Key Takeaways

- Margin and earnings upside are likely as digital transformation and advanced manufacturing boost efficiency beyond current consensus expectations.

- Strong product pipeline, regulatory tailwinds, and advanced material innovation position the company for outsized revenue growth and continued pricing power.

- Accelerating industry shifts, underinvestment in innovation, high leverage, and external pressures threaten Cooper-Standard's profitability, market relevance, and long-term financial stability.

Catalysts

About Cooper-Standard Holdings- Through its subsidiary, manufactures and sells sealing, fuel and brake delivery, and fluid transfer systems in the North America, Europe, the Asia Pacific, and the South America.

- Analyst consensus sees margin expansion from cost savings and restructuring, but this is likely understated given Cooper-Standard has already achieved world-class manufacturing efficiency, with substantial operational headroom as digital transformation and AI-powered optimization are rolled out globally-this makes double-digit EBITDA margins not just attainable but beatable, positioning net margins and earnings for significant upside.

- Analyst consensus points to a strong new product pipeline and increasing content per vehicle, but given Cooper-Standard's booked pipeline already represents over 80 percent of $1 billion in incremental revenue and largely excludes upside from vertical integration and next-gen hybrid/EV systems, top-line growth could accelerate well beyond consensus, with content per vehicle and mix-driven revenues materially outpacing industry estimates.

- Major regulatory tailwinds-such as more stringent global emissions and lightweighting mandates-directly expand Cooper-Standard's addressable market for innovative sealing and fluid solutions, supporting durable multi-year revenue and margin growth as OEMs are forced to adopt their advanced materials and systems.

- The company's commitment to advanced material R&D and ongoing vertical integration in fluid systems lays the foundation for structurally higher returns on invested capital and pricing power, leading to sustained improvement in long-term EBITDA margins and cash generation.

- With global manufacturing excellence and exceptional customer relationships-highlighted by supplier-of-the-year awards and program launches with major OEMs-Cooper-Standard is best positioned to capture incremental share from the industry's focus on localized, resilient supply chains, supporting outperformance in revenue growth, resilience in earnings, and a superior balance sheet as auto production recovers.

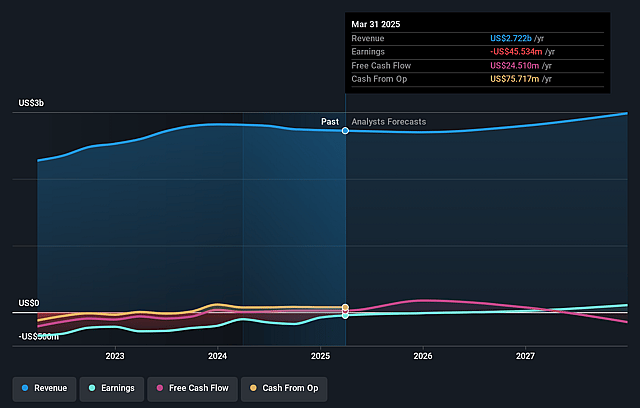

Cooper-Standard Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Cooper-Standard Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Cooper-Standard Holdings's revenue will grow by 6.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.1% today to 7.1% in 3 years time.

- The bullish analysts expect earnings to reach $229.4 million (and earnings per share of $13.09) by about September 2028, up from $29.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 4.3x on those 2028 earnings, down from 23.4x today. This future PE is lower than the current PE for the US Auto Components industry at 17.7x.

- Analysts expect the number of shares outstanding to grow by 1.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.01%, as per the Simply Wall St company report.

Cooper-Standard Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating electric vehicle adoption threatens to reduce the need for traditional hoses and seals, shrinking Cooper-Standard's addressable market and likely leading to ongoing pressure on long-term revenue and earnings growth.

- The company continues to exercise discipline around capital investments, with recent capital expenditures representing just over 1% of sales, highlighting the historic underinvestment in R&D and alternative materials, which may cause Cooper-Standard to lose future OEM contracts and limit top-line growth as the industry evolves.

- High leverage and significant interest expenses-such as the $110 million in annual cash interest payments-constrain financial flexibility and directly pressure net margins; if cyclical downturns or lower industry volumes persist, the company may struggle to generate sufficient free cash flow and meet its deleveraging targets.

- Increased supplier consolidation among OEMs and higher bargaining power for automakers are squeezing margins for traditional suppliers, meaning Cooper-Standard could face downward pricing pressure and be forced to accept less favorable contract terms, negatively impacting profitability.

- Ongoing global supply chain volatility and increasing environmental regulations may drive up compliance and raw material costs-especially for suppliers dependent on traditional chemical processes-which Cooper-Standard may not be able to fully pass through, creating sustained margin pressure and risk to future cash flows.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Cooper-Standard Holdings is $39.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Cooper-Standard Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $39.0, and the most bearish reporting a price target of just $25.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $3.2 billion, earnings will come to $229.4 million, and it would be trading on a PE ratio of 4.3x, assuming you use a discount rate of 12.0%.

- Given the current share price of $38.9, the bullish analyst price target of $39.0 is 0.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.