Key Takeaways

- Rapid digital transformation and AI-enabled operations are set to drive margin expansion, innovation, and operating leverage far beyond current market expectations.

- Leadership in smart home and water solutions, alongside premium branding and resilient supply chain, positions the company for strong, recurring revenue growth and outperformance.

- Heavy reliance on U.S. housing, rising input costs, intensified competition, supply chain risks, and stricter regulations all threaten long-term revenue growth and profitability.

Catalysts

About Fortune Brands Innovations- Engages in the provision of home and security products for residential home repair, remodeling, new construction, and security applications in the United States and internationally.

- Analyst consensus expects full mitigation of tariff impacts through supply chain, cost-out efforts, and pricing, but with Fortune Brands' rapid digitalization and AI-driven supply chain optimization, margin expansion could meaningfully outpace expectations, providing sustained upside to both net margins and long-term earnings.

- While analysts broadly agree that the new consolidated headquarters will foster better collaboration and execution, such a best-in-class platform with standardized, AI-enabled processes and high-caliber talent is poised to accelerate innovation cycles, unlock cross-brand synergies, and drive operating leverage at a level likely underappreciated in current earnings estimates.

- The company's early-mover advantage in water management, smart home, and premium connected products, combined with growing insurance partnerships and a new subscription model, positions Fortune Brands to convert its digital transformation into a high-margin, recurring revenue engine-potentially resulting in a step-change in revenue growth and EPS visibility.

- Rising consumer investment in home improvement due to an aging U.S. housing stock and robust millennial/baby boomer demand will structurally increase replacement cycle volumes, providing Fortune Brands with multi-year, above-market top-line growth and the ability to command premium pricing.

- Fortune Brands' North American-focused, resilient supply chain and industry-leading U.S. and USMCA manufacturing base enables it to rapidly capture share as importers falter amid trade disruptions, further accelerating revenue growth and skewing margin profiles upward given higher utilization and fixed-cost absorption.

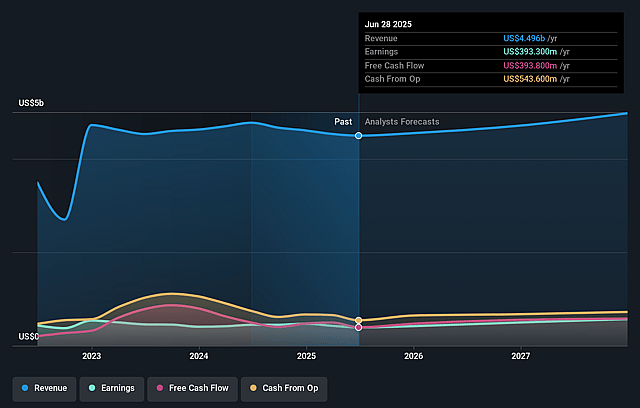

Fortune Brands Innovations Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Fortune Brands Innovations compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Fortune Brands Innovations's revenue will grow by 4.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 8.7% today to 12.2% in 3 years time.

- The bullish analysts expect earnings to reach $634.1 million (and earnings per share of $5.83) by about September 2028, up from $393.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.4x on those 2028 earnings, up from 17.9x today. This future PE is lower than the current PE for the US Building industry at 23.0x.

- Analysts expect the number of shares outstanding to decline by 3.37% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.16%, as per the Simply Wall St company report.

Fortune Brands Innovations Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's continued heavy reliance on the U.S. single-family housing market means slowing or declining new home construction and ongoing weak household formation due to an aging population could suppress demand for its core products over the long term, leading to stagnation or decline in future revenues and top-line growth.

- Margin pressure remains a concern as input costs such as raw materials, labor, and transportation continue to rise, with Fortune Brands Innovations forced to offset these through a combination of pricing actions and cost savings; if these cost increases outpace the company's ability to pass them on or drive efficiency, net margins and overall earnings could be squeezed.

- Heightened competitive pressure from established players and disruptive entrants, especially direct-to-consumer brands, risks eroding the company's market share and pricing power-this could undermine both revenue and long-term earnings growth if Fortune Brands Innovations cannot keep pace with innovation or changing consumer preferences.

- Ongoing supply chain vulnerabilities, including exposure to global tariffs, trade policy shifts, and geopolitical risks, continue to generate unpredictability in sourcing and costs. While mitigation efforts are underway, unforeseen disruptions or higher-than-expected tariffs could still negatively impact gross margins and profitability.

- Increasing regulatory and sustainability requirements, such as more demanding energy efficiency and water conservation standards, may raise compliance costs and lengthen product development cycles, potentially slowing time-to-market, reducing operating margins, and dampening profitability over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Fortune Brands Innovations is $83.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Fortune Brands Innovations's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $83.0, and the most bearish reporting a price target of just $51.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $5.2 billion, earnings will come to $634.1 million, and it would be trading on a PE ratio of 18.4x, assuming you use a discount rate of 9.2%.

- Given the current share price of $58.75, the bullish analyst price target of $83.0 is 29.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.