Last Update 23 Aug 25

Fair value Decreased 22%Sabre's consensus price target has been cut from $3.52 to $2.76 as recent disappointing earnings, reduced guidance, and concerns over management credibility outweigh otherwise stable industry fundamentals.

Analyst Commentary

- Bullish analysts highlight resilient industry fundamentals, noting that fears of airline profit warnings and the impact of tariffs have not materialized into an industry downturn.

- Traffic growth and increased airline capacity, with the exception of intra North American routes, support a more optimistic near-term outlook.

- Bearish analysts point to Sabre's Q2 earnings miss and a reduced outlook, which came as a negative surprise shortly after prior optimistic guidance.

- Concerns are raised about management credibility, as the company must now rebuild investor trust following recent guidance changes.

- Some analysts are moving to a more neutral stance, as near-term execution risks and uncertainty about Sabre’s ability to deliver on revised targets outweigh positive sector trends.

What's in the News

- Sabre renewed its long-term partnership with oneworld through PRISM, reinforcing its position in airline corporate contract management and supporting expansion within global markets.

- Sabre provided 2025 earnings guidance, expecting revenue to grow flat to low single digits.

- Sabre signed a new multi-year agreement with Christopherson Business Travel, making Sabre the primary technology partner to enhance efficiency and expand capabilities via Sabre Red 360, APIs, and automation solutions.

- Sabre Hospitality expanded SynXis Concierge.AI, integrating advanced AI-driven guest engagement across booking engine, email, social platforms, and voice, to increase conversions and streamline hotel operations.

- Vietravel Airlines renewed its five-year agreement with Sabre's Radixx platform, adding payment gateway integration and gaining access to expanded retailing, analytics, and distribution capabilities.

Valuation Changes

Summary of Valuation Changes for Sabre

- The Consensus Analyst Price Target has significantly fallen from $3.52 to $2.76.

- The Future P/E for Sabre has significantly risen from 28.47x to 61.13x.

- The Net Profit Margin for Sabre has significantly fallen from 2.39% to 0.88%.

Key Takeaways

- Expansion in travel markets and innovative AI technology adoption are driving efficiency, value, and increased customer retention for Sabre.

- Diversified content integration and scalable ancillary offerings position Sabre for long-term revenue growth and enhanced financial flexibility.

- Shifts toward direct booking models and technology delays, combined with increased competition and reduced diversification, threaten Sabre's growth, margins, and resilience to industry changes.

Catalysts

About Sabre- Operates as a software and technology company for travel industry in the United States, Europe, Asia-Pacific, and internationally.

- The ongoing global expansion of travel and tourism is expected to increase addressable market opportunities for Sabre, and management anticipates that broad-based travel growth and the normalization of corporate and government travel volumes will drive a rebound in air distribution bookings and revenue growth as current headwinds are seen as transitory.

- Acceleration in digital and AI-powered technology adoption, including Sabre's enhanced cloud-based platforms and AI-driven offer management solutions, is expected to improve operational efficiency, enhance product value for travel providers, and reduce technology expenses, supporting both net margin expansion and higher customer retention rates over time.

- Continued investment in and expansion of Sabre's multi-source content integration-especially the addition of low-cost carrier (LCC) and NDC connections-positions Sabre to capture incremental market share in the evolving distribution landscape, which is expected to disproportionately benefit technology providers and support long-term revenue growth.

- Strengthening balance sheet fundamentals, including significant debt reduction (over $1 billion paid down in 2025) and enhanced free cash flow generation, provide greater financial flexibility for future innovation investment and strategic initiatives, supporting forward earnings growth and balance sheet resilience.

- Cross-selling opportunities through data-driven solutions and ancillary travel services-such as digital payments and merchandising-are scaling, with fast-growing platforms and increasing attachment rates, potentially generating new recurring revenue streams and supporting sustained top-line growth.

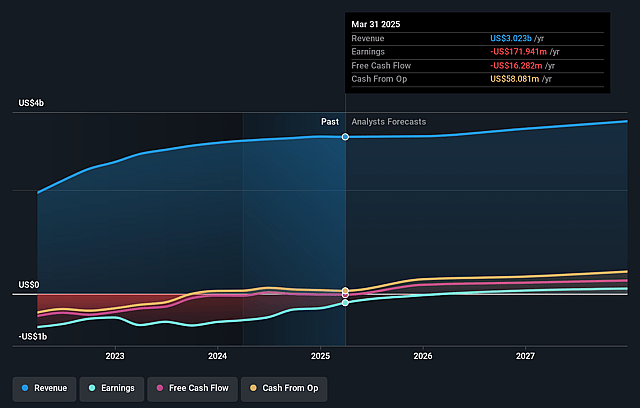

Sabre Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sabre's revenue will decrease by 0.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -11.5% today to 0.9% in 3 years time.

- Analysts expect earnings to reach $26.9 million (and earnings per share of $0.17) by about September 2028, up from $-345.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 61.1x on those 2028 earnings, up from -2.0x today. This future PE is greater than the current PE for the US Hospitality industry at 24.0x.

- Analysts expect the number of shares outstanding to grow by 2.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Sabre Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sabre's significant exposure to corporate, government, and military travel-segments currently experiencing persistent weakness relative to leisure and direct bookings-poses an ongoing risk to transaction volumes and revenue, especially if these structural shifts toward leisure and direct channels persist longer term.

- Continued industry adoption of direct distribution models by airlines and hotels, including NDC and other API-driven solutions, threatens to bypass GDS intermediaries like Sabre, directly impacting Sabre's ability to sustain transaction revenue growth and gross margins over time.

- The company's lag in growing NDC booking volumes relative to competitors and delays in launching new technology solutions (such as the multi-source LCC content platform) highlight potential execution risk and technology adoption challenges, which may erode Sabre's market share and future revenue growth.

- The divestiture of the Hospitality Solutions business not only removes a revenue and diversification stream but also potentially increases reliance on the cyclical air distribution segment, elevating earnings volatility and risk to net margins during travel downturns.

- Heightened competition from cloud-native and more agile travel tech providers, along with Sabre's still-high leverage and recent history of negative (or minimal) free cash flow, may constrain its ability to invest in innovation, further risking long-term earnings growth and margin improvement.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $2.758 for Sabre based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $3.9, and the most bearish reporting a price target of just $2.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.1 billion, earnings will come to $26.9 million, and it would be trading on a PE ratio of 61.1x, assuming you use a discount rate of 12.3%.

- Given the current share price of $1.73, the analyst price target of $2.76 is 37.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.