Last Update07 May 25Fair value Decreased 3.05%

Key Takeaways

- Strong demographic trends, a focus on entry-level buyers, and suburban shifts position PulteGroup for sustained growth in volume, sales pipeline, and profitability.

- Strategic capital allocation and adoption of technology enhance margins, operational efficiency, and resilience amid industry consolidation and evolving housing preferences.

- Declining demand, margin pressures, geographic concentration, and rising costs pose significant risks to revenue and earnings growth amid ongoing economic and supply chain uncertainty.

Catalysts

About PulteGroup- Through its subsidiaries, engages in the homebuilding business in the United States.

- PulteGroup is uniquely positioned to capitalize on the fundamental shortage of housing in the United States, which is driven by years of underbuilding and continuing population growth; this persistent demand is expected to support sustainable volume growth and drive future revenue and earnings higher.

- As Millennials and Gen Z age into their homebuying years, PulteGroup’s focus on entry-level and first-time buyers through its Centex and Pulte brands positions the company to capture a disproportionate share of these large, demographically driven buyer cohorts, thereby expanding its future sales pipeline and supporting bullish revenue forecasts.

- The ongoing trend toward suburban living and remote/hybrid work is shifting consumer preferences toward new-build homes in amenity-rich communities, where PulteGroup’s national scale and broad local presence in these key markets should allow the company to command higher average selling prices and drive stronger net margins over time.

- PulteGroup’s disciplined capital allocation—including substantial investments in land acquisition, development, and share repurchases—alongside a robust balance sheet and industry-leading gross margins, positions the company to enhance future EPS and shareholder returns, especially by taking advantage of market volatility and industry consolidation as smaller builders exit the market.

- The company’s embrace of advanced construction technologies and digital tools, as well as its strategic investments in building energy-efficient homes that comply with evolving regulatory incentives, are expected to lower build costs, improve operational efficiency, and support future margin expansion, adding long-term upside to net income and supporting premium valuations.

