Key Takeaways

- Expansion into affordable EVs and scaling production will boost revenue growth, improve margins, and broaden Rivian’s market presence as consumer demand rises.

- Investments in technology, localized supply chains, and software-driven features will enable cost efficiencies, recurring revenue, and financial stability despite industry and supply risks.

- Rising costs, persistent losses, restricted market demand, intensifying competition, and overdependence on a narrow product lineup threaten Rivian’s growth prospects and financial stability.

Catalysts

About Rivian Automotive- Designs, develops, manufactures, and sells electric vehicles and accessories.

- The upcoming launch of the R2 platform at a starting price of $45,000, supported by significant scaling efforts at both the Normal, Illinois and future Georgia facilities, is set to expand Rivian’s addressable market by offering more affordable EV options just as regulations and consumer demand accelerate the transition from internal combustion engines. This should drive substantial top-line revenue growth and improve margins generated by economies of scale.

- Rivian’s multi-year investment in vertically integrated technology—including in-house battery pack development, proprietary software, and advanced electrical and propulsion architectures—will enable ongoing cost reductions and margin expansion, with future margin upside as new platforms like R2 and R3 internalize even more value creation.

- Strategic localization of battery supply, including the planned transition of LG-supplied R2 cells to U.S. manufacturing in Arizona by early 2027, will reduce exposure to tariffs and supply chain risks while capitalizing on declining battery costs, supporting both gross margins and long-term earnings stability.

- Rapid advancements in Rivian’s autonomy platform and integrated AI stack, including the roll-out of hands-free and eventually eyes-off driving features, position the company to capture premium pricing and new recurring revenue streams via software, over-the-air updates, and potential subscription services, driving both average selling prices and software/service revenue as software-based automotive business models become more mainstream.

- The growing Rivian-Amazon partnership, ongoing demand for last-mile electric delivery vans, and strong performance in commercial contracts provide a diverse, resilient revenue base aligned with the broader rise in e-commerce and electrification of fleets, insulating topline revenues from consumer cyclicality and supporting growth through commercial deployments.

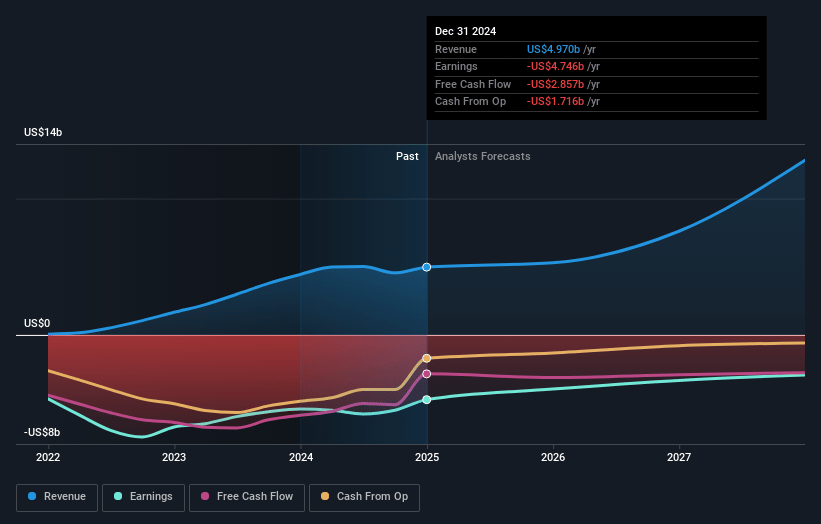

Rivian Automotive Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Rivian Automotive compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Rivian Automotive's revenue will grow by 56.6% annually over the next 3 years.

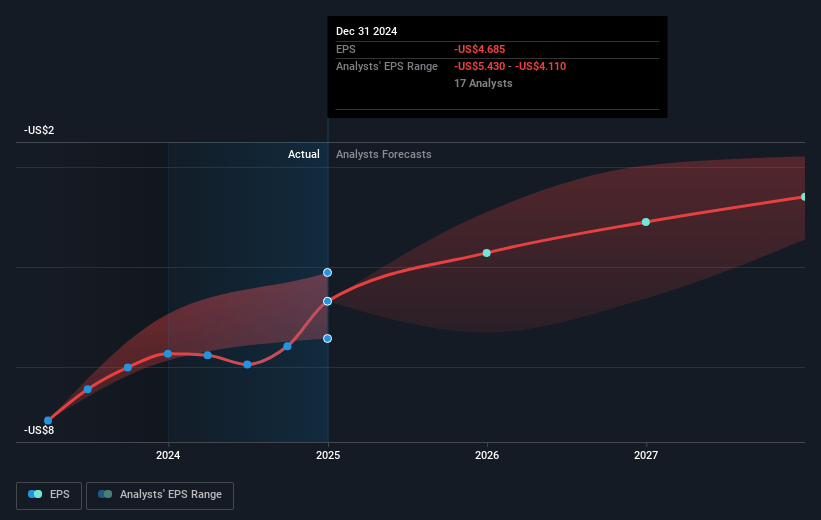

- Even the bullish analysts are not forecasting that Rivian Automotive will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Rivian Automotive's profit margin will increase from -76.8% to the average US Auto industry of 5.3% in 3 years.

- If Rivian Automotive's profit margin were to converge on the industry average, you could expect earnings to reach $1.0 billion (and earnings per share of $0.7) by about July 2028, up from $-3.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 42.4x on those 2028 earnings, up from -4.4x today. This future PE is greater than the current PE for the US Auto industry at 15.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

Rivian Automotive Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising input costs from tariffs on batteries and potential export restrictions on critical rare earth materials from China could increase Rivian’s cost of goods sold and force higher capital expenditures, negatively affecting net margins and long-term profitability.

- Persistent operating losses, large R&D investments in autonomy and EV platforms, and the delayed path to meaningful scale—especially as R2 is still a year away—raise the risk that Rivian may continue to operate with negative EBITDA and negative earnings for several years.

- A high average selling price for R1 vehicles, combined with consumer price sensitivity and waning EV incentives in an environment of high interest rates, limits Rivian’s addressable market and restricts revenue growth opportunities until more affordable models launch.

- Intensifying competition from legacy OEMs and new EV entrants, as well as rapid advancements by rivals (notably Tesla in autonomy), heightens the risk of market share loss and escalating price wars, which could compress revenue and erode margins.

- Heavy reliance on a limited vehicle lineup and key customers, especially commercial vans for Amazon and the delayed ramp-up of R2, creates revenue volatility and exposes Rivian to risk if volume, partnerships, or consumer demand underperform expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Rivian Automotive is $21.33, which represents two standard deviations above the consensus price target of $14.79. This valuation is based on what can be assumed as the expectations of Rivian Automotive's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $23.0, and the most bearish reporting a price target of just $7.05.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $19.2 billion, earnings will come to $1.0 billion, and it would be trading on a PE ratio of 42.4x, assuming you use a discount rate of 11.6%.

- Given the current share price of $14.12, the bullish analyst price target of $21.33 is 33.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.