Narratives are currently in beta

Key Takeaways

- Starbucks' strategic pricing and focus on core offerings aim to boost revenue through customer engagement and efficiency.

- Digital and operational investments target efficiency and customer experience, supporting store expansion and future revenue growth.

- Challenges in growth, cost management, and efficiency targets could impact profitability and earnings, with potential risks from strategic shifts and investment dependencies.

Catalysts

About Starbucks- Operates as a roaster, marketer, and retailer of coffee worldwide.

- Starbucks' Back to Starbucks strategy is focused on revitalizing its brand by reducing discount-driven offers and improving pricing transparency, which could lead to enhanced revenue through a more engaged and loyal customer base.

- Investments in technology, like the mobile ordering sequencing algorithm, aim to streamline operations and reduce bottlenecks, potentially improving operational efficiency and positively impacting net margins.

- The company's plan to double its U.S. store count through optimized store formats and designs suggests a strong growth trajectory in store expansion, likely contributing to increased future revenues.

- Efforts to simplify the menu by reducing SKUs and focusing on core beverage offerings are expected to enhance customer satisfaction and operational efficiency, which could lead to improved earnings.

- The focus on digital innovation, including the deployment of digital menu boards and app enhancements, is intended to enhance the customer experience and drive greater consumer engagement, supporting long-term revenue growth and potentially boosting earnings.