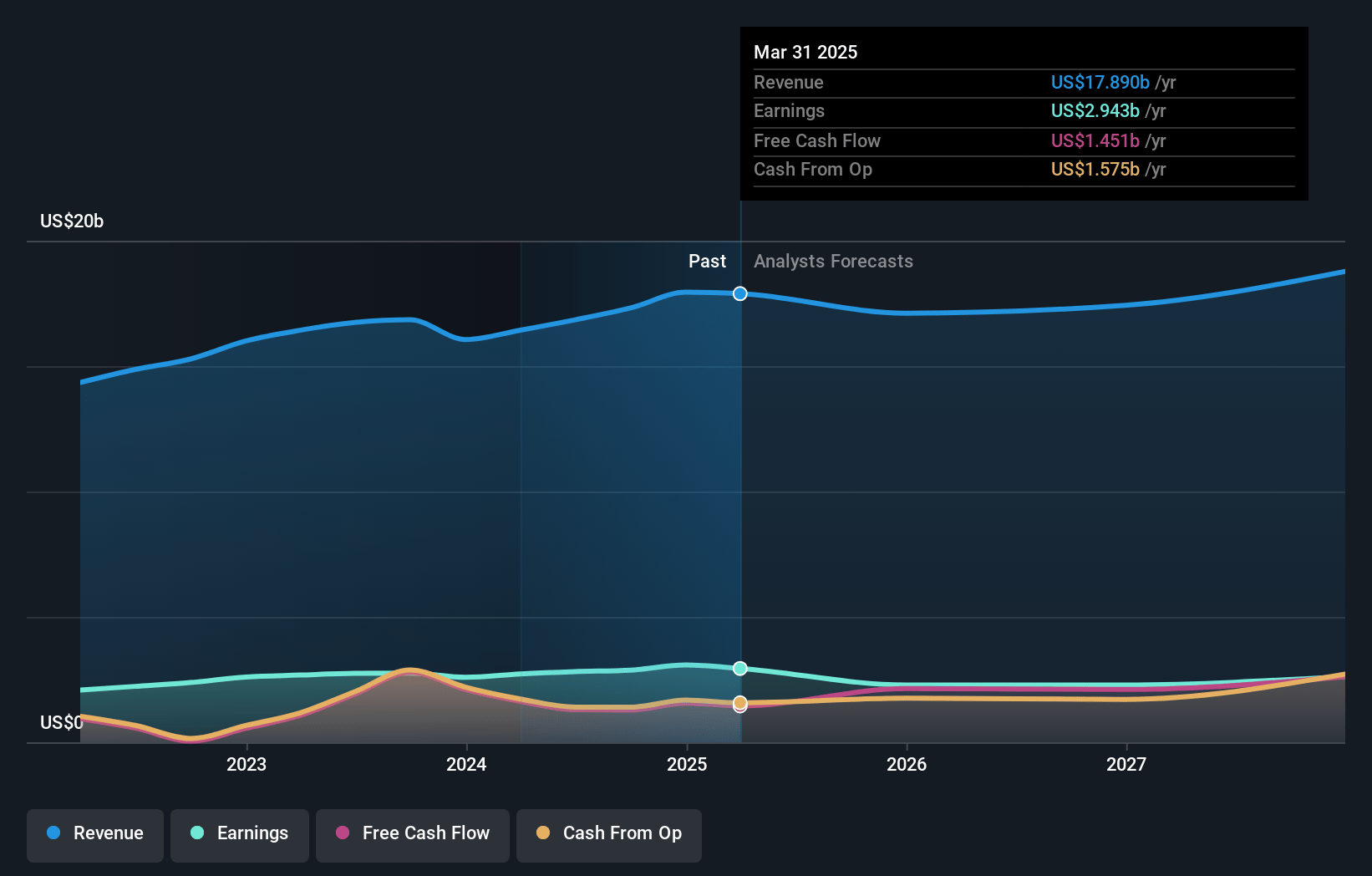

PulteGroup Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on PulteGroup compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming PulteGroup's revenue will grow by 5.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 16.5% today to 13.9% in 3 years time.

