Last Update 07 May 25

Fair value Decreased 12%Aging Housing Stock Will Limit Remodeling Margins Amid Rising Costs

Key Takeaways

- Reliance on aging housing and North American markets heightens vulnerability to shifting demographics, affordability challenges, and housing market downturns.

- Rising regulatory, material, and supply chain costs, plus distributor consolidation, threaten margins and force costly innovation just to remain competitive.

- Focus on digital innovation, supply chain resilience, luxury brand expansion, and smart home technologies positions the company for stable long-term growth and increased earnings stability.

Catalysts

About Fortune Brands Innovations- Engages in the provision of home and security products for residential home repair, remodeling, new construction, and security applications in the United States and internationally.

- Long-term demand for home renovation and remodeling may falter as aging U.S. housing stock collides with persisting affordability issues and declining homeownership rates among younger generations, potentially leading to sustained revenue headwinds for Fortune Brands Innovations as its core customer base shrinks.

- With escalating regulatory pressures and material input costs driven by heightened sustainability and climate mandates, the company is likely to face structurally higher expenses and ongoing supply chain overhauls, which could erode net margins and make it difficult to maintain historical levels of profitability.

- Heavy dependence on North American markets exposes the company to deep cyclicality and regional housing downturns; persistent high interest rates and muted new home construction in the U.S. threaten to stall both top-line growth and earnings resilience well into the next economic cycle.

- As technology giants accelerate the adoption of integrated smart home solutions, Fortune Brands Innovations risks being marginalized and forced to pursue expensive research and development investments or acquisitions simply to keep pace, which would put further pressure on cash flow and long-term earnings.

- Ongoing consolidation among retail channels and the strengthening bargaining power of large distributors are likely to compress average selling prices and reduce the company's ability to pass on input cost increases, putting significant strain on gross margins and limiting the impact of future branding or product innovation strategies.

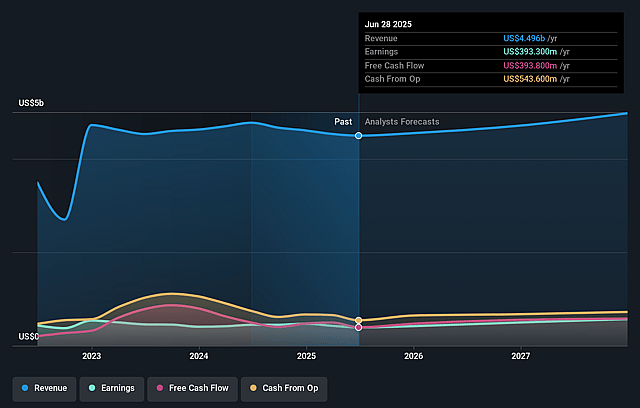

Fortune Brands Innovations Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Fortune Brands Innovations compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Fortune Brands Innovations's revenue will grow by 3.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 8.7% today to 12.2% in 3 years time.

- The bearish analysts expect earnings to reach $609.9 million (and earnings per share of $5.28) by about September 2028, up from $393.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.7x on those 2028 earnings, down from 17.9x today. This future PE is lower than the current PE for the US Building industry at 23.0x.

- Analysts expect the number of shares outstanding to decline by 3.37% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.16%, as per the Simply Wall St company report.

Fortune Brands Innovations Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Secular trends such as the aging housing stock in the U.S. and developed markets, along with a significant underbuild and historically high home equity values, are likely to drive sustained long-term demand for home renovation, repair, and replacement, providing enduring growth opportunities that can support Fortune Brands Innovations' revenues and earnings.

- The company has made substantial progress in its multi-year transformation, shifting towards a unified, brand-driven innovation platform with strong digital capabilities, which is improving operational efficiency and positioning for above-market growth, possibly leading to higher net margins and stronger long-term earnings.

- Fortune Brands is accelerating investments in smart home and connected water solutions, resulting in robust growth in its digital business with recurring revenue models and key partnerships (such as with Google and major insurance carriers), suggesting incremental revenue streams and greater earnings stability in future years.

- Strategic portfolio moves-including the acquisition of Yale and Emtek, and the focus on luxury brands like House of Rohl-are supporting pricing power, brand differentiation, and exposure to less price-sensitive luxury consumers, enabling the company to defend or expand net margins even during cyclical slowdowns.

- The company's North American manufacturing footprint and reduced reliance on China (with China now just 10% of cost of goods sold) enhance supply chain resilience and margin protection, while its robust free cash flow enables ongoing investment, share buybacks, and the capability to capitalize on long-term industry consolidation for revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Fortune Brands Innovations is $51.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Fortune Brands Innovations's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $83.0, and the most bearish reporting a price target of just $51.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $5.0 billion, earnings will come to $609.9 million, and it would be trading on a PE ratio of 11.7x, assuming you use a discount rate of 9.2%.

- Given the current share price of $58.73, the bearish analyst price target of $51.0 is 15.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.