Key Takeaways

- Operational improvements, facility expansions, and automation position REV Group for significant margin expansion and potential outperformance versus current conservative forecasts.

- Investments in capacity, electrification, and technology integration enable stronger market share gains, premium revenue streams, and enhanced long-term earnings quality.

- Exposure to persistent cost pressures, slow electrification, reliance on public sector sales, intense price competition, and shifting demand patterns threaten REV Group's margins and long-term growth.

Catalysts

About REV Group- Designs, manufactures, and distributes specialty vehicles, and related aftermarket parts and services in North America and internationally.

- Analyst consensus sees margin expansion driven by operational improvements and solid backlog, but these estimates may be too conservative as REV Group is already achieving EBITDA margins near 3-year targets and ongoing facility expansions, automation, and further lean initiatives set the stage for net margins well above 12 percent by 2027, with upside from incremental productivity gains not yet embedded in forecasts.

- While analysts broadly expect multi-year demand visibility from the $4.3 billion backlog, the company's investments in throughput and capacity-most notably, a 40 percent increase at Spartan Emergency Response-position REV to meaningfully outpace peers on normalized lead times and market share capture, suggesting outsized revenue growth as industry backlogs normalize.

- The accelerating adoption of electrified specialty vehicles and connected fleet solutions is poised to unlock new premium revenue streams for REV, allowing the company to move up the technology value chain and capture both higher unit pricing and enhanced recurring revenues from software, telematics, and after-market services.

- REV's strategic focus on government and municipal procurement cycles puts it at the forefront of benefiting from impending infrastructure and public safety spending, especially as stimulus-driven fleet replacements and public health concerns drive sustained growth in their highest-value categories, boosting both long-term revenue and quality of earnings.

- The company's extremely strong balance sheet and robust free cash flow generation provide capacity for transformative M&A or accelerated reinvestment in high-return projects, offering significant upside to future EPS, free cash flow per share, and long-term consolidated EBITDA that is not reflected in current valuation.

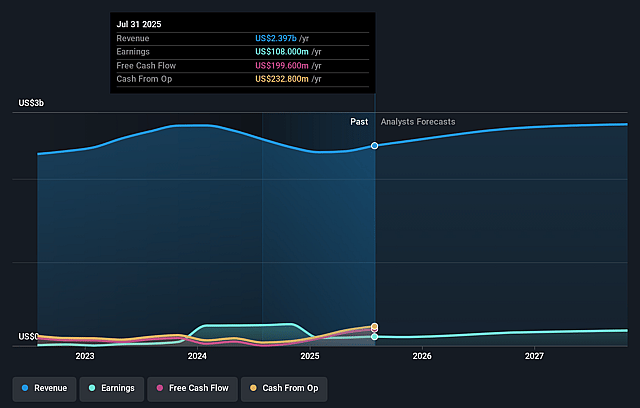

REV Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on REV Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming REV Group's revenue will grow by 9.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.5% today to 7.0% in 3 years time.

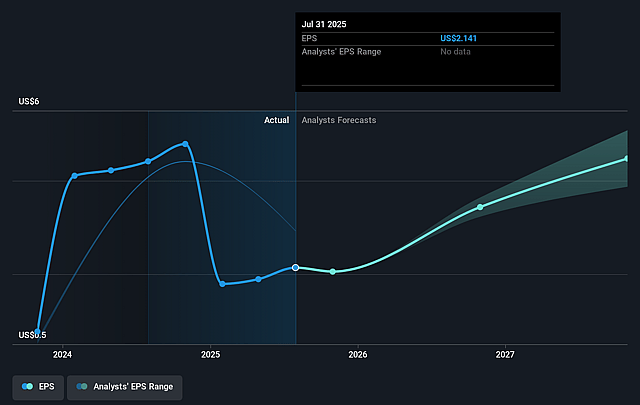

- The bullish analysts expect earnings to reach $220.2 million (and earnings per share of $6.48) by about September 2028, up from $108.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.6x on those 2028 earnings, down from 28.1x today. This future PE is lower than the current PE for the US Machinery industry at 24.7x.

- Analysts expect the number of shares outstanding to decline by 6.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.99%, as per the Simply Wall St company report.

REV Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent tariffs and inflationary pressures-particularly those related to core component imports and luxury van tariffs-are becoming a structural part of REV Group's cost base, which may cause sustained margin compression and ultimately lower net earnings if they are not fully offset by productivity improvements or price increases.

- REV Group's current absence of proprietary electric vehicle (EV) offerings and the slow pace of electrification within its Specialty Vehicles and RV segments place it at risk of losing market share to more advanced competitors, especially as tightening emissions standards and customer preferences shift towards decarbonization, threatening long-term revenue.

- Overreliance on municipal and government procurement exposes REV Group to significant cyclicality; public sector austerity cycles or changes in government funding priorities could sharply reduce order intake for fire, ambulance, and specialty vehicles, leading to erratic revenue and profit declines in downturns.

- Industry-wide capacity expansions and efficiency gains by larger or more technologically advanced competitors may heighten price competition, putting downward pressure on selling prices, reducing REV Group's pricing power, and eroding long-term net margins.

- Ongoing normalization of the order backlog and a declining trend in backlog duration, combined with demographic shifts such as urbanization and declining rural populations, may result in reduced future demand for specialty and recreational vehicles-potentially slowing revenue growth once the current elevated order pipeline is exhausted.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for REV Group is $68.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of REV Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $3.1 billion, earnings will come to $220.2 million, and it would be trading on a PE ratio of 15.6x, assuming you use a discount rate of 8.0%.

- Given the current share price of $62.16, the bullish analyst price target of $68.0 is 8.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.