Last Update 18 Oct 25

Fair value Decreased 1.70%Aging US Housing Trends Will Drive Remodeling Transformation

Analysts have modestly adjusted their price target for Fortune Brands Innovations, lowering it from $66.94 to $65.80. This change reflects updated expectations around growth, profit margin improvements, and strategic initiatives that support improved earnings guidance for fiscal 2025.

Analyst Commentary

Bullish Takeaways- Bullish analysts point to the reinstatement of fiscal 2025 earnings guidance, seeing it as a sign of management's confidence in the company's growth trajectory.

- Expectations for improved growth in the second half of the year are driven by a focus on branding, increased promotional activity, and the successful ramp-up of new products.

- Recent upward adjustments to price targets reflect optimism regarding the company's ability to execute strategic initiatives and drive profitability.

- The combination of enhanced promotions and the launch of innovative offerings is expected to support stronger revenue growth and improved margins, which underpin positive valuation outlooks.

- Bearish analysts remain cautious about the company’s ability to sustain margin improvements in a competitive market environment.

- There is some concern that the company’s reliance on branding and promotions may not fully offset potential headwinds from broader market conditions or consumer demand fluctuations.

- Execution risk remains, particularly regarding the timely and successful rollout of new products, which could impact growth expectations if not achieved.

What's in the News

- Opened a new headquarters in Deerfield, Illinois, welcoming over 500 associates, including more than 400 new hires. This milestone was reached two years ahead of its 2027 hiring goal. The modern campus amenities include a fitness center, day care, and recreational facilities (Key Developments).

- Updated 2025 earnings guidance: net sales expected to range from negative 2% to flat, and EPS before charges or gains projected at $3.75 to $3.95 (Key Developments).

- Completed share repurchase of 2.22% for $163 million as part of the previously announced buyback. This includes the repurchase of nearly 1.2 million shares between March and July 2025 (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has decreased modestly from $66.94 to $65.80.

- Discount Rate has risen slightly from 9.16% to 9.39%.

- Revenue Growth expectations have declined from 4.94% to 3.65%.

- Net Profit Margin is projected to improve from 11.66% to 12.30%.

- Future P/E multiple has decreased from 15.52x to 15.11x.

Key Takeaways

- Tech-enabled product focus and strategic digital investments are driving margin expansion, recurring revenue, and earnings growth.

- Portfolio diversification, brand strength, and operational improvements are positioning the company for sustainable, above-market growth and financial flexibility.

- Heavy reliance on North American housing, slow smart home adoption, and rising costs expose margins to structural risks and limit growth diversification.

Catalysts

About Fortune Brands Innovations- Engages in the provision of home and security products for residential home repair, remodeling, new construction, and security applications in the United States and internationally.

- Fortune Brands is positioned to capture significant growth from increased demand for home renovation and remodeling driven by the aging U.S. housing stock and historically high home equity, supporting long-term revenue expansion as pent-up demand is released.

- The company's strategic investments in digital products-such as connected water management, smart locks, and a new subscription-based recurring revenue model-are enabling a transition toward higher-margin, tech-enabled solutions, driving both improved net margins and earnings growth.

- Robust market share gains and long-term contracts in Water (notably with major builders and retail partners), coupled with strong brand recognition among professional users, are laying the groundwork for sustainable above-market revenue and share growth.

- Portfolio optimization, bolt-on acquisitions (like Yale and Emtek), and diversification into premium luxury and outdoor categories position the company to benefit from urbanization, Sun Belt migration, and increased DIY activity, supporting top-line growth and margin synergies.

- Ongoing operational transformation-moving to an integrated, agile HQ with enhanced supply chain resilience, cost controls, and targeted SG&A savings-is expected to deliver sustained improvement in operating margins and free cash flow, supporting financial flexibility for reinvestment and buybacks.

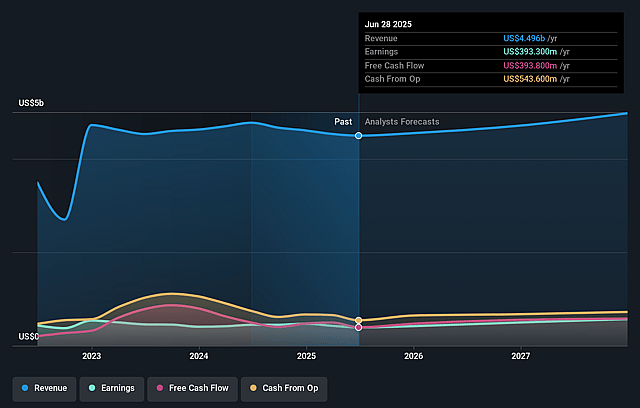

Fortune Brands Innovations Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Fortune Brands Innovations's revenue will grow by 4.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.7% today to 11.7% in 3 years time.

- Analysts expect earnings to reach $606.0 million (and earnings per share of $5.37) by about September 2028, up from $393.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.5x on those 2028 earnings, down from 17.9x today. This future PE is lower than the current PE for the US Building industry at 23.0x.

- Analysts expect the number of shares outstanding to decline by 3.37% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.16%, as per the Simply Wall St company report.

Fortune Brands Innovations Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued weakness in U.S. housing and remodeling activity presents a structural risk to revenue growth, as management projects flat to declining net sales and notes homebuyers and owners remain hesitant to invest-undermining the view that aging housing or pent-up demand alone will drive meaningful long-term expansion.

- Persistent dependence on North American residential markets makes the company vulnerable to regional housing downturns or macro shocks, which could significantly impact both revenue and earnings; there is little evidence of substantial international diversification to offset this exposure.

- Despite progress in digital/connected business, the connected products run rate is behind initial expectations and described as progressing "broader and a little bit slower," creating uncertainty around Fortune Brands' ability to innovate quickly enough in smart home areas needed to defend or expand margins long-term.

- Margin pressure remains a risk from commodity input costs (e.g., "higher cost inventory," and tariff mitigation relying heavily on supply chain and pricing actions); inability to fully offset future commodity swings or tariff changes may erode gross and operating margins.

- Industry consolidation among large retailers and distributors (e.g., Home Depot, Lowe's, Amazon) could squeeze supplier margins further, and the earnings call suggests that while promotional discipline is a focus, overall pricing power is not guaranteed, especially as the company seeks to balance cost mitigation with volume and channel partner relationships-potentially impacting net margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $66.938 for Fortune Brands Innovations based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $83.0, and the most bearish reporting a price target of just $51.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $5.2 billion, earnings will come to $606.0 million, and it would be trading on a PE ratio of 15.5x, assuming you use a discount rate of 9.2%.

- Given the current share price of $58.75, the analyst price target of $66.94 is 12.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.