Key Takeaways

- Strong project execution, AI integration, and leadership in storage position Emeren for outsized revenue and margin growth beyond current market expectations.

- Robust balance sheet and capital-light approach enable rapid expansion and M&A, enhancing scalability and optionality for transformational growth and valuation uplift.

- Heavy concentration in Europe, execution delays, power price pressures, rising financing costs, and strong competition threaten revenue stability, profitability, and long-term earnings growth.

Catalysts

About Emeren Group- Develops, builds, and sells solar power projects.

- Analyst consensus expects project pipeline execution and DSA contract wins to underpin growth, but a more bullish outlook shows Emeren's DSA pipeline could materially outperform expectations as over $100 million of additional DSA revenue is already in late-stage negotiation, with management signaling a strong likelihood of substantially exceeding guidance and realizing high-margin milestone revenue in 2025, directly enhancing both revenue and net margins.

- While consensus expects stable earnings from expansion in the merchant power market in China and energy storage, in reality, Emeren's early BESS integration into grid services and its leadership in key European storage projects position the company for outsized upside, as storage monetization could deliver recurring high-margin income streams and leverage policy support for grid modernization, accelerating EBITDA and supporting sustained higher return on equity.

- Demand for utility-scale clean energy and storage is likely to accelerate beyond consensus assumptions due to intensifying global decarbonization targets, with new government incentive programs and stricter ESG mandates poised to unlock access to lower-cost capital and attract premium counterparties, lowering financing costs and enabling outsized revenue growth.

- Emeren is already embedding AI and data-driven optimization in project development and operation-particularly as it increases exposure to power-hungry sectors like data centers-pointing to significant long-term operational efficiency improvements, higher project yields, and superior risk-adjusted returns that are not yet priced into the company's earnings or margin forecasts.

- The company's robust balance sheet and disciplined capital-light model create capacity to accelerate M&A or fast-track development in underpenetrated European and U.S. regions, amplifying revenue scalability and providing optionality for transformational growth that could lead to a significant re-rating in valuation multiples as visibility on future cash flow improves.

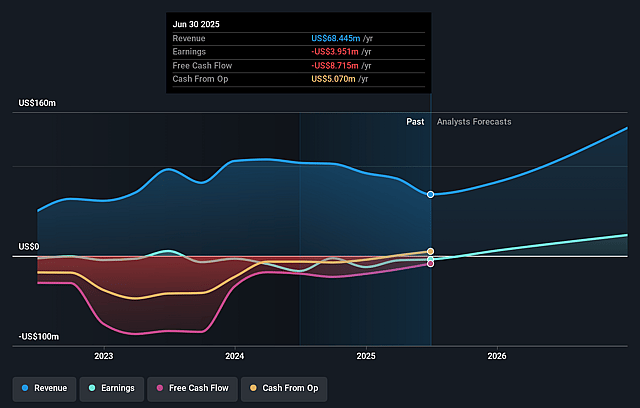

Emeren Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Emeren Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Emeren Group's revenue will grow by 53.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -5.8% today to 50.7% in 3 years time.

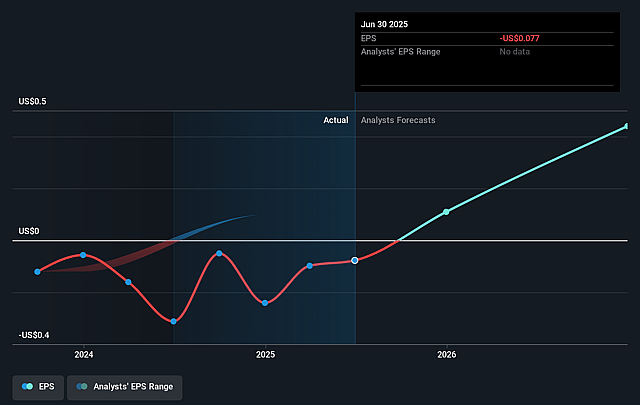

- The bullish analysts expect earnings to reach $126.2 million (and earnings per share of $2.4) by about September 2028, up from $-4.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 3.8x on those 2028 earnings, up from -24.4x today. This future PE is lower than the current PE for the US Construction industry at 34.7x.

- Analysts expect the number of shares outstanding to grow by 0.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.4%, as per the Simply Wall St company report.

Emeren Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Emeren continues to face persistent project execution delays, particularly linked to government approvals in key regions such as Europe and the U.S., which introduces unpredictability in project completion and can negatively impact revenue timing, cash flow, and earnings visibility over the long term.

- The company has over 70% of its revenue and project pipeline concentrated in Europe, making it vulnerable to adverse regulatory changes or downturns in specific markets, which poses a significant risk to revenue diversification and future growth potential.

- Declining power prices in major European markets such as Spain and uncertainty in long-term price stability may reduce project profitability and compress net margins on both IPP and monetized assets for Emeren.

- Rising global interest rates threaten to lift financing costs for Emeren's capital-light, project-based business model, which could erode long-term net margins and restrict reinvestment capacity if borrowing to fund new projects becomes more expensive.

- Intensifying competition from larger, more technologically differentiated solar and storage developers could constrain Emeren's ability to secure premium contracts, thereby limiting margin expansion and depressing earnings growth over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Emeren Group is $7.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Emeren Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.0, and the most bearish reporting a price target of just $2.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $249.0 million, earnings will come to $126.2 million, and it would be trading on a PE ratio of 3.8x, assuming you use a discount rate of 10.4%.

- Given the current share price of $1.88, the bullish analyst price target of $7.0 is 73.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.