Key Takeaways

- Titan is poised for accelerated growth and margin expansion due to favorable industry trends, strategic partnerships, and innovative premium products.

- Expansion in Brazil and a robust global manufacturing presence position Titan to capture rising demand across agriculture, construction, and military sectors.

- Shifting technology, climate uncertainty, evolving industry standards, OEM dependence, and competitive pressures threaten Titan's market relevance, margin stability, and long-term profitability.

Catalysts

About Titan International- Manufactures and sells wheels, tires, and undercarriage systems and components for off-highway vehicles in the United States and internationally.

- While analysts broadly agree Titan will benefit from a cyclical ag upturn, the removal of unfair foreign competition via tariffs and the acceleration of depreciation benefits for new equipment could unleash a far larger wave of farm investment than anticipated, dramatically boosting revenue and operating leverage as OEM and aftermarket demand rebounds sharply.

- Analyst consensus sees Brazil as a growth driver, but Titan's strategic minority stake in Roderos uniquely positions it to control a dominant share of the Brazilian wheel and tire assembly market, accelerating both market share gains and margin expansion in a region poised for outsized agricultural equipment growth.

- Rapid urbanization and global infrastructure spending are set to drive multi-year growth in construction and earthmoving equipment, and Titan's strong global manufacturing footprint and deep OEM relationships position it to capture a disproportionate share of this demand surge, supporting sustained top-line outperformance.

- New advancements in smart farming and autonomous machinery are generating strong demand for specialized, high-value tires-Titan's continued innovation pipeline (including AI-driven product marketing and data-backed LSW value propositions) could fundamentally shift the product mix toward premium offerings, elevating average selling prices and expanding gross margins.

- Industry consolidation and Titan's aggressive "one-stop shop" strategy, including expanded third-party sourcing and renewed military market entry, will allow the company to leverage its scale for improved supplier terms and recurring, higher-margin revenue streams, leading to structural EBITDA growth and cash flow durability.

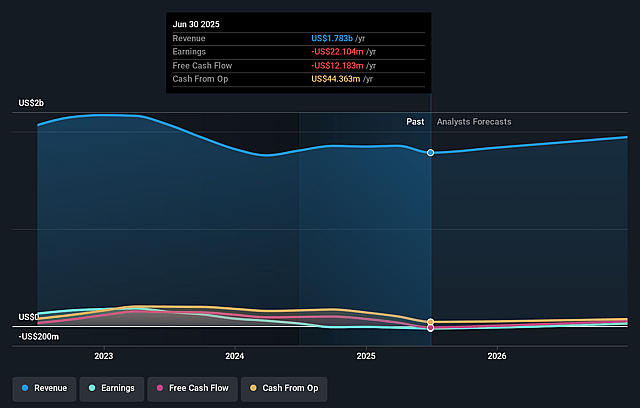

Titan International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Titan International compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Titan International's revenue will grow by 6.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -1.2% today to 8.4% in 3 years time.

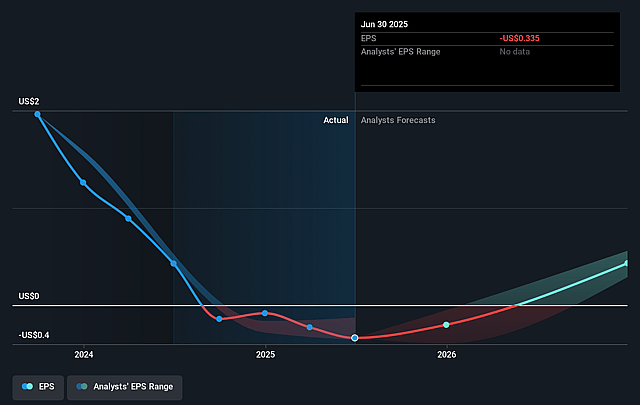

- The bullish analysts expect earnings to reach $180.7 million (and earnings per share of $2.83) by about September 2028, up from $-22.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 6.1x on those 2028 earnings, up from -24.1x today. This future PE is lower than the current PE for the US Machinery industry at 24.7x.

- Analysts expect the number of shares outstanding to grow by 1.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.38%, as per the Simply Wall St company report.

Titan International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The acceleration of automation and robotics in agriculture could structurally shrink the traditional market for Titan International's core products, leading to lower long-term revenues as advanced tech reduces demand for conventional off-the-road tires and wheels.

- Climate change may continue to drive unpredictable weather conditions and shifts in arable land, potentially depressing global cycles of agricultural equipment investment and causing persistent weakness in Titan's revenue and earnings.

- An increasing global emphasis on ESG initiatives, including electrification and a shift toward lighter and more fuel-efficient machinery, poses a risk that Titan's legacy off-the-road products will lose relevance-pressuring both market share and net margins as the industry evolves.

- Titan's heavy reliance on a few large OEM customers, combined with their ongoing destocking and wait-and-see approach tied to interest rates and tariffs, increases vulnerability to abrupt order reductions or loss of major contracts, putting significant pressure on revenue stability and earnings predictability.

- The combination of volatile operating margins, slow innovation adoption in manufacturing, and intensifying competition from lower-cost producers in Asia exposes Titan to margin compression and potential long-term erosion of profitability, especially if the company fails to modernize quickly.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Titan International is $12.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Titan International's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $2.1 billion, earnings will come to $180.7 million, and it would be trading on a PE ratio of 6.1x, assuming you use a discount rate of 11.4%.

- Given the current share price of $8.35, the bullish analyst price target of $12.0 is 30.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.