Last Update 11 Sep 25

Fair value Increased 56%The sharp upward revision in Emeren Group's price target reflects a substantial improvement in projected net profit margin and accelerated consensus revenue growth, lifting the fair value estimate from $4.50 to $7.00.

What's in the News

- Special/Extraordinary Shareholders Meeting scheduled in Raleigh, NC.

- No shares repurchased in the most recent buyback period; full buyback completed with 124,703,920 shares repurchased for $49.17 million under the prior program.

- Delayed SEC filings; company unable to file next 10-Q by the required deadline.

Valuation Changes

Summary of Valuation Changes for Emeren Group

- The Consensus Analyst Price Target has significantly risen from $4.50 to $7.00.

- The Net Profit Margin for Emeren Group has significantly risen from 24.09% to 38.68%.

- The Consensus Revenue Growth forecasts for Emeren Group has significantly risen from 43.0% per annum to 55.9% per annum.

Key Takeaways

- Expansion into China's merchant power market and strategic energy storage initiatives are expected to boost revenue and enhance profitability through high-margin opportunities.

- Early-stage project monetization and strong liquidity position provide a solid foundation for revenue stability and support financial resilience and growth.

- Regional concentration in Europe and dependence on revenue negotiations introduce risks of revenue volatility and cash flow unpredictability amidst currency fluctuations and project delays.

Catalysts

About Emeren Group- Develops, builds, and sells solar power projects.

- Emeren Group has a robust pipeline of projects across Europe, the U.S., and China, including 4.3 gigawatts of advanced-stage storage and 2.4 gigawatts of solar PV projects, which are expected to drive long-term revenue growth.

- The company's strategy of early-stage project monetization through their DSA model is expected to provide a solid revenue foundation, with $84 million in contracted DSA revenue and an additional $100 million under negotiation, likely enhancing revenue stability.

- The anticipated entry into China's merchant power market in 2025 presents a significant opportunity, potentially boosting revenue through new revenue streams from energy storage and grid services utilizing BESS assets.

- Emeren's strong liquidity position with $50 million in cash and expected positive operating cash flow in 2025 supports financial resilience and growth, which is likely to impact earnings positively.

- Expansion in energy storage initiatives and strategic transactions, such as the 462-megawatt DSA for battery storage in Italy, are expected to enhance net margins and profitability by capitalizing on high-margin opportunities in growing markets.

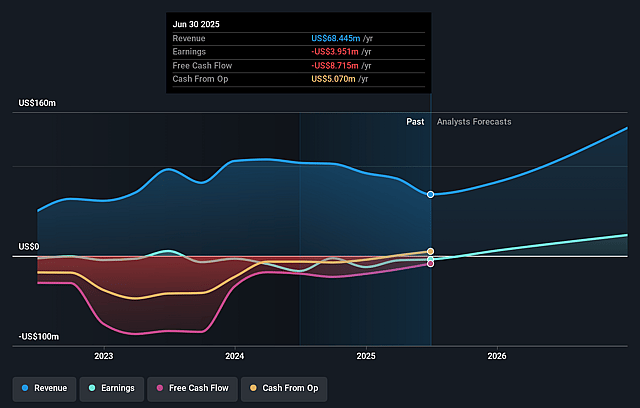

Emeren Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Emeren Group's revenue will grow by 43.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from -5.8% today to 24.1% in 3 years time.

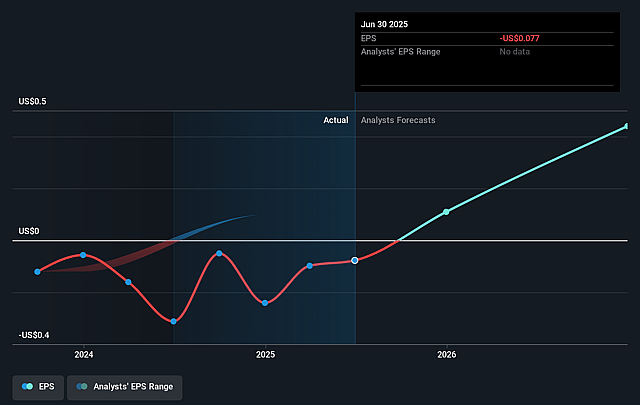

- Analysts expect earnings to reach $48.3 million (and earnings per share of $0.9) by about September 2028, up from $-4.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.4x on those 2028 earnings, up from -24.7x today. This future PE is lower than the current PE for the US Construction industry at 34.5x.

- Analysts expect the number of shares outstanding to grow by 0.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.56%, as per the Simply Wall St company report.

Emeren Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company reported an overall net loss attributed to foreign exchange losses and weak operating performance, which could impact future earnings.

- Lingering delays in project sales due to pending government approvals in the US and Europe contributed to decreased revenue in Q4, signaling potential risks to revenue stability.

- The company's revenues are significantly dependent on the European market, with 70% of revenue generated there, leading to regional concentration risk and possible revenue volatility if European market conditions worsen.

- The financial performance is affected by fluctuations in currency, particularly with the strength of the US dollar impacting foreign earnings, which can affect net margins.

- Emeren relies heavily on contracted and uncontracted revenue negotiations for future revenue streams, introducing uncertainty in revenue realization timelines and potentially affecting cash flow predictability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $4.5 for Emeren Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.0, and the most bearish reporting a price target of just $2.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $200.4 million, earnings will come to $48.3 million, and it would be trading on a PE ratio of 6.4x, assuming you use a discount rate of 10.6%.

- Given the current share price of $1.9, the analyst price target of $4.5 is 57.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.