Key Takeaways

- Accelerated product innovation, digital personalization, and strategic cost optimization are set to drive revenue growth, margin expansion, and customer retention above industry peers.

- Strengthened delivery capabilities and faster international growth in key regions should boost market share, high-margin royalties, and global earnings beyond prevailing market expectations.

- Heavy dependence on a traditional menu, rising costs, and increased competition threaten Papa John's margins, sales growth, and long-term financial stability.

Catalysts

About Papa John's International- Operates and franchises pizza delivery and carryout restaurants under the Papa Johns trademark in the United States, Canada, and internationally.

- Analysts broadly agree that Papa John's product innovation and premium menu expansion can lift revenues, but the breadth and cadence of new offerings-including global category innovations like Croissant Pizza and disruptive new formats such as Grand Papa and shareable pizzas-could drive a much more material increase in both transaction counts and average ticket, especially as innovation ramp accelerates into 2026, leading to sustained top line outperformance and higher gross margin per store.

- While existing consensus highlights margin upside from supply chain and refranchising actions, the speed, scale, and discipline of Papa John's cost optimization program-including at least $50 million in identified savings by 2028 and rapid realization beginning in 2026-could boost net margin expansion well above current expectations, particularly as logistics, procurement, and fixed cost utilization initiatives take hold and combine with likely commodity deflation in the back half of the decade.

- Papa John's advanced digital and AI-driven personalization, reinforced by its new Google Cloud partnership and CRM upgrades, is poised to deliver outsized gains in app conversion, loyalty engagement, and order frequency-capitalizing on secular growth in digital ordering to drive industry-leading customer retention and lift both revenue and earnings quality over the next several years.

- The brand's strong competitive position on third-party delivery aggregators, paired with ongoing enhancements to delivery tracking and omni-channel technology, uniquely positions Papa John's to win share in the rapidly expanding delivery and off-premise dining market, fueling above-peer growth in both system-wide sales and enterprise-level EBIT.

- International comp acceleration, especially in high-growth regions like the Middle East and revitalized markets such as the UK, combined with a soon-to-reignite global development engine and a disciplined market optimization strategy, positions Papa John's for faster-than-expected high-margin royalty stream growth and robust international earnings contribution, outperforming consensus system sales forecasts.

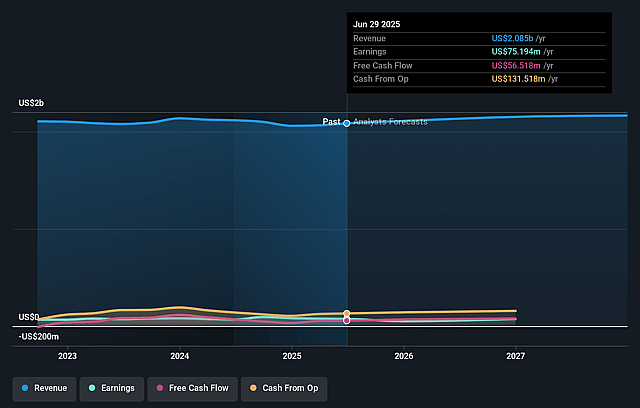

Papa John's International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Papa John's International compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Papa John's International's revenue will grow by 2.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.6% today to 4.5% in 3 years time.

- The bullish analysts expect earnings to reach $101.0 million (and earnings per share of $3.04) by about September 2028, up from $74.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 29.2x on those 2028 earnings, up from 21.4x today. This future PE is greater than the current PE for the US Hospitality industry at 23.9x.

- Analysts expect the number of shares outstanding to grow by 0.36% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.14%, as per the Simply Wall St company report.

Papa John's International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increased consumer health consciousness and ongoing regulatory pressures around nutrition may continue to erode demand for indulgent fast foods, with Papa John's heavily reliant on its existing pizza-centric menu, raising the risk of long-term declines in revenue growth.

- Sustained inflation in labor costs due to wage regulations and ongoing labor shortages is placing downward pressure on store-level EBITDA margins, as evidenced by the 210 basis point margin erosion attributed to labor inflation, aggregator fees, and advertising despite management's cost-saving initiatives.

- Persistent commodity cost volatility, particularly for cheese and proteins, presents a structural challenge for Papa John's, embedding uncertainty into pricing and exposing the company to continued gross margin risk across both company-operated and franchised locations.

- Stagnant same-store sales growth in mature North American markets, coupled with higher-than-usual annualized store closures in both North America and international markets, suggests weak organic topline expansion and intensifies risk of system-wide revenue stagnation.

- Ongoing competitive intensity from third-party aggregators, ghost kitchens, and pizza chain rivals with stronger brand equity forces Papa John's to increase marketing and promotional spending, likely compressing net margins and threatening long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Papa John's International is $67.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Papa John's International's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $67.0, and the most bearish reporting a price target of just $42.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $2.3 billion, earnings will come to $101.0 million, and it would be trading on a PE ratio of 29.2x, assuming you use a discount rate of 10.1%.

- Given the current share price of $48.76, the bullish analyst price target of $67.0 is 27.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.