Key Takeaways

- Uncertainty from project delays, regulatory hurdles, and regional concentration could lead to volatile earnings and unpredictable revenue growth.

- Intensifying competition and higher costs threaten profitability and could limit Emeren's ability to efficiently expand its project portfolio.

- Geographic concentration, regulatory delays, power price declines, and foreign exchange volatility create earnings instability and margin pressure for Emeren's international projects and contracts.

Catalysts

About Emeren Group- Develops, builds, and sells solar power projects.

- Although Emeren Group is well positioned to benefit from the ongoing global shift toward renewable energy, including strong policy support and increasing investments in grid modernization, persistent project delays and unpredictable government approval timelines-particularly in key European markets like Spain and the U.S.-introduce uncertainty around the timing of revenue recognition and may dampen growth in both the near and intermediate term.

- While the declining cost of solar modules and storage continues to expand Emeren's addressable markets and enhance project profitability, this also heightens pricing pressure and intensifies competition from both local and global players, potentially compressing net margins as Emeren is forced to compete on price, especially for larger utility-scale projects.

- Emeren's strategy to focus on high-margin project origination, development, and asset management should, in theory, lead to improved net margins and more predictable cash flows, but heavy concentration of revenue in a limited number of European and Chinese markets exposes the company to regional regulatory risks and demand fluctuations, heightening earnings volatility and revenue concentration risks if policy or macro trends turn unfavorable in any one area.

- Although the company has established a robust pipeline in advanced energy storage and solar projects, ongoing issues with permitting and regulatory complexity, particularly in the U.S. and Europe, may continue to delay milestone achievements in key DSA contracts, resulting in unpredictable cash flows and delayed revenue growth even as the secular demand environment strengthens.

- Despite strong secular tailwinds from rising ESG focus and growing access to low-cost financing, higher global interest rates and the risk of reduced subsidies threaten to raise the company's cost of capital and undermine long-term project returns, which could not only compress operating margins but also limit Emeren's ability to scale its portfolio as efficiently as anticipated.

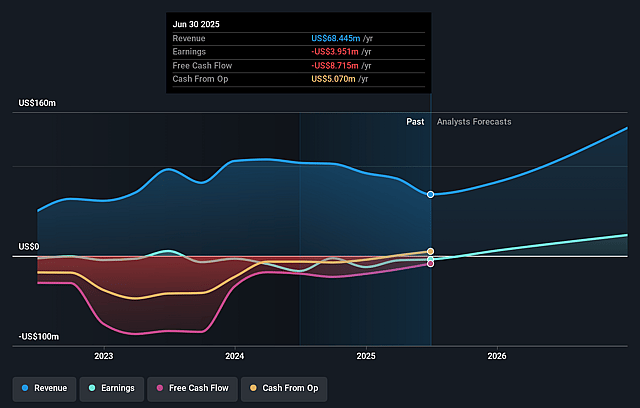

Emeren Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Emeren Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Emeren Group's revenue will grow by 37.3% annually over the next 3 years.

- The bearish analysts are not forecasting that Emeren Group will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Emeren Group's profit margin will increase from -5.8% to the average US Construction industry of 5.7% in 3 years.

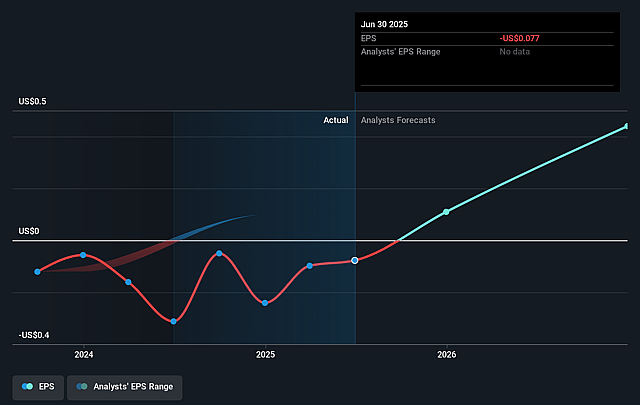

- If Emeren Group's profit margin were to converge on the industry average, you could expect earnings to reach $10.1 million (and earnings per share of $0.2) by about September 2028, up from $-4.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 13.7x on those 2028 earnings, up from -24.7x today. This future PE is lower than the current PE for the US Construction industry at 34.4x.

- Analysts expect the number of shares outstanding to grow by 0.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.56%, as per the Simply Wall St company report.

Emeren Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Emeren Group continues to experience persistent project delays due to government approvals in key markets like Europe and the United States, which can negatively impact the company's ability to recognize revenue on time and create volatility in future cash flows and earnings.

- The company's revenue is highly concentrated in Europe, with 70% of revenue from that region and 19% from China, exposing Emeren to geographic concentration risk and making its revenue and gross margins vulnerable to regulatory, political, or market shifts in those specific regions.

- Declining power prices in important European markets such as Spain are likely to reduce project profitability and compress margins, especially for new and existing IPP and DSA contracts, which may lower long-term earnings potential as the wholesale price environment weakens.

- The initial gross margins on newer DSA contracts are expected to be lower due to the milestone payment structure, meaning early revenue from these deals is less profitable and could depress near-term gross margins and net earnings until later-stage milestones are met.

- Potential foreign exchange volatility, as seen with foreign exchange losses due to U.S. dollar strength, poses ongoing risk to net income, particularly given Emeren's large international footprint and reliance on multi-currency project transactions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Emeren Group is $2.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Emeren Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.0, and the most bearish reporting a price target of just $2.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $177.0 million, earnings will come to $10.1 million, and it would be trading on a PE ratio of 13.7x, assuming you use a discount rate of 10.6%.

- Given the current share price of $1.9, the bearish analyst price target of $2.0 is 5.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.