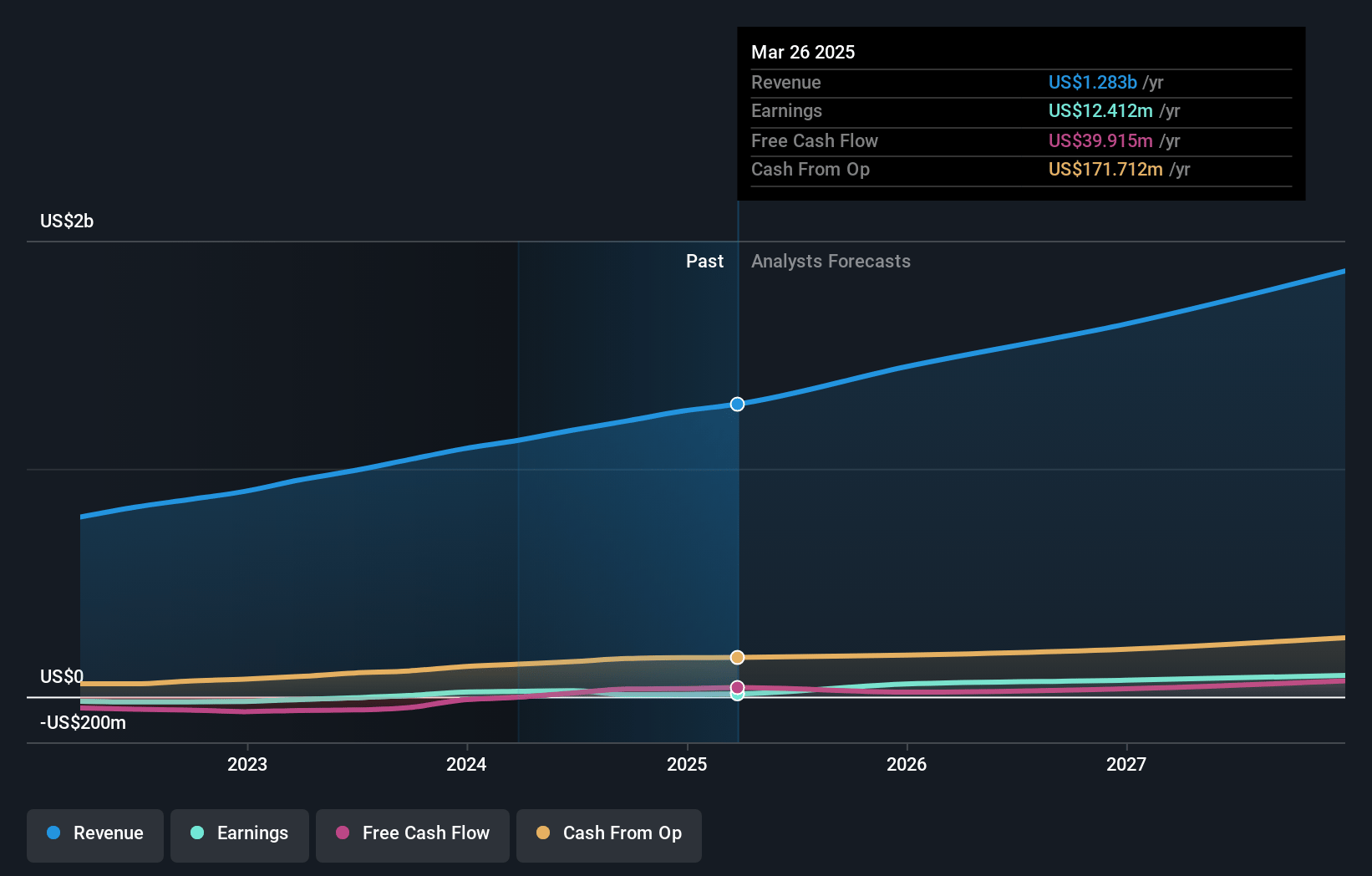

Shake Shack Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Shake Shack compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Shake Shack's revenue will grow by 12.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 1.0% today to 4.8% in 3 years time.

