Last Update07 Aug 25Fair value Increased 6.90%

Driven by a sharp improvement in net profit margin and a notably lower future P/E, the consensus analyst price target for Cooper-Standard Holdings has increased from $29.00 to $31.00.

What's in the News

- Cooper Standard is collaborating with Renault Group on the eco-friendly Embleme family demo car, integrating low-carbon vehicle innovations.

- The company shifted from traditional rubber-plus-metal seals to a fully thermoplastic, recyclable FlexiCore body seal, reducing weight and CO2 emissions.

- The project marks the first automotive validation of a fully colored visible thermoplastic door seal surface, enhancing interior customization options.

- Cooper Standard's FlushSeal system, featured in the Embleme, supports flush glass styling with advanced aerodynamic design and material flexibility.

Valuation Changes

Summary of Valuation Changes for Cooper-Standard Holdings

- The Consensus Analyst Price Target has risen from $29.00 to $31.00.

- The Net Profit Margin for Cooper-Standard Holdings has significantly risen from 3.51% to 6.20%.

- The Future P/E for Cooper-Standard Holdings has significantly fallen from 6.81x to 4.14x.

Key Takeaways

- Strong order pipeline and focus on electric vehicle solutions position the company for steady growth and higher margins through premium project wins.

- Cost-saving initiatives and financial restructuring are improving profitability, while industry sustainability trends enhance the outlook for future high-margin contracts.

- Structural shifts toward electric vehicles, margin pressure from inflation, high leverage, key customer dependency, and trade uncertainty all threaten long-term revenue growth and profitability.

Catalysts

About Cooper-Standard Holdings- Through its subsidiary, manufactures and sells sealing, fuel and brake delivery, and fluid transfer systems in the North America, Europe, the Asia Pacific, and the South America.

- Cooper-Standard's strong pipeline of net new business awards ($300M in sealing and $500M in fluid systems over five years, representing ~80% of projected incremental revenue) positions the company for steady top-line growth, as these contractually backed orders are likely to drive revenue visibility and limit downside risk.

- The rapid growth of electric and hybrid vehicles is expanding the need for advanced sealing, fluid, and thermal management solutions-a segment where Cooper-Standard is investing and winning eco-conscious projects (e.g., Renault Emblème), supporting both higher average content per vehicle and premium pricing potential, which should drive revenue and margin expansion.

- Successful deployment of digital manufacturing tools, AI-powered process optimization, and lean/footprint restructuring have already yielded significant cost savings ($29M in Q2), and with further rollouts planned globally, the company expects expanded EBITDA margins and higher net income, with guidance for continued margin improvement through 2030.

- The company's financial repositioning-with improving free cash flow, a lower net leverage ratio, and expectations to refinance high-cost debt at better rates as credit ratings improve-sets up for higher net margins and increased earnings as interest expense declines.

- Secular regulatory and sustainability trends (automaker demand for lightweight, low-carbon components) align with Cooper-Standard's ongoing R&D and recent innovations, enhancing its competitive position, supporting margin expansion, and increasing the likelihood of winning higher-margin contracts, which directly benefits long-term profitability and returns on invested capital.

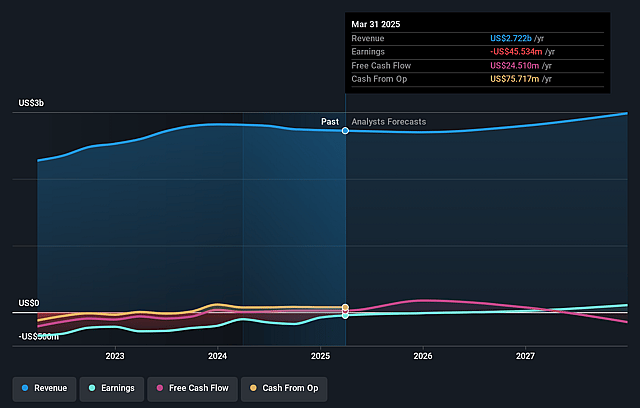

Cooper-Standard Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cooper-Standard Holdings's revenue will grow by 4.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.1% today to 6.2% in 3 years time.

- Analysts expect earnings to reach $191.2 million (and earnings per share of $8.54) by about August 2028, up from $29.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 4.1x on those 2028 earnings, down from 17.4x today. This future PE is lower than the current PE for the US Auto Components industry at 16.9x.

- Analysts expect the number of shares outstanding to grow by 1.82% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Cooper-Standard Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite operational improvements, Cooper-Standard's slight year-over-year revenue decline and ongoing flat or low industry volume assumptions underscore a risk from secular automotive trends-such as the shift to electric vehicles-which could structurally reduce demand for traditional sealing and fluid handling components, potentially pressuring long-term revenue growth.

- Increased customer price concessions, flat pricing, and persistent inflationary pressures (notably higher wage costs and general inflation cited in the quarter) suggest ongoing risk of net margin compression if cost increases outpace the company's ability to pass them on, affecting sustainable profitability.

- Elevated leverage and continued outflows for restructuring, coupled with heavy interest burdens (notably $110 million–$115 million annual interest), may constrain financial flexibility to invest in innovation and could increase vulnerability in an industry downturn, limiting future net earnings and capital allocation options.

- Heavy dependence on a few major OEM customers for net new business and recent gains is a structural risk; high customer concentration increases exposure to volume volatility, potential pricing power erosion, and negative impact on revenue consistency.

- Global trade policy uncertainty, tariffs, and supply chain realignments continue to pose a risk to cost structure and profitability; while Cooper-Standard has negotiated partial recovery of direct tariff impacts, sustained protectionism or localization trends could erode global cost advantages and compress net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $31.0 for Cooper-Standard Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $37.0, and the most bearish reporting a price target of just $25.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.1 billion, earnings will come to $191.2 million, and it would be trading on a PE ratio of 4.1x, assuming you use a discount rate of 12.3%.

- Given the current share price of $28.96, the analyst price target of $31.0 is 6.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.