Last Update08 Aug 25Fair value Increased 9.77%

Despite lower revenue growth forecasts, the consensus price target for Papa John's International has increased, driven by a notable improvement in net profit margin, raising fair value from $47.10 to $49.90.

What's in the News

- Papa John's added to the Russell 2000 Dynamic Index.

- Apollo Global Management and Irth Capital Management have approached Papa John's with a potential take-private deal valuing the company at just above $60 per share; shares rose 7.5% on the news.

- Shaq-a-Roni pizza, created with franchisee Shaquille O'Neal, has become a permanent menu item across the U.S.

- Papa John's launched the Cheddar Crust Pizza and Cheddar Cheesesticks in Canada, expanding its menu offerings.

Valuation Changes

Summary of Valuation Changes for Papa John's International

- The Consensus Analyst Price Target has risen from $47.10 to $49.90.

- The Consensus Revenue Growth forecasts for Papa John's International has significantly fallen from 2.9% per annum to 1.8% per annum.

- The Net Profit Margin for Papa John's International has significantly risen from 2.30% to 3.08%.

Key Takeaways

- Menu innovation is not fully aligned with growing demand for healthier, plant-based options, risking stagnation as consumer preferences evolve.

- Ongoing cost pressures, reliance on volatile delivery channels, and regulatory risks threaten profitability and may constrain near-term earnings growth despite digital efforts.

- Papa John's focus on technology, supply chain efficiency, franchising, and international growth supports long-term profitability, stable earnings, and stronger digital-driven customer engagement.

Catalysts

About Papa John's International- Operates and franchises pizza delivery and carryout restaurants under the Papa Johns trademark in the United States, Canada, and internationally.

- The market appears to be ignoring increasing headwinds from shifting consumer preferences toward healthier, fresher, and plant-based diets-while Papa John's focuses heavily on menu innovation, it remains centered on traditional and indulgent pizza products. This shift could limit future revenue growth and compress overall sales if the company's innovation pipeline does not adequately evolve with changing tastes.

- Persistent increases in labor costs, aggregator/delivery fees, and food commodity prices (especially cheese and proteins), together with hints of margin pressure from ongoing investments in technology, marketing, and loyalty programs, suggest future compression in net margins and operating profitability.

- A continued rise in regulatory scrutiny and potential for new taxes or compliance costs related to processed and unhealthy food offerings are not reflected in near-term optimism. These factors could directly pressure operational costs and indirectly impact earnings through reduced pricing flexibility.

- Momentum in digital ordering, loyalty, and personalization initiatives is heavily dependent on sustained high capex and increasing marketing outlays, which are expected to persist through at least 2026. This sustained investment period may constrain free cash flow and limit near-term earnings growth, even as digital adoption increases.

- Growth expectations seem overly reliant on international expansion and aggregator-driven delivery channels, yet both are subject to high volatility, ongoing strategic closures, and risk of margin dilution from third-party fee pressures, possibly leading to lower-than-anticipated earnings and less robust revenue growth than currently valued.

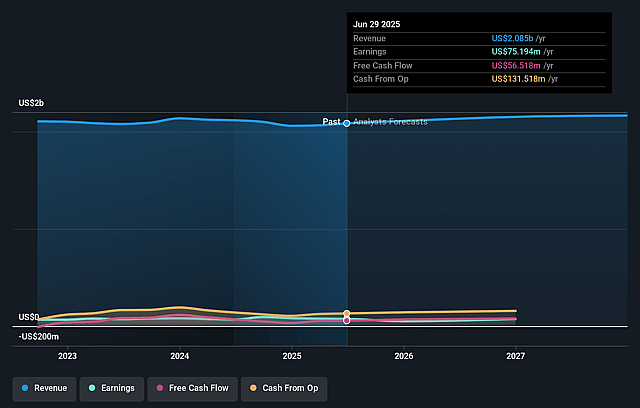

Papa John's International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Papa John's International's revenue will grow by 1.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 3.6% today to 3.1% in 3 years time.

- Analysts expect earnings to reach $67.5 million (and earnings per share of $2.02) by about August 2028, down from $74.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.8x on those 2028 earnings, up from 20.8x today. This future PE is greater than the current PE for the US Hospitality industry at 22.8x.

- Analysts expect the number of shares outstanding to grow by 0.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.22%, as per the Simply Wall St company report.

Papa John's International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Papa John's significant investments in technology (AI, app experience, Google Cloud partnership), menu innovation (Cheddar Crust, Croissant Pizza, new product pipeline), and personalized digital marketing are already driving increased digital engagement and loyalty membership, positioning the brand to leverage the secular shift to digital ordering and repeat purchase, thus likely enhancing long-term revenue and customer lifetime value.

- Strategic supply chain optimization and planned cost savings of at least $50 million (with 40% realized by 2026) are set to improve four-wall EBITDA margins at both company and franchise restaurants, directly benefiting net margins and supporting sustainable profitability growth.

- The refranchising strategy, including deals tied to development agreements and market share gains in important U.S. regions and internationally, signals a shift toward an "asset-light" franchise model; this can boost system-wide sales, recurring high-margin royalty streams, and enhance earnings stability.

- Accelerating international momentum-demonstrated by robust comps in markets like the UK, Middle East, and Dubai, and plans to open 180–200 new international restaurants in 2025-positions Papa John's to capitalize on the global expansion of the QSR sector and the growth of the middle class abroad, driving both topline and systemwide sales growth.

- The success of loyalty and digital engagement efforts-reflected in a rapidly growing rewards membership base (+2.7 million since November 2024), higher app conversions, accelerated repeat purchases, and improved brand health metrics-indicates Papa John's is well-placed to benefit from the long-term industry trend toward digital marketing, customer engagement, and tech-enabled scale, ultimately supporting stronger revenue and earnings over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $51.7 for Papa John's International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $67.0, and the most bearish reporting a price target of just $38.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.2 billion, earnings will come to $67.5 million, and it would be trading on a PE ratio of 33.8x, assuming you use a discount rate of 10.2%.

- Given the current share price of $47.54, the analyst price target of $51.7 is 8.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.