Key Takeaways

- Heavy reliance on large OEMs and exposure to commodity volatility leave Titan vulnerable to revenue swings and industry cycles, despite efforts to build partnerships and localize production.

- Technological shifts toward automation and unfavorable demographic trends could shrink demand for traditional products, limiting long-term growth even with supportive regulations.

- Prolonged market uncertainty, financial constraints, and structural industry risks threaten stable demand, profit growth, and Titan's long-term margin sustainability.

Catalysts

About Titan International- Manufactures and sells wheels, tires, and undercarriage systems and components for off-highway vehicles in the United States and internationally.

- While Titan is positioned to benefit from global population growth and infrastructure investment in emerging markets-catalysts that should boost long-term revenue-ongoing uncertainty around tariffs, trade policy, and especially persistently high interest rates are causing equipment buyers and channel partners to remain hesitant, which may delay any revenue recovery and prolong the current cyclical trough.

- Although expanded alliances with major OEMs and recent initiatives like the Roderos partnership in Brazil could eventually enhance revenue stability and broaden market share, Titan's continued dependence on a handful of large OEMs exposes it to contract renegotiations and sharp revenue swings if purchasing activity remains muted or concentrated risk materializes.

- Even as sustainable agriculture and food security initiatives create a foundational demand for Titan's core markets, rapid advances in agricultural automation and smart farming technologies could ultimately shrink the addressable market for traditional wheel and tire products, pressuring both revenue growth and net margins over the long term.

- While efforts to localize manufacturing and maintain a one-stop shop position may improve Titan's gross margins during upswings, the company still faces volatility from commodity price exposure and cyclical industry dynamics; this operating leverage could work against net profitability if demand remains sluggish or input costs rise due to environmental regulations or supply chain disruptions.

- Despite regulatory tailwinds in the form of accelerated tax depreciation for farm equipment and strengthening relationships in South American markets, consolidating trends among major OEMs and shifting demographic realities-such as the aging farming population and workforce transitions-threaten to cap long-term industry growth, potentially resulting in structurally flat or declining earnings even once current demand recovers.

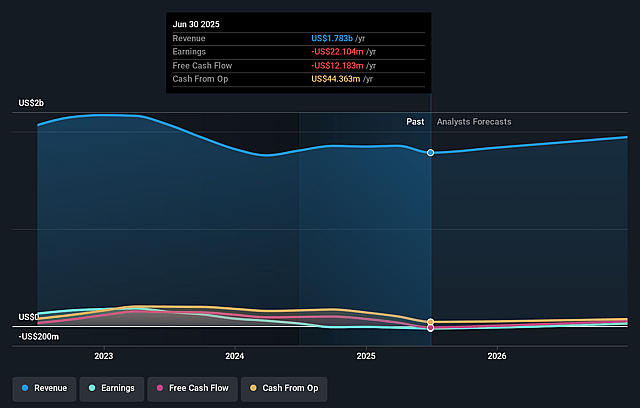

Titan International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Titan International compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Titan International's revenue will grow by 5.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -1.2% today to 6.0% in 3 years time.

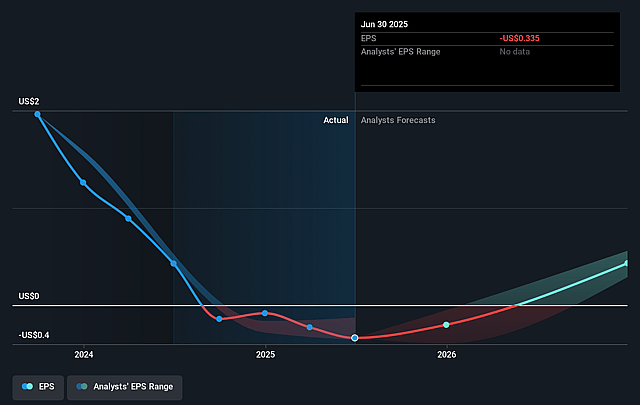

- The bearish analysts expect earnings to reach $124.5 million (and earnings per share of $1.92) by about September 2028, up from $-22.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 7.3x on those 2028 earnings, up from -24.7x today. This future PE is lower than the current PE for the US Machinery industry at 24.7x.

- Analysts expect the number of shares outstanding to grow by 1.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.39%, as per the Simply Wall St company report.

Titan International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged market softness in core end markets and continued buyer wait-and-see mentality tied to high interest rates and unclear tariff and trade policies could delay demand recovery for agricultural and consumer equipment, suppressing revenue growth and earnings for an extended period.

- Reliance on cyclical order drop-ins as opposed to steady baseline demand-caused by OEM and distributor destocking and uncertain restocking patterns-creates volatility in sales and limits visibility, which can pressure profitability and future revenue consistency.

- Elevated net leverage and persistent high debt levels, even with current free cash flow generation, can limit the company's financial flexibility and increase risk should a downturn worsen, potentially elevating interest expense or constraining investment in growth initiatives, all of which threaten net income.

- Exposure to geographic mix and profitability differences, as evidenced by an effective tax rate well over 100% due to profit distribution, suggests that fluctuating profit centers or future geographic headwinds could dilute overall net margins and after-tax earnings.

- Structural industry risks including technological advancements in farm automation, demographic shifts like an aging farm population, and increased regulatory or sustainability pressures could, over the long term, erode Titan's core market demand and compress margins, challenging the company's ability to sustain revenue and profit growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Titan International is $10.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Titan International's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $2.1 billion, earnings will come to $124.5 million, and it would be trading on a PE ratio of 7.3x, assuming you use a discount rate of 11.4%.

- Given the current share price of $8.54, the bearish analyst price target of $10.0 is 14.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.