Tesla’s resurgence in growth suggests that the company will experience a remarkable year, particularly under the leadership of President Trump. With the decision to eliminate the EV tax credit, while initially detrimental to Tesla, will ultimately benefit the company by reducing its competition.

Tesla has performed well before such incentives. Recent reductions in APRs have a more significant impact on the company than the incentives. Personally, I would have preferred to save more money with a 0% than a $7,500 that is not guaranteed.

It is also worth noting that China’s sales are rebounding again even with a high competitive market. One additional aspect that we should keep in mind is, significant market dominance in charging stations, which it adds to its energy department.

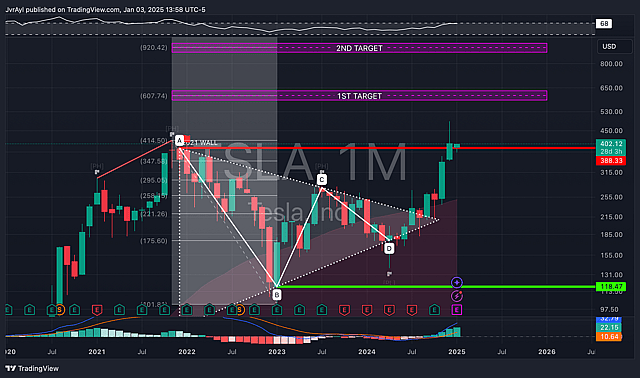

Finally it is worth noting, that Tesla has finally broken out of a consolidation pattern and formed a bull flag on the monthly chart with a close still higher than 2021 ATH close of $388.

$TSLA Key catalysts that could drive Tesla stock price in 2025 include:

- FSD Unsupervised.

- Robotaxi roadmap updates.

- Introduction of a sub $30,000 EV.

- Optimus roadmap updates.

- Confirmation of substantial growth.

- Decrease in interest rates. *Eased FSD regulations.

- FSD release in China.

- Removal of EV Tax incentives.

- FSD outside the US

- Cybertruck in Asia

- Cybertruck in Europe

- Model Y Juniper in Asia

These factors collectively have the potential to propel $TSLA’s stock to $3T.

Understanding that Tesla is no longer an auto manufacturer only is key to understanding why this Stock is heavily undervalued... Soon it will depend less and less on auto profits and investor will also have less focus on that sector, and you can start seeing them generate much better profits in energy vs autos

How well do narratives help inform your perspective?

Disclaimer

The user NahuaCapital has a position in NasdaqGS:TSLA. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.