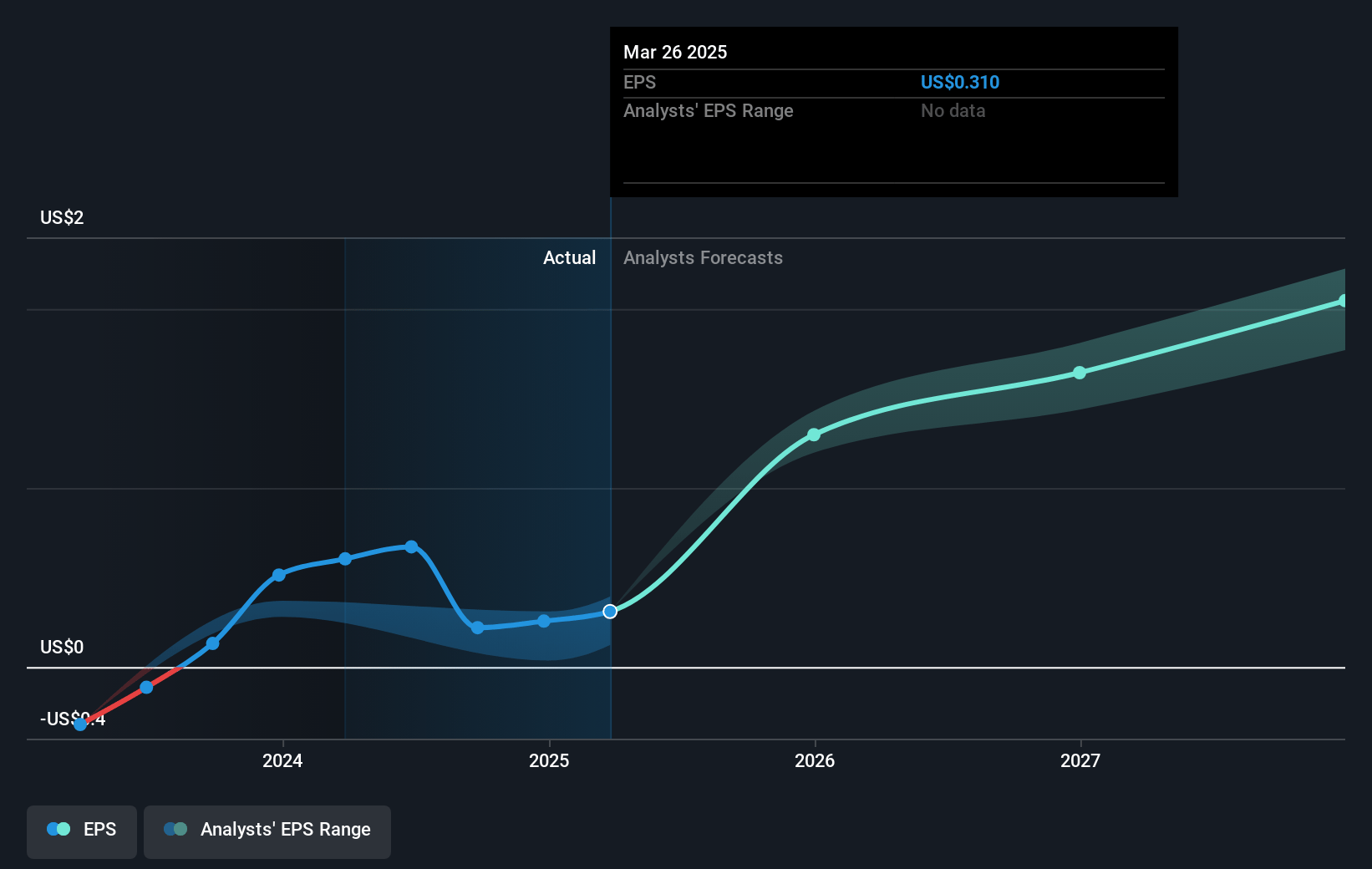

- The bearish analysts expect earnings to reach $87.2 million (and earnings per share of $1.77) by about May 2028, up from $12.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 53.8x on those 2028 earnings, down from 330.3x today. This future PE is greater than the current PE for the US Hospitality industry at 21.9x.

- Analysts expect the number of shares outstanding to grow by 1.48% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.87%, as per the Simply Wall St company report.

Shake Shack Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong operational improvements, such as the new labor model and increased supply chain productivity, are consistently expanding restaurant-level profit margins, which could fuel sustained margin growth and drive higher long-term net income and profitability.

- Strategic acceleration of new Shack openings, particularly in high-growth U.S. markets outside of the traditional urban core, enables Shake Shack to broaden its geographic footprint and tap into regions with increasing population and purchasing power, supporting durable revenue growth.

- Expansion of menu offerings, including successful limited-time offerings and innovation in beverages and sides, is attracting new and returning guests, strengthening brand differentiation, and potentially increasing both same-store sales and average ticket size, resulting in higher system-wide revenues.

- Digital guest recognition initiatives and mobile ordering platforms are deepening customer engagement and frequency, unlocking the potential for higher lifetime value per customer while improving marketing ROI and supporting long-term earnings growth.

- Shake Shack’s ability to consistently open new units with best-in-class cash-on-cash returns, combined with deliberate cost reductions in new build-outs, strengthens capital efficiency and accelerates network expansion, supporting strong revenue momentum and improved overall returns for shareholders.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Shake Shack is $85.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Shake Shack's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $145.0, and the most bearish reporting a price target of just $85.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.8 billion, earnings will come to $87.2 million, and it would be trading on a PE ratio of 53.8x, assuming you use a discount rate of 7.9%.

- Given the current share price of $101.93, the bearish analyst price target of $85.0 is 19.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.