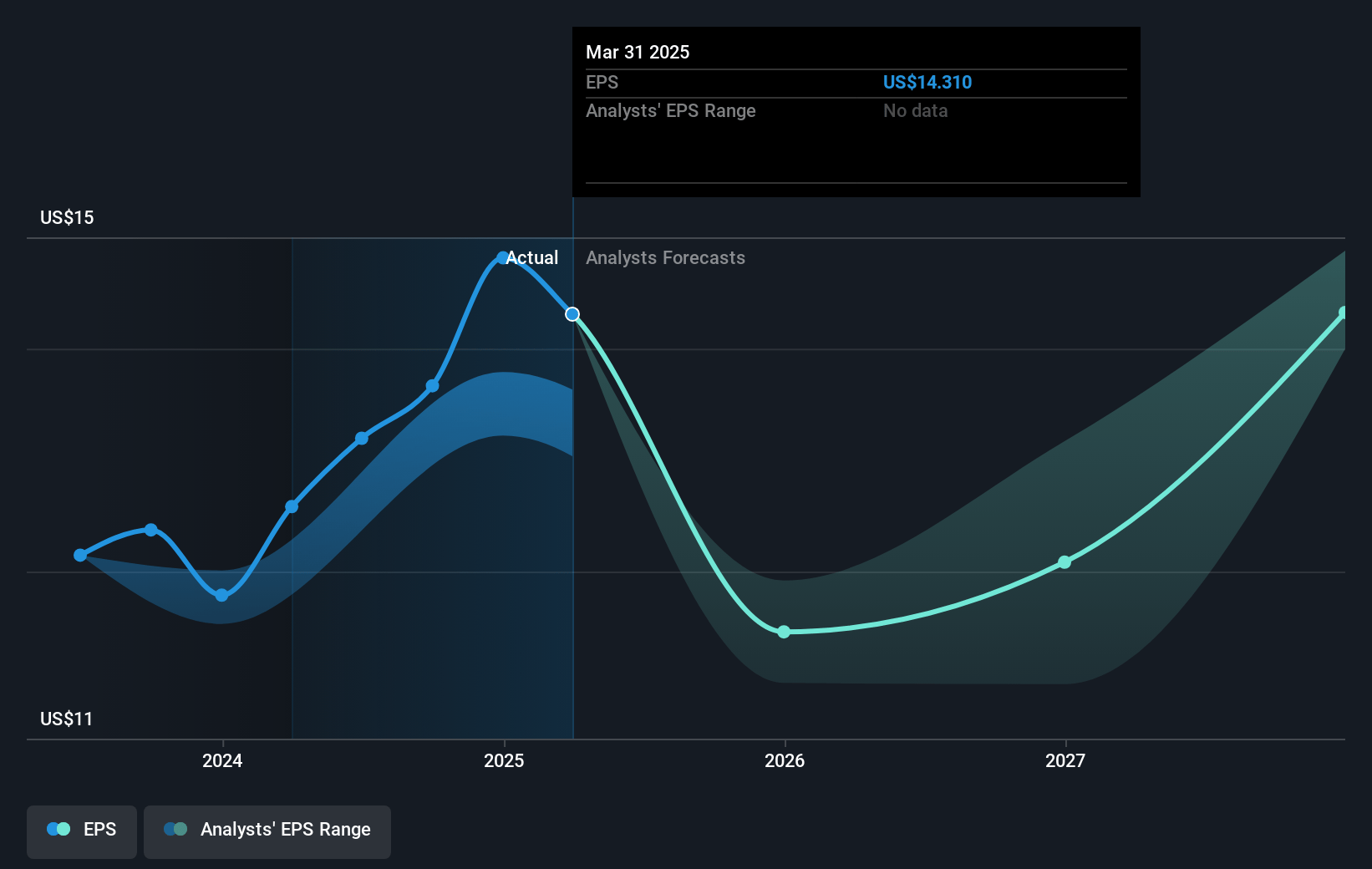

- The bullish analysts expect earnings to remain at the same level they are now, that being $2.9 billion (with an earnings per share of $15.5). The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.5x on those 2028 earnings, up from 6.9x today. This future PE is greater than the current PE for the US Consumer Durables industry at 8.7x.

- Analysts expect the number of shares outstanding to decline by 4.71% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.82%, as per the Simply Wall St company report.

PulteGroup Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- PulteGroup is experiencing declining net new home orders and lower closing volumes, with net new orders down 7 percent year-over-year and a 16 percent decline in backlog homes, signaling demand headwinds that could limit future revenue growth and earnings potential if the trend persists.

- The company is reliant on elevated sales incentives and is guiding for a slight decline in gross margins throughout 2025, due to both higher incentive rates and the impact of tariffs raising construction costs by roughly 1 percent of average selling price, pointing to ongoing margin compression and downward pressure on net income.

- Management highlighted unusual volatility and unpredictability in consumer demand, especially in April, citing macroeconomic uncertainty, interest rate fluctuations, tariff-induced inflation concerns, and potential recession, all of which could further disrupt sales throughput, lower revenues, and pressure net margins.

- The business model is heavily weighted toward move-up and active adult buyers and is geographically concentrated in sunbelt states like Florida, which is currently facing softer resale inventory and local headwinds; this concentration amplifies risks to revenues and earnings if regional downturns or demographic shifts—such as aging populations and slower household formation—dampen demand.

- PulteGroup faces escalating land, labor, and regulatory costs, as well as the threat of supply chain disruptions either from tariffs or climate-related events, which could raise input costs and delay projects, potentially reducing delivery volumes, further compressing margins, and impairing long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for PulteGroup is $154.35, which represents two standard deviations above the consensus price target of $123.36. This valuation is based on what can be assumed as the expectations of PulteGroup's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $165.0, and the most bearish reporting a price target of just $98.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $20.9 billion, earnings will come to $2.9 billion, and it would be trading on a PE ratio of 11.5x, assuming you use a discount rate of 7.8%.

- Given the current share price of $100.84, the bullish analyst price target of $154.35 is 34.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives