Last Update05 Sep 25Fair value Increased 7.88%

Upward revisions to REV Group’s price target reflect consistent operational execution, sustained demand in its Fire/Ambulance segment, and improved efficiency, prompting analysts to raise fair value from $55.00 to $59.33.

Analyst Commentary

- Bullish analysts highlight consistent operational execution, providing greater visibility into performance through 2026 and beyond.

- Positive price target revisions reflect a series of beat-and-raise quarters, with the company now tracking well toward its long-term FY27 financial targets.

- Sustained demand and multi-year visibility for Fire/Ambulance segment sales and margins are underpinning optimism, while recreational vehicle segment stability adds confidence.

- Improved price/cost dynamics and enhanced operational efficiency have led to stronger company throughput, supporting higher valuations.

- Previously underestimated strong execution and resilient end-market demand, especially in fire and emergency vehicles, have caused analysts to reassess the stock's risk/reward profile as more balanced.

What's in the News

- The company completed the repurchase of 3,456,979 shares (6.68%) for $107.52 million under its current buyback program, with no additional shares repurchased between May 1 and July 31, 2025.

- Fiscal 2025 guidance was raised: Net sales now expected at $2,400 million to $2,450 million (prior: $2,350 million to $2,450 million) and net income at $95 million to $108 million (prior: $88 million to $107 million).

- Spartan Emergency Response began a $20 million facility expansion in Brandon, increasing custom apparatus production capacity by 40%, adding 56,000 sq. ft., creating 50 new jobs, and enhancing regional economic impact.

- REV Group was dropped from multiple Russell indexes, including the Russell 2000 Value, 2500 Value, 3000E Value and Growth, Small Cap Comp Value, Microcap Growth/Value, and related indexes.

- American Coach launched a new custom-designed luxury motorhome floorplan for its American Eagle line, in collaboration with influencers, featuring upgraded powertrain, bespoke interiors, and expanded amenities.

Valuation Changes

Summary of Valuation Changes for REV Group

- The Consensus Analyst Price Target has risen from $55.00 to $59.33.

- The Consensus Revenue Growth forecasts for REV Group has significantly fallen from 7.7% per annum to 4.9% per annum.

- The Future P/E for REV Group has significantly risen from 11.36x to 13.46x.

Key Takeaways

- Streamlined operations and investments in production efficiency, technology, and electrification position the company for improved margins and growth amid rising specialty vehicle demand.

- A robust order backlog and targeted divestitures provide earnings stability and capital for expansion, insulating against economic uncertainties and supporting future profitability.

- Narrowed market focus heightens vulnerability to downturns, while persistent cost pressures and rising competition threaten margins and future revenue growth.

Catalysts

About REV Group- Designs, manufactures, and distributes specialty vehicles, and related aftermarket parts and services in North America and internationally.

- Continued operational investments-such as the Spartan Emergency Response facility expansion-enhance production capacity and efficiency, positioning REV Group to capitalize on sustained municipal demand for fire and emergency vehicles as aging fleets require replacement, supporting long-term revenue growth and scale-driven margin improvements.

- Elevated focus on manufacturing throughput and process innovation enables REV Group to reduce lead times and cycle times, providing a competitive edge to capture consistent government and institutional orders, especially as urbanization and municipal infrastructure investments underpin a secular increase in specialty vehicle demand, positively impacting both revenue visibility and net margins.

- A strategically large, multi-year backlog in the fire and ambulance divisions provides earnings protection while allowing pricing actions and favorable product mix to be realized over time, buffering against near-term economic uncertainty and driving steady earnings and margin expansion.

- Accelerated divestitures of non-core businesses and reinvestment into higher-margin segments not only streamline operations but also unlock operating leverage and free up capital for targeted growth initiatives-improving future net margins and cash flow generation.

- Early-cycle, scalable investments in technology and green solutions (including upcoming expansions in EV production and partnerships for electrification) are set to benefit from the impending transition of public transit and emergency services toward electrified fleets, aligning with policy-driven demand and paving the way for incremental revenue growth and improved long-term earnings quality.

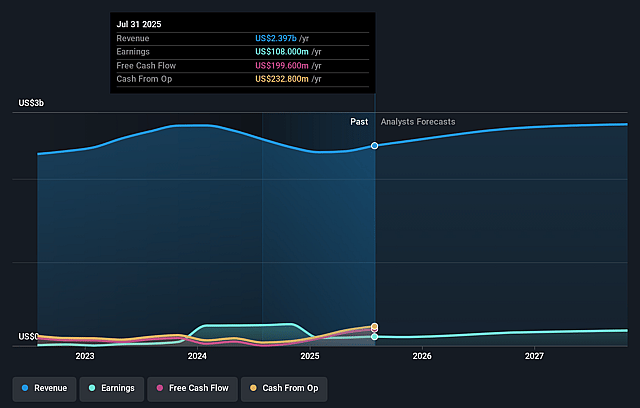

REV Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming REV Group's revenue will grow by 7.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.5% today to 8.2% in 3 years time.

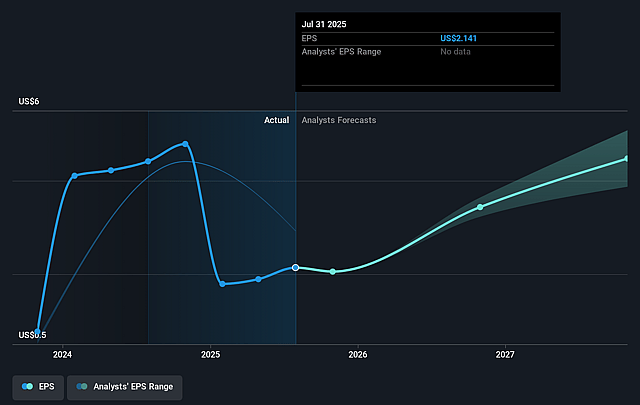

- Analysts expect earnings to reach $243.9 million (and earnings per share of $6.59) by about September 2028, up from $108.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.4x on those 2028 earnings, down from 26.4x today. This future PE is lower than the current PE for the US Machinery industry at 24.0x.

- Analysts expect the number of shares outstanding to decline by 6.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.01%, as per the Simply Wall St company report.

REV Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued exposure to inflationary pressures and new tariffs (notably $20 million annual headwind expected to persist into fiscal 2026) could become permanent additions to the cost base, limiting REV Group's ability to expand net margins if productivity gains or future price increases fail to sufficiently offset these incremental expenses.

- The divestiture of the ENC transit bus business and Lance Camper narrows the company's end-market exposure, reducing diversification and potentially making revenues more dependent on a smaller set of sectors (fire, ambulance, and motorized RVs), which increases vulnerability to cyclical downturns or funding disruptions in these core markets.

- Persistent softness and macroeconomic uncertainty in the Recreational Vehicles segment, including dealer destocking and declining backlogs, highlight the risk that discretionary demand for motorized RVs may remain depressed, impacting revenue growth and EBITDA generation in this segment over the long term.

- Progress in reducing Specialty Vehicles backlog and delivery times-while currently advantageous-signals that the exceptional demand and extended lead times supporting recent financial performance may be normalizing, posing a risk that revenue and order intake could slow as the market absorbs prior excess demand.

- Increasing industry-wide efficiency, capacity expansions (including at competitors), and the threat of greater price competition as order books normalize could exert downward pressure on prices and erode REV Group's competitive advantage, ultimately impacting future revenue growth and profit margins as market dynamics evolve.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $55.0 for REV Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $64.0, and the most bearish reporting a price target of just $46.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.0 billion, earnings will come to $243.9 million, and it would be trading on a PE ratio of 11.4x, assuming you use a discount rate of 8.0%.

- Given the current share price of $58.32, the analyst price target of $55.0 is 6.0% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.