Narratives are currently in beta

Key Takeaways

- Solid loan growth and strategic shift in loan portfolio aim to increase net interest income and revenue.

- Selling investment securities and mortgage business to improve profitability and earnings per share.

- Elevated expenses and uncertainties in loan growth and rate cut assumptions could pressure Horizon Bancorp’s net margins and revenue stability in the near term.

Catalysts

About Horizon Bancorp- Operates as the bank holding company for Horizon Bank that engages in the provision of commercial and retail banking services.

- Horizon Bancorp is observing solid average loan growth, particularly in the commercial loan sector, coupled with a planned phase-out of lower yielding auto loans. This shift in the loan portfolio is positioned to boost net interest income and overall revenue growth.

- The expansion efforts in the core commercial portfolio and newly introduced equipment financing division are expected to support long-term growth in commercial lending, contributing positively to future revenue streams and earnings.

- Horizon's strategy includes selling off a portion of their investment securities and mortgage warehouse business. These actions are intended to enhance structural profitability, lift net interest margin, and result in substantial EPS accretion, thereby improving profitability metrics.

- There is an expectation of continued net interest margin expansion driven by changes in asset mix, rate cuts, and strategic balance sheet repositioning, which will significantly impact net interest income and thereby improve overall earnings.

- Stable and increasing deposit balances, including a strong mix of core consumer and commercial deposits, are expected to support future growth. This deposit stability is anticipated to enhance net interest income as rates change favorably.

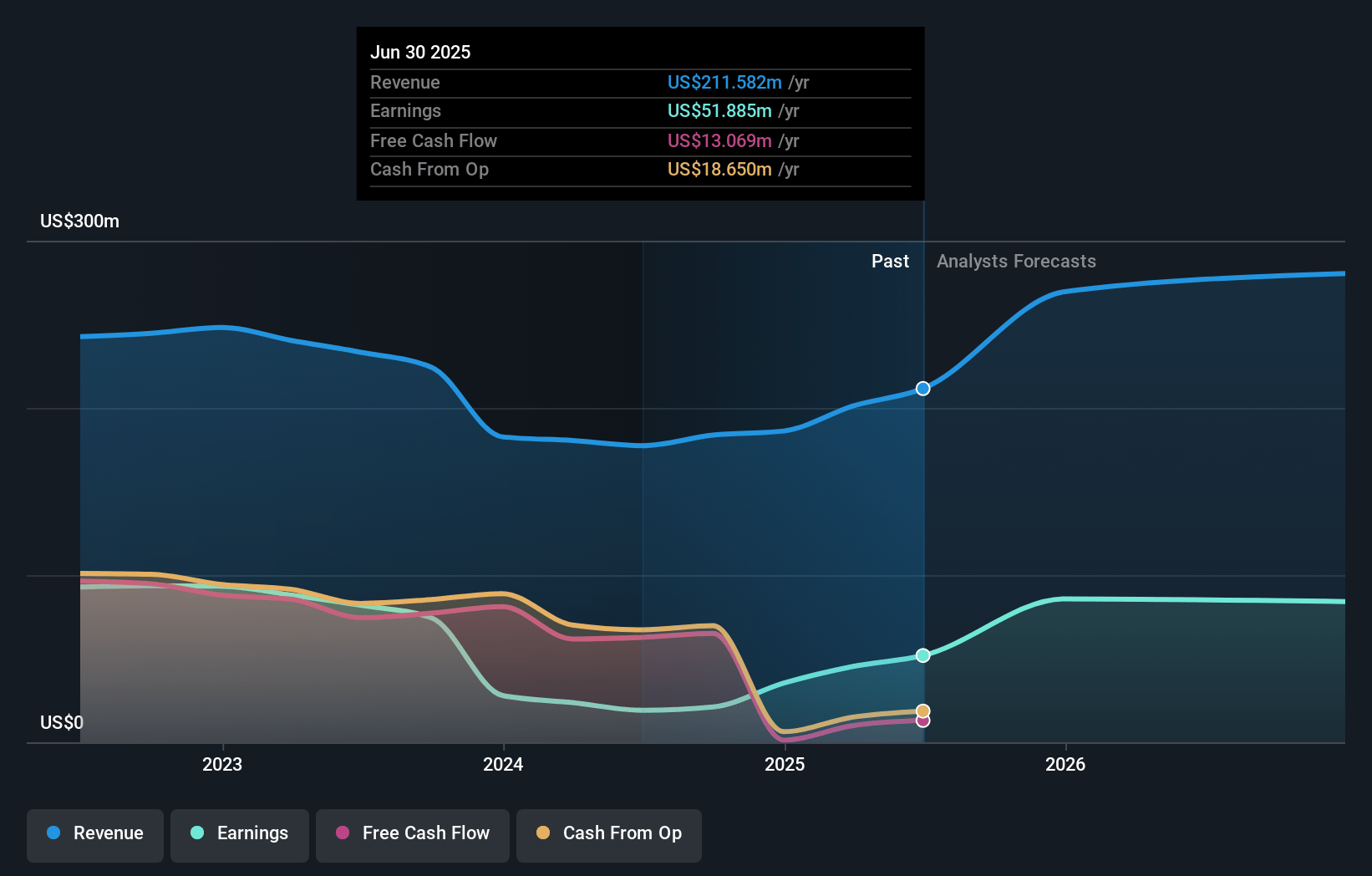

Horizon Bancorp Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Horizon Bancorp's revenue will grow by 18.3% annually over the next 3 years.

