Key Takeaways

- The company's dependence on legacy auto products and slow EV transition increase vulnerability to revenue decline, margin compression, and loss of market share.

- High financial leverage, rising input costs, and strong customer bargaining power restrict competitiveness, free cash flow, and future growth opportunities.

- Strong new business pipeline, cost controls, and innovation in electrification uniquely position Cooper-Standard for multi-year profitable growth, even amid industry or trade uncertainties.

Catalysts

About Cooper-Standard Holdings- Through its subsidiary, manufactures and sells sealing, fuel and brake delivery, and fluid transfer systems in the North America, Europe, the Asia Pacific, and the South America.

- The accelerating global shift to electric vehicles is expected to significantly reduce demand for Cooper-Standard's core legacy products, particularly traditional sealing and rubber components, leading to stagnant or declining revenues over the next decade as EVs require fewer of these materials.

- Increasing global regulatory pressure on sustainability and the adoption of alternative, eco-friendly materials is likely to erode Cooper-Standard's relevance, forcing major investments or write-downs in existing manufacturing capacity and reducing long-term net margins.

- Ongoing high customer concentration, with major automakers continuing to exert significant bargaining power, will intensify pricing pressure just as platform consolidation accelerates across the industry, leading to meaningful compression of profit margins and threatening future earnings stability.

- The company's slow pace of diversification into EV-specific contracts, despite management's focus on innovation, exposes it to market share erosion at the hands of faster-moving competitors and low-cost Asian manufacturers; this dynamic could cause Cooper-Standard's top-line growth to lag materially below industry averages despite current bookings.

- Persistently high leverage and substantial interest expenses are anticipated to further constrain R&D and inorganic expansion just as supply chain deglobalization and trade disruptions increase input cost volatility, resulting in structurally lower free cash flow and heightened financial risk for years to come.

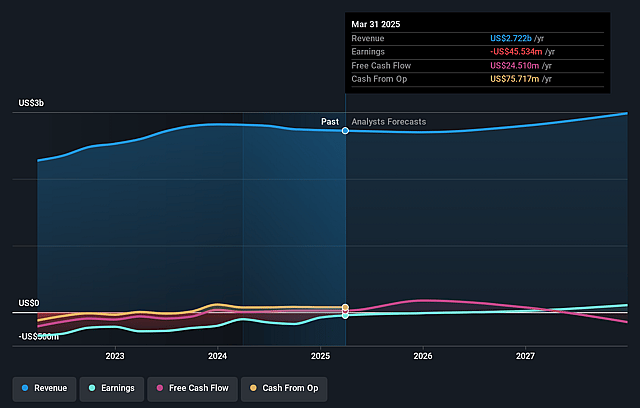

Cooper-Standard Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Cooper-Standard Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Cooper-Standard Holdings's revenue will grow by 5.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 1.1% today to 7.2% in 3 years time.

- The bearish analysts expect earnings to reach $226.6 million (and earnings per share of $12.93) by about September 2028, up from $29.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 2.8x on those 2028 earnings, down from 22.9x today. This future PE is lower than the current PE for the US Auto Components industry at 17.3x.

- Analysts expect the number of shares outstanding to grow by 1.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.02%, as per the Simply Wall St company report.

Cooper-Standard Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Cooper-Standard's substantial book of new business awards in both sealing and fluid handling systems, with over 80 percent of incremental revenue through 2030 already secured and a strong line of sight on program launches, increases visibility and confidence in multi-year revenue growth, contradicting the idea of an impending revenue decline.

- The company's demonstrated success in aggressive cost optimization, restructuring, and plant consolidation-generating tens of millions of dollars in annual savings-is already driving sustainable margin expansion, and management anticipates this trend will further support improved EBITDA margins and net earnings over the coming years.

- Strategic investment in product innovation, particularly in proprietary solutions for hybrid and EV platforms (such as thermal management and new sealing systems), positions Cooper-Standard to capitalize on long-term trends in vehicle electrification, supporting top-line growth and higher content per vehicle.

- Cooper-Standard's resilience against external shocks, such as tariffs, is reinforced by its ability to successfully renegotiate commercial agreements with global OEMs, allowing the company to recover the majority of tariff costs, thereby protecting net margins even in a challenging trade environment.

- Management's guidance and planning are based on conservative automotive production forecasts, with significant upside potential if industry vehicle volumes recover above these conservative assumptions, which could result in better-than-expected revenue, operating income, and free cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Cooper-Standard Holdings is $25.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Cooper-Standard Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $39.0, and the most bearish reporting a price target of just $25.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $3.2 billion, earnings will come to $226.6 million, and it would be trading on a PE ratio of 2.8x, assuming you use a discount rate of 12.0%.

- Given the current share price of $38.07, the bearish analyst price target of $25.0 is 52.3% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.