Key Takeaways

- Greater ESG scrutiny and shifts in defense funding threaten valuation, investor sentiment, and future revenue reliability for Leonardo DRS.

- Dependence on legacy systems, raw material volatility, and slow innovation expose the company to shrinking margins and technological obsolescence.

- Strong alignment with defense sector trends, technological innovation, and expanded U.S. Navy ties drive robust growth prospects and improve long-term revenue diversification.

Catalysts

About Leonardo DRS- Provides defense electronic products and systems, and military support services worldwide.

- The persistent increase in global ESG (Environmental, Social, Governance) scrutiny could diminish institutional investor support for Leonardo DRS over the coming years, which may exert downward pressure on valuation multiples and share liquidity, ultimately putting sustained pressure on the company’s long-term equity valuation.

- Mounting fiscal constraints and ballooning government deficits in the U.S. and Western Europe threaten the outlook for the durable growth in defense budgets that Leonardo DRS relies on. Should these budgetary pressures force even modest reductions or delays in defense procurement cycles, revenue growth rates could rapidly decelerate, exposing the company’s high fixed-cost base and compressing operating margins.

- Leonardo DRS remains heavily dependent on U.S. government contracts, so any loss or resizing of major defense programs would have an outsized negative effect on revenue and earnings, especially as ongoing integration with the parent company could introduce internal inefficiencies and unpredictability to strategy execution.

- A secular shift in defense procurement towards autonomous and cyberwarfare solutions risks making Leonardo DRS’s legacy investments—such as traditional network computing and propulsion systems—obsolete, creating the potential for stranded assets, poor backlog conversion, and earnings deterioration if innovation does not keep pace with rapid technological change.

- Escalating raw materials volatility, such as the sharp increase in germanium prices due to global supply disruptions, directly undermines program profitability and reduces gross margin visibility. If supply chain risk and pricing instability persist or intensify, Leonardo DRS could face additional margin contraction and higher recurring costs, eroding bottom-line performance.

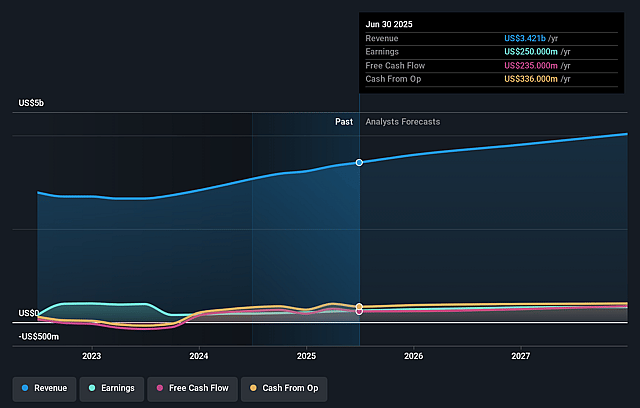

Leonardo DRS Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Leonardo DRS compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Leonardo DRS's revenue will grow by 6.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 7.0% today to 8.9% in 3 years time.

- The bearish analysts expect earnings to reach $355.7 million (and earnings per share of $1.29) by about July 2028, up from $234.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 40.6x on those 2028 earnings, down from 54.6x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 34.2x.

- Analysts expect the number of shares outstanding to grow by 0.89% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.12%, as per the Simply Wall St company report.

Leonardo DRS Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Robust global defense spending driven by elevated geopolitical tensions and large supplemental funding plans in the United States, combined with alignment of Leonardo DRS's portfolio to administration priorities such as shipbuilding, force protection, and modernization, support ongoing revenue growth and backlog expansion.

- Consistent multi-year book-to-bill ratios above one and record backlog of $8.6 billion underscore sustained strong demand and provide high visibility into future revenue and earnings stability.

- Expanding into higher-margin, mission-critical technologies including electric propulsion, advanced sensing, Counter-UAS, and next-gen missile system components diversifies revenue streams and offers the potential for margin improvement over time.

- Deepening relationships with the U.S. Navy and accelerated investments in new production facilities, as well as proactive moves into greenfield adjacencies like missile sensors and international naval contracts, position the company for top-line growth and improved market share.

- Increasing internal R&D and successful integration of AI and digital solutions enable Leonardo DRS to capitalize on sector-wide digitalization, supporting innovation-led growth and higher future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Leonardo DRS is $43.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Leonardo DRS's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $51.0, and the most bearish reporting a price target of just $43.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $4.0 billion, earnings will come to $355.7 million, and it would be trading on a PE ratio of 40.6x, assuming you use a discount rate of 7.1%.

- Given the current share price of $48.01, the bearish analyst price target of $43.0 is 11.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.