Last Update03 Oct 25Fair value Increased 3.23%

Narrative Update on Turkiye Garanti Bankasi

Analysts have raised their price target for Turkiye Garanti Bankasi from ₺161.66 to ₺166.88. This change reflects updated assumptions around discount rates, revenue growth, and profit margins.

Valuation Changes

- Fair Value increased from TRY 161.66 to TRY 166.88

- Discount Rate rose slightly from 31.92% to 32.05%

- Revenue Growth increased from 31.27% to 32.20%

- Net Profit Margin decreased marginally from 34.30% to 33.58%

- Future P/E increased slightly from 7.34x to 7.60x

Key Takeaways

- Ongoing digitalization and retail loan growth are boosting efficiency, customer engagement, and future revenue opportunities across an expanding market.

- Strong fee income, prudent balance sheet management, and a focus on sustainable finance enhance earnings quality and defend profitability in changing conditions.

- Concentration in Turkey's volatile economy, unrepeatable credit gains, digital competition, and regulatory uncertainty threaten Garanti's margins, earnings quality, and long-term revenue stability.

Catalysts

About Turkiye Garanti Bankasi- Provides various banking products and services in Turkey.

- Continued expansion of the retail and SME loan portfolio, supported by Turkey's young and growing population and rising urbanization, is expected to drive sustained loan growth and broaden Garanti's addressable market, supporting future revenue expansion.

- The bank's early and ongoing investments in digitalization (with 99% of transactions and 86% of product sales now digital) will likely further reduce cost-to-income ratios, enhance customer engagement, and accelerate cross-selling, positively impacting net margins and earnings scalability.

- Robust fee income growth (up 57% YoY in H1) led by payment systems and increasing credit card volumes signals resilience against margin headwinds and creates upside potential for non-interest revenue streams, supporting profitability even in a lower NIM environment.

- Prudent balance sheet management, with a strong focus on customer deposits and active margin/spread management, allows Garanti to rapidly adapt to changing interest rate cycles and contain funding costs, thereby defending net interest margins and earnings stability.

- Expansion into sustainable and green finance, as well as leveraging BBVA's backing for capital and risk management, positions Garanti to capture emerging ESG opportunities and maintain capital strength, supporting long-term earnings quality and sector leadership.

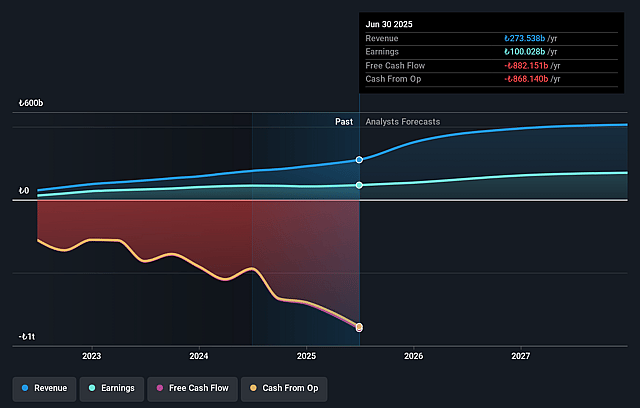

Turkiye Garanti Bankasi Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Turkiye Garanti Bankasi's revenue will grow by 31.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 36.6% today to 34.3% in 3 years time.

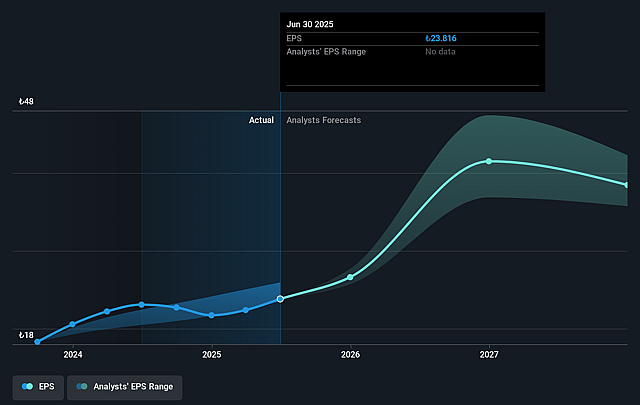

- Analysts expect earnings to reach TRY 212.2 billion (and earnings per share of TRY 38.46) by about September 2028, up from TRY 100.0 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.3x on those 2028 earnings, up from 5.6x today. This future PE is greater than the current PE for the GB Banks industry at 7.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 31.92%, as per the Simply Wall St company report.

Turkiye Garanti Bankasi Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent high inflation and tight monetary policy in Turkey could squeeze consumer purchasing power and raise funding costs, leading to margin compression and increased risk of non-performing loans-potentially reducing Garanti's revenues and net margins over the long term.

- The bank's asset quality has benefited from large, unbudgeted provision reversals and exceptional collection performance in the first half, but management acknowledges these are not expected to repeat, which could increase risk costs and weaken earnings quality in future periods.

- With Garanti's loan book and funding largely concentrated within Turkey's volatile macroeconomic environment, limited geographic diversification exposes the bank to economic and policy uncertainty, escalating earnings volatility and potential revenue declines in downturns.

- Ongoing investment in digitalization and AI, coupled with rising competitive pressure from fintechs and digital challengers, risks higher operating expenses and customer attrition if technological transformation is outpaced, negatively impacting efficiency ratios and net income.

- The regulatory landscape remains unpredictable, with potential interest rate caps, stricter cost controls, and changing policies (such as loan restructuring regulation) possibly compressing profitability, increasing compliance costs, and reducing long-term revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of TRY161.657 for Turkiye Garanti Bankasi based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of TRY208.9, and the most bearish reporting a price target of just TRY105.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be TRY618.8 billion, earnings will come to TRY212.2 billion, and it would be trading on a PE ratio of 7.3x, assuming you use a discount rate of 31.9%.

- Given the current share price of TRY133.8, the analyst price target of TRY161.66 is 17.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.