Last Update 01 Dec 25

COST: Solid Membership Retention And Defensive Edge Will Support Future Share Gains

Analysts have modestly lowered their average price target for Costco Wholesale, now expecting shares to reach around $1,020. Recent updates reflect both the company's continued strong performance as well as persistent concerns over its premium valuation and mixed quarterly results.

Analyst Commentary

Recent analyst reports highlight both strengths and concerns for Costco Wholesale, reflecting a nuanced outlook on the company’s future performance and valuation. The discussions center around factors such as its solid execution, valuation premium, and resilience within a challenging retail environment.

Bullish Takeaways

- The company consistently reports strong core comparable sales and overall comp growth, reflecting robust consumer demand and a solid value proposition.

- Costco continues to demonstrate impressive traffic and core earnings growth, even as it navigates a complex retail backdrop and rising input costs.

- Analysts see Costco’s supply chain scale and operational efficiency as providing a defensive edge and supporting further market share gains.

- Renewal rates above 90% and a focus on higher income consumers contribute to stable revenue streams that help mitigate broader industry volatility.

Bearish Takeaways

- Valuation remains a central concern, with the stock trading at around 50 times forward earnings, a premium multiple that some view as difficult to justify for new investors.

- Recent quarterly results offered mixed signals, including stable but slightly slowing EBIT growth and inconsistent margins, raising questions about continued operating leverage.

- Lower-income consumer confidence has come under pressure due to recent reductions in SNAP benefits and delayed government payments, which could dampen grocery and staple sales industry-wide, even if Costco is less exposed than some peers.

- Some analysts note that Costco’s premium valuation may already reflect its strong business model and growth prospects, limiting the immediate upside potential.

What's in the News

- President Donald Trump is expected to sign an order reducing tariffs on beef, coffee, tomatoes, and bananas. This action is intended to lower grocery costs and could impact grocery retailers including Costco (Bloomberg).

- A federal judge ruled that suspending SNAP benefits would likely be unlawful, which may preserve grocery spending power at major retailers like Costco (Bloomberg).

- Costco has reportedly removed its Xbox section from U.S. and U.K. websites. Currently, no Xbox products are available for purchase online, while other gaming platforms remain listed (TheGamer).

Valuation Changes

- Fair Value Estimate remains stable at $1,055.97, reflecting no change in the underlying assessment of Costco's intrinsic worth.

- Discount Rate has edged down minimally, now at 6.95%, which suggests slightly lower perceived risk for future cash flows.

- Revenue Growth projection is virtually unchanged, holding at 7.45% per year. This indicates consistent expectations for top-line expansion.

- Net Profit Margin has dipped marginally from 3.20% to 3.19%, signaling a very slight pullback in profitability forecasts.

- Future P/E Ratio has risen fractionally from 52.16x to 52.22x. This shows a minor increase in the expected price-to-earnings multiple assigned to Costco's future earnings.

Key Takeaways

- Expansion of warehouse locations and gas station hours aims to increase membership, store traffic, and revenue growth.

- E-commerce growth and international market investments could boost overall earnings and diversify sales.

- Rising costs from labor, tariffs, and supply chains, along with foreign exchange fluctuations, could pressure Costco's margins and market competitiveness.

Catalysts

About Costco Wholesale- Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

- Costco plans to continue expanding its warehouse locations, with 28 new openings planned for fiscal year 2025. This expansion is likely to increase membership and sales volume, driving revenue growth.

- Costco's extension of gas station hours is designed to enhance member convenience, which could lead to higher gasoline sales and increased store traffic, positively impacting revenue.

- The updated employee agreement with higher wages may initially increase SG&A expenses, but Costco's focus on labor productivity and cost discipline could help maintain net margins over time.

- E-commerce and digital channels show significant growth, with e-commerce comp sales up 22.2% adjusted for FX, suggesting a strong potential to boost revenue and earnings from online sales.

- Continued investment in international markets with new warehouse openings and the introduction of Executive Memberships in additional countries could further diversify and increase international sales, enhancing overall earnings potential.

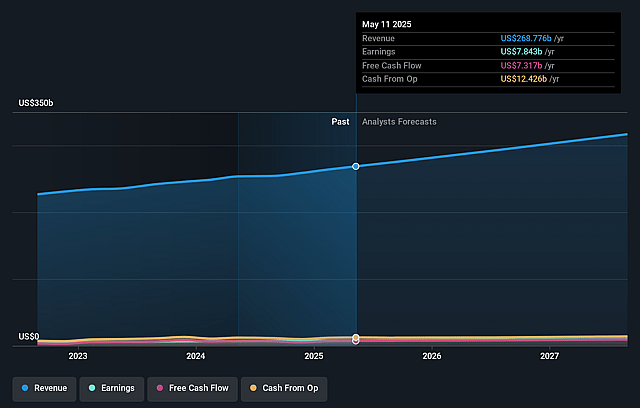

Costco Wholesale Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Costco Wholesale's revenue will grow by 7.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.9% today to 3.2% in 3 years time.

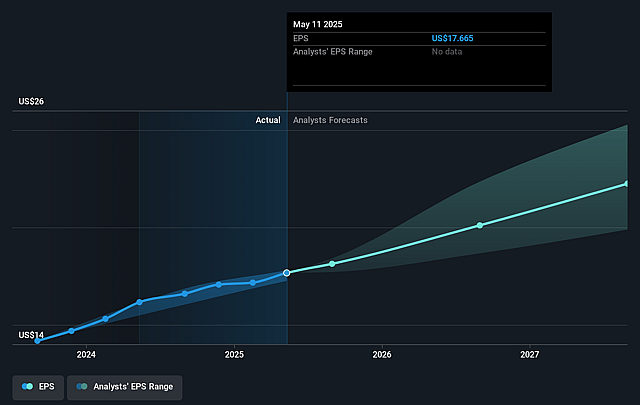

- Analysts expect earnings to reach $10.4 billion (and earnings per share of $23.52) by about September 2028, up from $7.8 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $8.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 55.6x on those 2028 earnings, up from 55.4x today. This future PE is greater than the current PE for the US Consumer Retailing industry at 21.7x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Costco Wholesale Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Foreign exchange fluctuations have negatively impacted Costco's international sales and profits, introducing uncertainty into net income and earnings.

- Increased labor costs due to the updated employee agreement could pressure margins, as Costco plans to improve wages significantly over the next few years.

- Tariff unpredictability and potential trade tensions, especially with a significant portion of sales being imports, could impact future costs and profit margins adversely.

- Supply chain cost increases, as Costco invests in maintaining higher inventory levels amidst global delays, could exert pressure on core operating margins.

- Rising competition from other retailers might impact market share and revenues, especially if they struggle to maintain price leadership amidst inflationary pressures.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $1072.667 for Costco Wholesale based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $1225.0, and the most bearish reporting a price target of just $620.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $329.0 billion, earnings will come to $10.4 billion, and it would be trading on a PE ratio of 55.6x, assuming you use a discount rate of 6.8%.

- Given the current share price of $979.25, the analyst price target of $1072.67 is 8.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Costco Wholesale?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.