Last Update07 May 25Fair value Decreased 8.94%

Key Takeaways

- Macroeconomic uncertainties and increased cancellation rates may hinder PulteGroup's revenue growth and consumer demand for homes.

- Tariffs and decreased land spending could compress gross margins and slow revenue and earnings growth in the near future.

- PulteGroup's diverse market strategy and strong financial position enable resilience and adaptability, potentially stabilizing returns and enhancing long-term profitability amidst market fluctuations.

Catalysts

About PulteGroup- Through its subsidiaries, engages in the homebuilding business in the United States.

- The volatility in the stock market, coupled with concerns about tariffs and recession risks, are likely to dampen consumer confidence and demand for homes in the near future. This could impact PulteGroup's revenue growth negatively.

- The cancellation rate has slightly increased to 11%, and with the company already experiencing a 7% decline in net new orders year-over-year, future revenue could see pressure if these trends continue or worsen.

- The tariffs could increase PulteGroup's house cost by an estimated $5,000 on average per home in the latter half of the year. This could compress gross margins to between 26.0% and 26.5% in later quarters, impacting earnings negatively.

- The addition of new Del Webb communities is expected only to contribute significantly to closings by 2026, which could mean weaker short-to-medium-term earnings growth unless other sources of growth are identified.

- Given macro uncertainties, PulteGroup has adjusted its land spend projections downward by 10% to $5 billion from the anticipated $5.5 billion. This cautious approach could limit growth opportunities, reflecting potentially slower revenue and earnings growth in coming years.

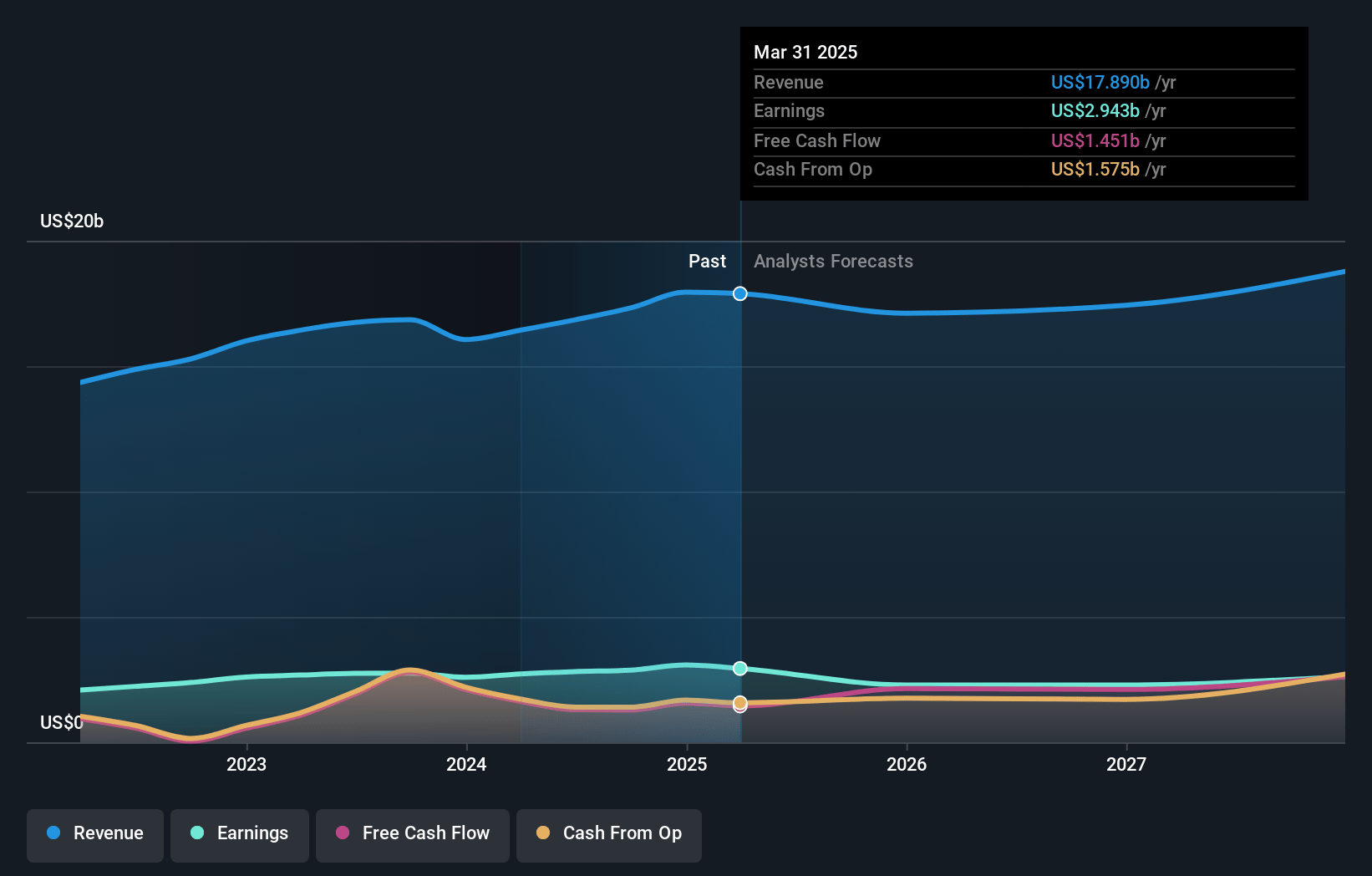

PulteGroup Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on PulteGroup compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming PulteGroup's revenue will decrease by 0.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 16.5% today to 14.7% in 3 years time.

