Last Update 05 Sep 25

With no analyst commentary provided, both Titan International’s discount rate and future P/E ratio remained essentially unchanged, resulting in a stable consensus price target of $11.00.

What's in the News

- Completed repurchase of 4,618,379 shares (6.99%) for $48.83 million under buyback announced in December 2022; no shares repurchased in most recent quarter.

- Issued third quarter 2025 sales guidance of $450 million to $475 million.

- Dropped from Russell 2000 Defensive Index.

- Dropped from Russell 2000 Value-Defensive Index.

Valuation Changes

Summary of Valuation Changes for Titan International

- The Consensus Analyst Price Target remained effectively unchanged, at $11.00.

- The Discount Rate for Titan International remained effectively unchanged, moving only marginally from 11.22% to 11.23%.

- The Future P/E for Titan International remained effectively unchanged, at 19.01x.

Key Takeaways

- Easing trade pressures and supportive government policies are expected to boost pricing power, margin expansion, and end-market demand for Titan.

- Strategic international expansion and recovering equipment inventories position Titan for long-term growth and heightened resilience as market conditions improve.

- Prolonged weak demand, margin pressure, lagging innovation, geopolitical risks, and high leverage threaten Titan's revenue stability, profitability, and competitive positioning.

Catalysts

About Titan International- Manufactures and sells wheels, tires, and undercarriage systems and components for off-highway vehicles in the United States and internationally.

- Anticipated resolution and consistent application of global trade policies and tariffs are expected to create a more level playing field, reducing competitive pressures from low-cost imports and supporting higher pricing power and improved net margins for Titan going forward.

- Ongoing government stimulus for infrastructure and supportive legislation (such as accelerated depreciation allowances for new farm equipment) are positioned to drive increased investment in agricultural and construction equipment, which is likely to accelerate end-market demand and support revenue growth.

- Strategic international expansion, including the minority investment in Brazil's Roderos and a broader focus on high-growth regions, is expected to broaden Titan's customer base and capture new growth opportunities, supporting long-term international revenue gains.

- Persistent underinvestment and inventory destocking in the agriculture and construction equipment sectors have resulted in unusually low dealer and distributor inventories. As market headwinds (interest rates, tariffs) ease, the replenishment of these inventories is likely to drive a sharp rebound in aftermarket demand, boosting both revenue and earnings.

- Operational efficiencies, cost management, and organizational agility demonstrated during the current cyclical downturn have led to sequential margin improvements. This positions Titan to expand net margins and earnings resilience as macro conditions and end-market demand recover.

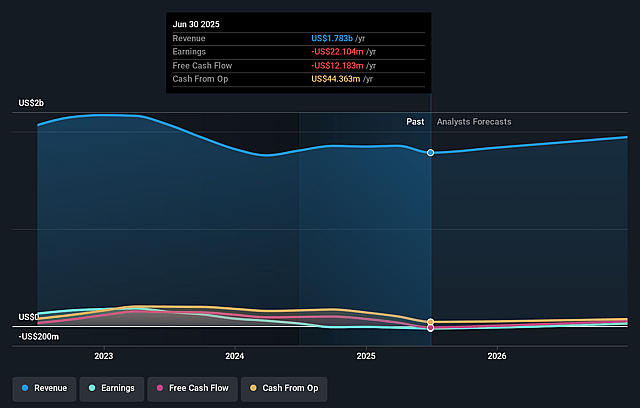

Titan International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Titan International's revenue will grow by 5.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.2% today to 2.5% in 3 years time.

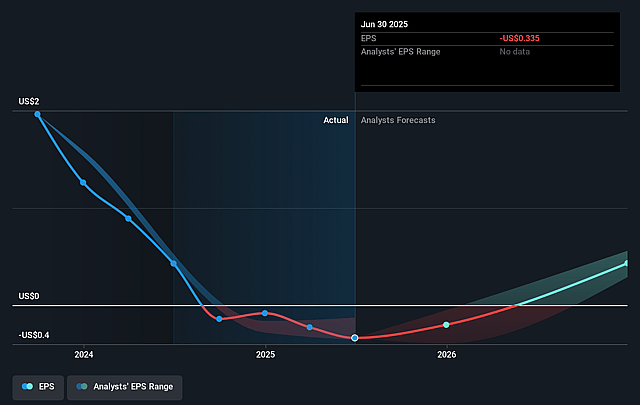

- Analysts expect earnings to reach $52.5 million (and earnings per share of $0.83) by about September 2028, up from $-22.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.1x on those 2028 earnings, up from -24.1x today. This future PE is lower than the current PE for the US Machinery industry at 24.7x.

- Analysts expect the number of shares outstanding to grow by 1.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.38%, as per the Simply Wall St company report.

Titan International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing muted demand in core agricultural markets, driven by high interest rates and buyers' "wait and see" approach, prolongs uncertainty and delays equipment purchases, directly limiting revenue growth and contributing to ongoing earnings and cash flow volatility.

- Margins remain under pressure, with year-over-year gross margin decline attributed to lower sales and negative overhead leverage; if cyclical softness persists or volumes do not recover as expected, net margins and profitability could see continued or further erosion.

- Titan's R&D spending remains flat and may lag behind potential industry innovation requirements (e.g., electrification, automation, and advanced tire technology), heightening the risk of losing market share to more technologically advanced or better-capitalized competitors, which would adversely impact future revenues and gross margins.

- Titan is highly exposed to geopolitical and trade-related risks; frequent changes in tariffs, trade agreements, or global policy can disrupt customer ordering patterns, affect channel inventory, and lead to unpredictable swings in demand, thus introducing risk to revenue reliability and cost structure.

- Leverage remains elevated, and while management expects this to be a peak, prolonged weak market conditions or operational missteps could constrain financial flexibility, trigger covenants, and elevate interest expense, limiting Titan's maneuverability for investments or acquisitions and adversely impacting earnings and net profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $11.0 for Titan International based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.1 billion, earnings will come to $52.5 million, and it would be trading on a PE ratio of 19.1x, assuming you use a discount rate of 11.4%.

- Given the current share price of $8.35, the analyst price target of $11.0 is 24.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.