Key Takeaways

- Dependence on legacy vehicles and slow adaptation to electrification threaten long-term profitability, while tightening regulations and labor shortages risk eroding margins and operational efficiency.

- Increasing competition and overreliance on cyclical fleet markets limit pricing power and revenue predictability, constraining future growth opportunities.

- Structural improvements, strategic divestitures, and targeted investments are strengthening operational efficiency, margins, and product positioning to support long-term earnings growth and profitability.

Catalysts

About REV Group- Designs, manufactures, and distributes specialty vehicles, and related aftermarket parts and services in North America and internationally.

- The accelerating industry transition to electrification and alternative powertrains poses a major risk to long-term profitability, as REV Group still derives the majority of its revenue from legacy combustion-engine vehicle lines and will require heavy, ongoing capital outlays and research and development investment just to keep pace with regulatory demands and competitor advancements, likely resulting in persistent downward pressure on net margins.

- Tightening emissions and safety regulations globally threaten to further inflate compliance and input costs, increasing the challenge for REV Group's mostly U.S.-centric operations to adapt existing product lines and maintain cost competitiveness-this is likely to erode operating margins and constrain future earnings growth.

- Persistent skilled labor shortages in the manufacturing sector threaten to raise wage costs and undermine operational efficiency improvements, offsetting recent gains in throughput and process optimization, and risking volatile quarterly performance and lower productivity-driven margin expansion.

- Despite recent backlog strength in the fire and ambulance segments, overexposure to highly cyclical municipal and commercial fleet markets exposes the company to abrupt downturns in public spending or recession, which could lead to sharp declines in revenue and less predictable earnings streams going forward.

- Intensifying competition from global original equipment manufacturers and electric-only entrants is likely to compress pricing power and gross margins for REV Group, as newer, technology-forward competitors increase share in fire, rescue, and specialty vehicle markets, capping potential for meaningful long-term revenue growth relative to industry benchmarks.

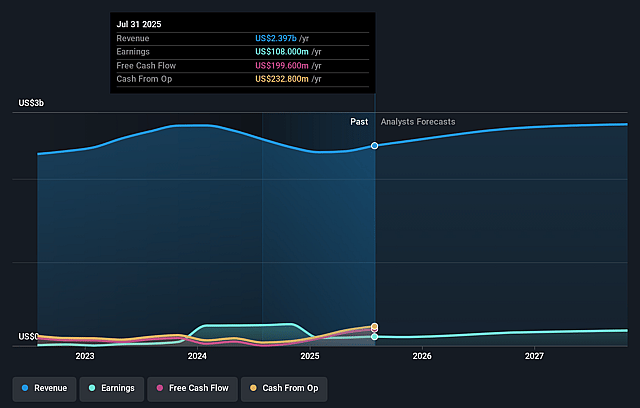

REV Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on REV Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming REV Group's revenue will grow by 6.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 4.2% today to 9.0% in 3 years time.

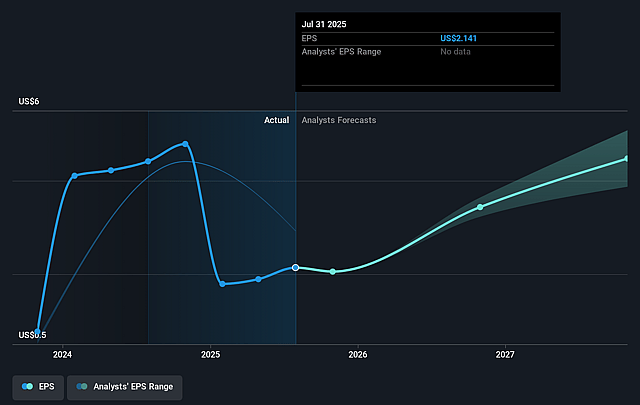

- The bearish analysts expect earnings to reach $253.1 million (and earnings per share of $5.39) by about August 2028, up from $96.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 9.2x on those 2028 earnings, down from 27.5x today. This future PE is lower than the current PE for the US Machinery industry at 24.3x.

- Analysts expect the number of shares outstanding to decline by 6.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.06%, as per the Simply Wall St company report.

REV Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- REV Group is experiencing strong operational momentum in its Specialty Vehicles segment, with year-over-year gains in throughput and operational efficiency, resulting in double-digit revenue growth and a record $4.3 billion segment backlog, which could drive further increases in top-line revenue and EBITDA.

- Structural improvements through ongoing investment in manufacturing, lean processes, workforce training, and plant modernization are driving sustainable cost discipline and quality gains, positioning the company for further margin expansion and enhanced earnings performance over time.

- The company is executing strategic portfolio optimization by divesting underperforming or non-core assets, such as the Lance Camper business, allowing a sharper focus on scalable, higher-margin operations and reinforcing long-term operating margins and overall profitability.

- REV Group is achieving healthy dealer inventory management in its Recreational Vehicles segment, outperforming industry retail trends and entering fiscal 2026 with a fresher product mix and improved channel positioning, which may stabilize or grow revenues if consumer demand improves.

- Accelerated capital investments, especially in key product programs like the S-180 modular fire apparatus, are expected to reduce lead times and boost production capacity, providing a platform for increased shipments and EBITDA growth, thereby supporting higher sustained earnings and cash generation in the future.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for REV Group is $46.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of REV Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $55.0, and the most bearish reporting a price target of just $46.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $2.8 billion, earnings will come to $253.1 million, and it would be trading on a PE ratio of 9.2x, assuming you use a discount rate of 8.1%.

- Given the current share price of $54.61, the bearish analyst price target of $46.0 is 18.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.