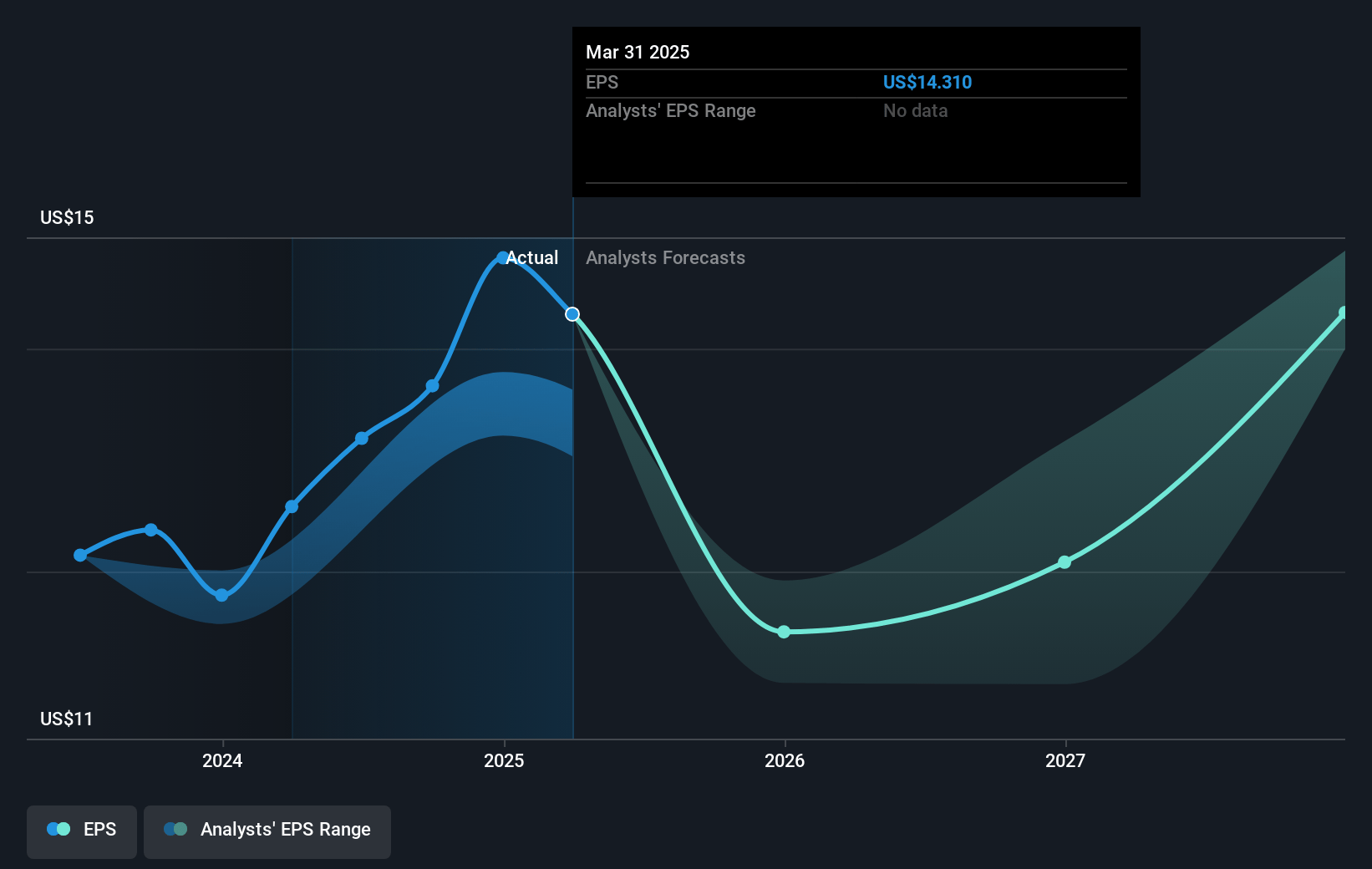

- The bearish analysts expect earnings to reach $2.6 billion (and earnings per share of $14.1) by about May 2028, down from $2.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.2x on those 2028 earnings, up from 6.9x today. This future PE is lower than the current PE for the US Consumer Durables industry at 8.7x.

- Analysts expect the number of shares outstanding to decline by 4.71% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.82%, as per the Simply Wall St company report.

PulteGroup Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- PulteGroup's national footprint and strategy of serving diverse buyer groups give its operators flexibility to navigate economic transitions, potentially maintaining revenue and returns even in challenging conditions.

- The company's ability to adjust pricing and sales pace strategically is likely to allow it to manage returns over the housing cycle effectively, supporting its gross margins.

- PulteGroup's strategic alignment of its portfolio towards financially stronger move-up and active adult buyers enhances its resilience in fluctuating market conditions, potentially stabilizing earnings.

- The reduction in speculative inventory and a maintained focus on pricing rather than volume might prevent excessive margin erosion, supporting net income.

- PulteGroup's balance sheet strength, with low debt and significant cash reserves, equips the company to capitalize on market opportunities that may arise, potentially benefiting long-term profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for PulteGroup is $98.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of PulteGroup's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $165.0, and the most bearish reporting a price target of just $98.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $17.6 billion, earnings will come to $2.6 billion, and it would be trading on a PE ratio of 8.2x, assuming you use a discount rate of 7.8%.

- Given the current share price of $101.32, the bearish analyst price target of $98.0 is 3.4% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that the bearish analysts believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.