Starbucks Future Earnings and Revenue Growth

Assumptions

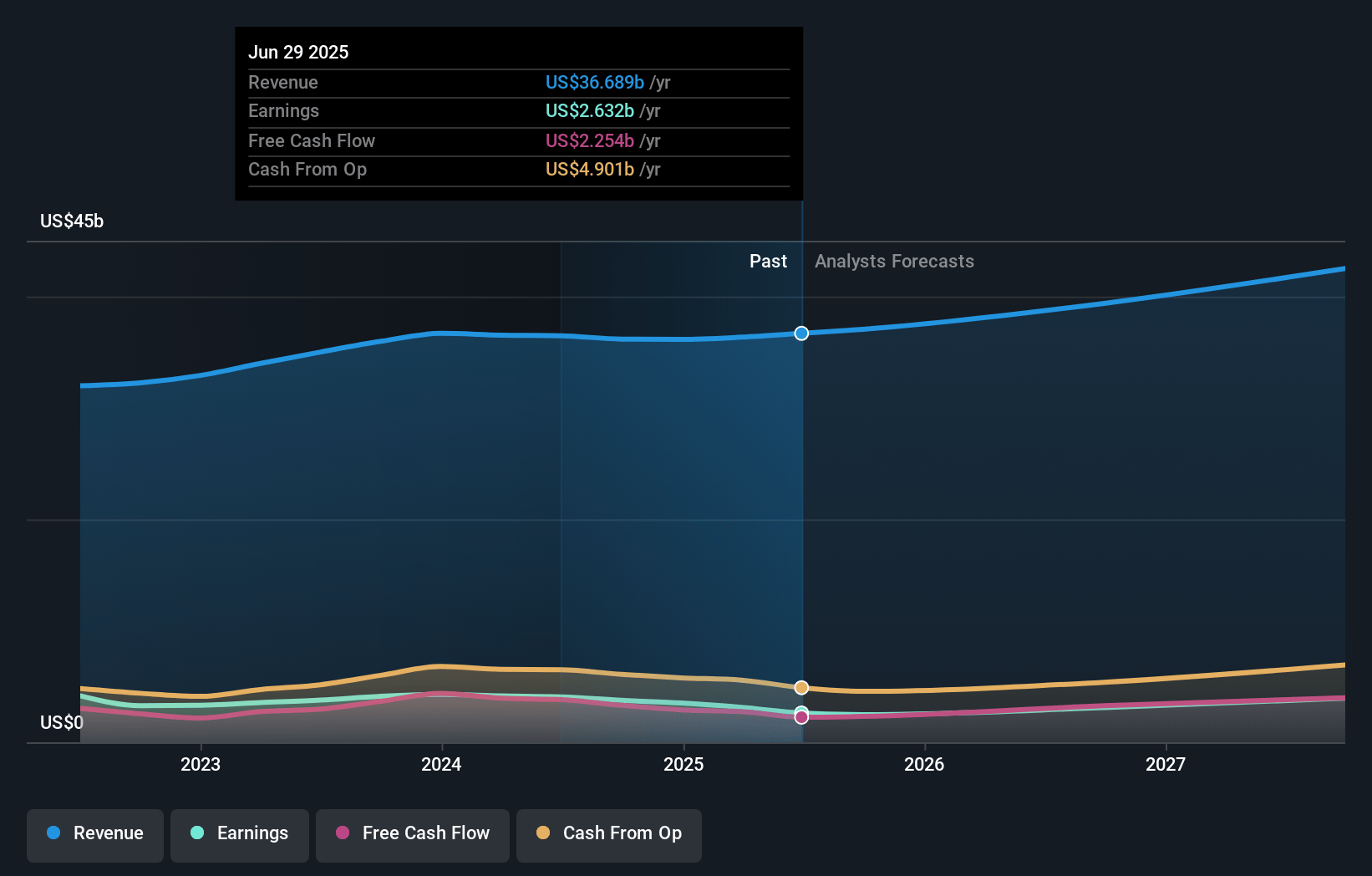

How have these above catalysts been quantified?- Analysts are assuming Starbucks's revenue will grow by 6.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.4% today to 11.4% in 3 years time.

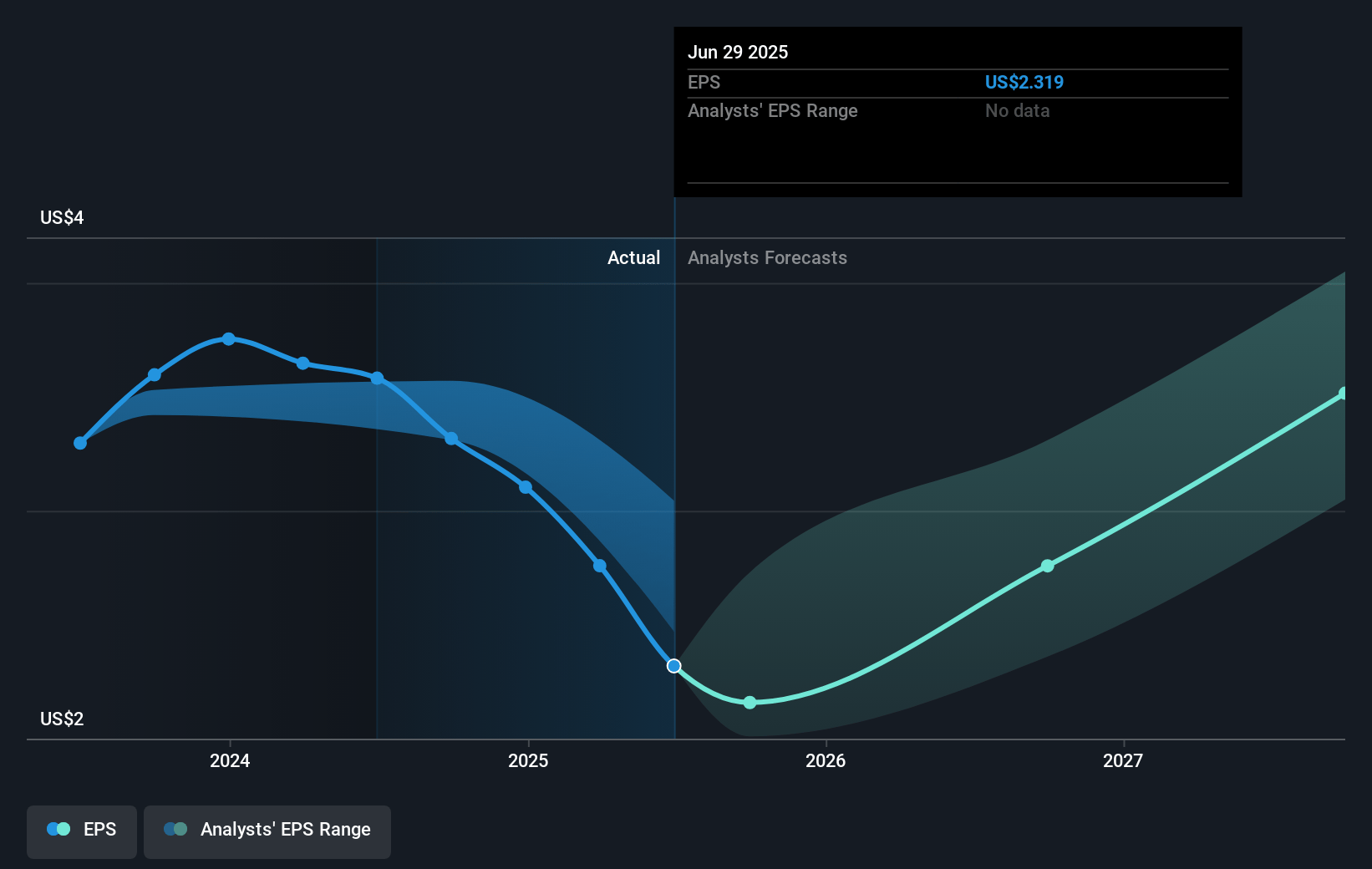

- Analysts expect earnings to reach $5.0 billion (and earnings per share of $4.56) by about January 2028, up from $3.8 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $5.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.7x on those 2028 earnings, down from 30.3x today. This future PE is greater than the current PE for the US Hospitality industry at 24.3x.

- Analysts expect the number of shares outstanding to decline by 1.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.94%, as per the Simply Wall St company report.

Starbucks Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A global comparable store sales decline of 4% indicates potential challenges in maintaining growth momentum, which could impact future revenue and profitability.

- The contraction in operating margin by 380 basis points due to increased costs, including store partner wages and nondairy milk customization, raises concerns about future net margins.

- The strategic shift away from discount-driven offers may initially lead to a decrease in transaction volumes and customer footfall, affecting near-term revenue growth.

- High dependency on labor investments, coupled with precision staffing, suggests potential risks in execution and cost management, which could impact net margins and earnings.

- Uncertainty in productivity goals, with no commitment to previous $4 billion efficiency targets, potentially limits opportunities for margin expansion and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $104.11 for Starbucks based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $120.0, and the most bearish reporting a price target of just $76.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $43.4 billion, earnings will come to $5.0 billion, and it would be trading on a PE ratio of 28.7x, assuming you use a discount rate of 7.9%.

- Given the current share price of $100.41, the analyst's price target of $104.11 is 3.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

ST

Equity Analyst and Writer

Inelastic Coffee Demand Coupled With Domestic and Foreign Growth Will Increase Revenues and Earnings

Key Takeaways Coffee consumption is still growing, and demand is inelastic Its brand strength means it can pass on higher costs to consumers SBUX will continue performing well domestically and globally Margins will slightly improve, despite pressure from cost increases The new CEO can stay on top of the risks of elevated debt, unionization issues, and foreign expansions. Catalysts Brand Strength and Inflationary Resilience Will Help Keep Revenue Predictable Since the stock market peaked, Starbucks scored six consecutive strong quarters showing minimal inflationary impact on its customer base in the core market (North America).

View narrativeUS$103.17

FV

4.4% overvalued intrinsic discount9.51%

Revenue growth p.a.

35users have liked this narrative

0users have commented on this narrative

11users have followed this narrative

20 days ago author updated this narrative

GO

Equity Analyst

International Store Growth To Sustain Revenue Growth Despite Labour Headwinds

Key Takeaways Store growth plans to increase by 74% internationally, but only 12% in the US. Coffee demand is expected to be a tailwind for revenues longer term, growing at a stable 4.2%.

View narrativeUS$86.27

FV

24.8% overvalued intrinsic discount5.00%

Revenue growth p.a.

20users have liked this narrative

0users have commented on this narrative

6users have followed this narrative

3 months ago author updated this narrative