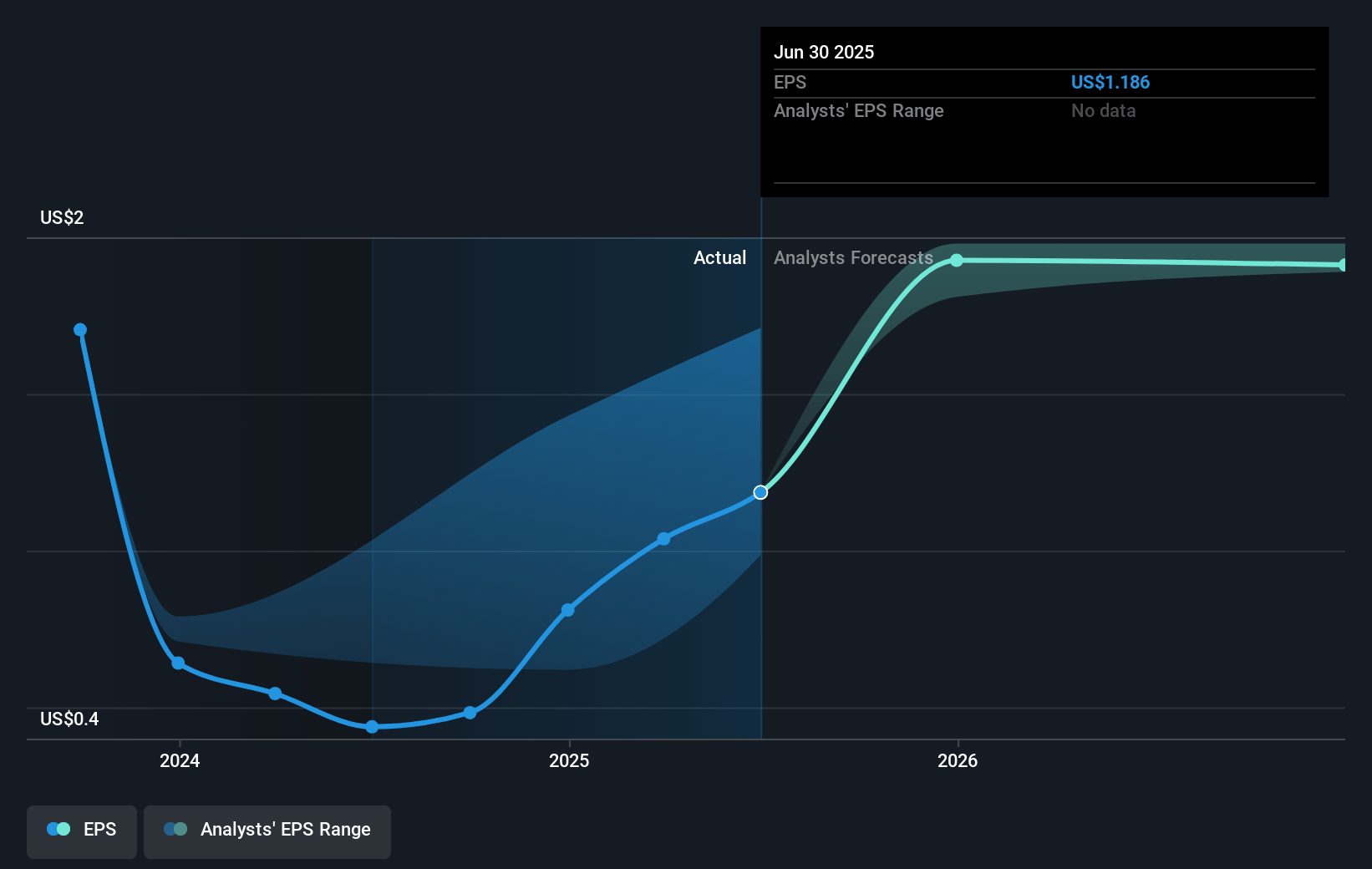

- Analysts assume that profit margins will increase from 11.5% today to 39.8% in 3 years time.

- Analysts expect earnings to reach $121.0 million (and earnings per share of $2.61) by about December 2027, up from $21.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.5x on those 2027 earnings, down from 33.9x today. This future PE is lower than the current PE for the US Banks industry at 12.5x.

- Analysts expect the number of shares outstanding to grow by 1.94% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.75%, as per the Simply Wall St company report.

Horizon Bancorp Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The conference call highlighted a slight increase in non-performing loans in the third quarter, driven by a few larger loans, which, although not expected to impact charge-offs significantly, could lead to higher future provisioning and affect net margins.

- Horizon Bancorp is experiencing elevated expenses that are not expected to normalize until 2025, which could pressure net income and profit margins in the near term.

- Despite expectations for rate cuts to modestly benefit net interest margins, continued reliance on assumptions around rate cuts introduces uncertainty into future earnings forecasts.

- The extent of payoff and pay-down activity in commercial loans is driven by customers' business models, adding variability to loan growth forecasts, which could impact revenue stability.

- Planned reduction in lower-yielding auto loans and a flat end-of-period loan growth may limit immediate revenue expansion, particularly if new commercial loan growth does not align with expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $20.0 for Horizon Bancorp based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $304.1 million, earnings will come to $121.0 million, and it would be trading on a PE ratio of 9.5x, assuming you use a discount rate of 7.7%.

- Given the current share price of $16.35, the analyst's price target of $20.0 is 18.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives