Key Takeaways

- Alignment with rising defense budgets and rapid innovation in AI-powered battlefield solutions position the company for sustained growth and market share gains.

- U.S.-focused supply chain strategies and portfolio optimization support resilient margins, while partnerships and cross-selling drive expanded revenue streams and earnings.

- Heavy dependence on traditional defense contracts and hardware, material sourcing risks, and intensifying competition threaten revenue stability, profitability, and long-term growth prospects.

Catalysts

About Leonardo DRS- Provides defense electronic products and systems, and military support services worldwide.

- The multiyear rise in global defense budgets, particularly in the U.S. and among key allies, has created a strong, durable foundation for demand, with Leonardo DRS uniquely aligned to national priorities in shipbuilding, force protection, advanced sensors, and modernization of digital battlefield capabilities. Future increases in defense appropriations, including up to one trillion dollars and supplemental funding initiatives, are expected to provide sustained, above-market revenue growth.

- Accelerating adoption of digital technologies, artificial intelligence, and next-generation combat systems is driving demand for C5ISR, AI-powered battlefield solutions, and advanced infrared sensing—the core strengths of Leonardo DRS. The company’s rapid innovation and integration of AI processors and open operating system architectures are expected to capture meaningful share in a growing addressable market, leading to new contract wins and expanding top-line revenue.

- Investments in U.S.-based supply chain localization and increased customer preference for domestic suppliers are mitigating international supply chain risks. Leonardo DRS’s predominantly U.S. footprint and diversified supplier base position it to benefit from greater contract allocation and resilience against tariffs and raw material disruptions, supporting revenue consistency and margin stability.

- Portfolio optimization efforts, including divesting lower-margin businesses and prioritizing high-growth, high-margin segments (such as electric power, propulsion, and advanced sensors), along with operational leverage from increased program volumes, are setting the stage for meaningful net margin expansion and strong EBITDA growth over the coming years.

- Execution of organic growth initiatives alongside targeted M&A, plus deeper strategic partnerships within the Leonardo Group and externally, are expected to accelerate cross-selling, drive incremental bookings, and create new revenue streams and scale, supporting both top-line expansion and earnings growth.

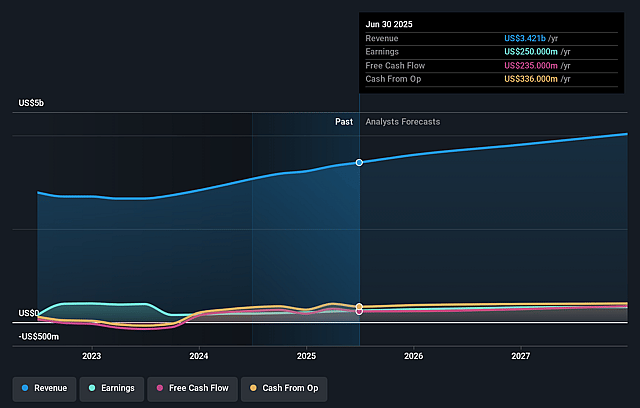

Leonardo DRS Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Leonardo DRS compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Leonardo DRS's revenue will grow by 7.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 7.0% today to 8.6% in 3 years time.

- The bullish analysts expect earnings to reach $356.4 million (and earnings per share of $1.43) by about July 2028, up from $234.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 48.0x on those 2028 earnings, down from 52.5x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 35.1x.

- Analysts expect the number of shares outstanding to grow by 0.89% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.13%, as per the Simply Wall St company report.

Leonardo DRS Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on U.S. defense contracts makes Leonardo DRS particularly vulnerable to changes in U.S. defense spending priorities, and any fiscal tightening, procurement delays, or shifts to other areas such as cyber capabilities could lead to significant pressure on future revenues and earnings.

- Advancements in digital and cyber warfare technologies may divert government budgets away from traditional hardware such as propulsion and sensing systems, areas where DRS is highly concentrated, resulting in long-term erosion of revenues and lower net margins.

- Supply chain risks, highlighted by recent challenges in sourcing rare earth minerals such as germanium, reveal vulnerability to material cost volatility and single-source supplier disruptions, which can compress profits and pressure margins, as was evident in the ASC segment’s recent performance.

- The long and unpredictable nature of the defense procurement cycle leads to uneven cash flows and potential delays in revenue recognition, heightening risk around quarterly results and introducing volatility in both earnings and free cash flow over the long term.

- Rising competition from both innovative startups and established global defense companies, combined with increasing regulatory scrutiny, may reduce pricing power and access to international markets, negatively impacting Leonardo DRS’s ability to expand revenue streams and sustain future profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Leonardo DRS is $51.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Leonardo DRS's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $51.0, and the most bearish reporting a price target of just $43.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.1 billion, earnings will come to $356.4 million, and it would be trading on a PE ratio of 48.0x, assuming you use a discount rate of 7.1%.

- Given the current share price of $46.14, the bullish analyst price target of $51.0 is 9.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.