Key Takeaways

- Growth in digital gaming and expanded entertainment partnerships are boosting high-margin revenues and strengthening Hasbro's intellectual property value.

- Strategic shift toward branded entertainment and operational efficiencies is enhancing profitability, cash flow, and earnings resilience amid changing market conditions.

- Trade barriers, shifting consumer habits, and overreliance on licensed brands are pressuring profitability, margins, and long-term revenue stability.

Catalysts

About Hasbro- Operates as a toy and game company in the United States, Europe, Canada, Mexico, Latin America, Australia, China, and Hong Kong.

- Strong growth and high engagement in the digital gaming and collectible card segment (e.g., MAGIC: THE GATHERING, MONOPOLY GO!, digital licensing) are expanding Hasbro's addressable market and providing high-margin, resilient revenue streams, supporting future top-line and operating margin expansion.

- Momentum in franchise

- and character-driven entertainment, especially new and extended partnerships with major IPs like Disney, Marvel, and Star Wars, is amplifying the value of Hasbro's intellectual property portfolio and is poised to further boost licensing revenues, which carry superior net margin profiles.

- Ongoing strategic shift towards a branded entertainment model with increased focus on leveraging owned and partnered IP across digital games, streaming, and film is lowering capital intensity and supporting margin growth by generating more lucrative royalty streams and licensing deals.

- The acceleration of supply chain diversification, operational cost savings initiatives, and portfolio SKU rationalization are positioning Hasbro for higher operational efficiency, improved EBITDA margins, and stronger free cash flow, especially as macro and tariff headwinds ease or stabilize.

- Increased investment in direct-to-consumer channels and advanced retail partnerships is strengthening Hasbro's pricing power, improving data-driven marketing, and maintaining sales volumes, which collectively drive revenue stability and earnings resilience even in volatile environments.

Hasbro Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hasbro's revenue will grow by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.0% today to 15.6% in 3 years time.

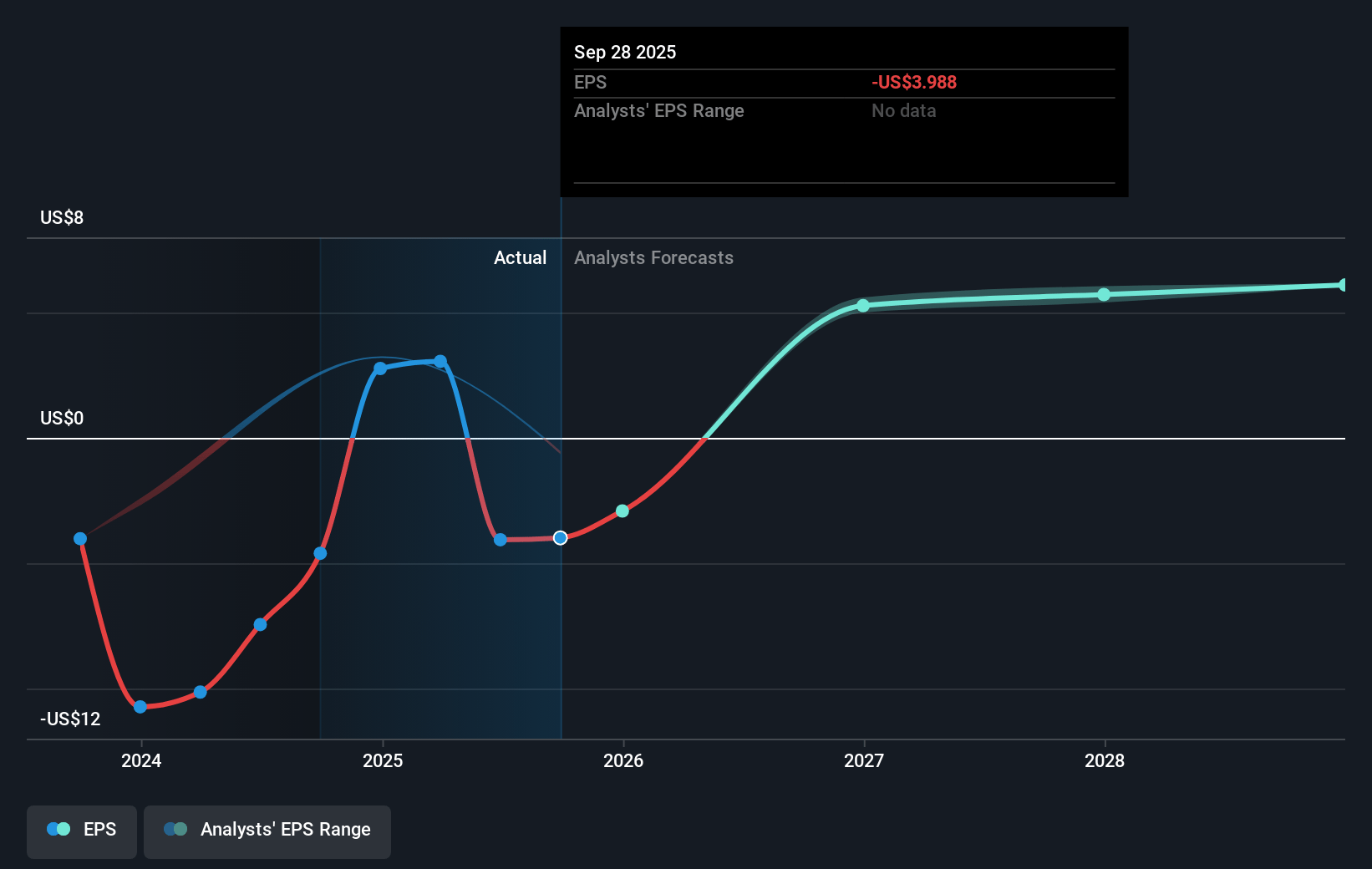

- Analysts expect earnings to reach $720.8 million (and earnings per share of $5.16) by about July 2028, up from $426.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.3x on those 2028 earnings, down from 24.6x today. This future PE is lower than the current PE for the US Leisure industry at 20.1x.

- Analysts expect the number of shares outstanding to grow by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.91%, as per the Simply Wall St company report.

Hasbro Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged and elevated tariffs (e.g., 145% on China and 10% reciprocal on other countries) pose a structural cost headwind that could persist into 2026 and beyond, increasing input costs, compressing margins, and potentially reducing net earnings and profitability in the medium term.

- Accelerated manufacturing diversification away from China may result in higher production and logistics expenses in the short to medium term, as certain regions (e.g., U.S., Turkey) have inherently higher costs, further pressuring operating margins and possibly impacting sustained free cash flow improvement.

- The toy category faces secular headwinds from increasing digitalization and shifting entertainment preferences among younger consumers, risking demand erosion for traditional toys and core consumer products, which could weigh on long-term revenue growth.

- Ongoing reliance on legacy brands and licensed franchises (e.g., Marvel, Star Wars, Peppa Pig, Monopoly, Transformers) introduces brand fatigue and margin pressure due to increased royalty and licensing costs, especially as Wizards scales tempo releases and collaborative IPs-potentially limiting organic IP-driven growth and net margins.

- Industry-wide risks such as trade route volatility, potential retailer order shifts and cancellations, and escalating private-label competition could hinder Hasbro's pricing power, disrupt inventory flows, and amplify earnings volatility over multiple years.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $80.112 for Hasbro based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $86.0, and the most bearish reporting a price target of just $70.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.6 billion, earnings will come to $720.8 million, and it would be trading on a PE ratio of 19.3x, assuming you use a discount rate of 6.9%.

- Given the current share price of $74.84, the analyst price target of $80.11 is 6.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.