Key Takeaways

- Sabre's shift to AI-powered and cloud-based platforms aims to boost margins and efficiency, but faces pressure from rising compliance costs and rapid competition from alternative providers.

- Growing direct-to-consumer digital trends and underperformance in certain travel segments threaten Sabre's ability to maintain transaction volumes, market share, and steady revenue growth.

- Shifts in booking channels, competitive pressures, margin challenges, and reduced business diversification threaten Sabre's growth potential, market share, and financial flexibility.

Catalysts

About Sabre- Operates as a software and technology company for travel industry in the United States, Europe, Asia-Pacific, and internationally.

- Although Sabre is benefiting from meaningful cost reductions and is executing a strategic transformation to modern, AI-powered, and multi-source travel distribution platforms that could deliver sustainable operating margin improvements, the company remains exposed to rising compliance, regulatory, and cybersecurity costs that are likely to pressure net margins as global travel technology standards become more stringent.

- While long-term global travel demand is expected to grow, expanding the potential market for Sabre's solutions, accelerating digital transformation within airlines and hotels may enable more direct-to-consumer bookings and disintermediate traditional GDS platforms like Sabre, posing a risk to future transaction volume and top-line revenue growth.

- Although Sabre's strong push into AI-driven offer management and advanced distribution solutions positions it well to benefit from industry-wide adoption of personalization and automation, rapid competitive advances from newer, cloud-native technology providers and alternative distribution channels may further erode Sabre's market share and limit its ability to maintain or grow revenue per transaction.

- Despite the potential for increased free cash flow generation and reduced net leverage following significant debt repayments and the sale of non-core businesses, Sabre's high exposure to segments underperforming the broader travel market-such as corporate, military, and government travel-could prolong revenue softness and increase year-over-year volatility.

- While migration to cloud-based platforms and ongoing investment in innovative products support Sabre's ability to deliver efficient, integrated services to airlines and agencies, persistent mix headwinds, execution delays in new solution launches, and dependence on successful realization of growth strategies introduce ongoing risk to the timely improvement of earnings and cash flow.

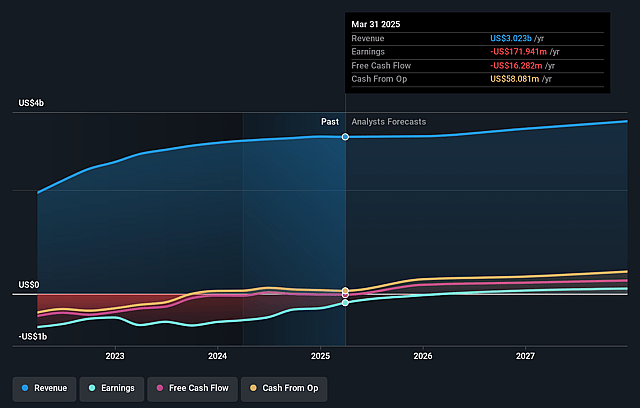

Sabre Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Sabre compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Sabre's revenue will decrease by 0.9% annually over the next 3 years.

- The bearish analysts are not forecasting that Sabre will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Sabre's profit margin will increase from -11.5% to the average US Hospitality industry of 8.2% in 3 years.

- If Sabre's profit margin were to converge on the industry average, you could expect earnings to reach $240.4 million (and earnings per share of $0.57) by about September 2028, up from $-345.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 5.0x on those 2028 earnings, up from -2.0x today. This future PE is lower than the current PE for the US Hospitality industry at 24.0x.

- Analysts expect the number of shares outstanding to grow by 2.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Sabre Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sabre's disproportionate exposure to corporate, military, and government travel-segments that have underperformed leisure and are booking less through GDS-has created persistent headwinds to transaction volumes, limiting revenue growth and putting pressure on air distribution bookings.

- Secular industry shifts toward direct airline and hotel bookings, as well as the proliferation of alternative distribution channels like NDC and direct API connectivity, are threatening traditional GDS volumes, risking long-term erosion of Sabre's core revenue and transaction-based income.

- Margin pressure from foreign exchange fluctuations, a higher share of lower-margin U.S. bookings, and continued investment requirements for technology modernization and delayed product launches (such as the multi-source LCC solution) threaten Sabre's ability to maintain or improve net margins and profitability.

- Heightened competitive intensity in the travel distribution sector, including rivals with higher leisure exposure and more favorable geographic mix, has resulted in market share losses for Sabre in key regions and challenged its negotiating leverage, potentially impacting average booking fees and top-line revenue.

- The sale of Sabre's Hospitality Solutions business reduces diversification and revenue streams, while high leverage and ongoing debt service obligations remain a burden, limiting financial flexibility and capital available for innovation, further constraining long-term earnings power.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Sabre is $2.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Sabre's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $3.9, and the most bearish reporting a price target of just $2.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $2.9 billion, earnings will come to $240.4 million, and it would be trading on a PE ratio of 5.0x, assuming you use a discount rate of 12.3%.

- Given the current share price of $1.73, the bearish analyst price target of $2.0 is 13.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.