Key Takeaways

- Geopolitical and economic instability, currency weakness, and rising interest rates threaten funding, lending growth, and asset quality, pressuring profitability and investor confidence.

- Increasing competition from digital banks and fintechs may erode market share, fee income, and revenue growth sustainability, impacting long-term margins and efficiency.

- Strategic digitalization, robust core revenue growth, strong funding flexibility, resilient capital position, and effective loan management collectively support profitability and long-term sustainability.

Catalysts

About Turkiye Garanti Bankasi- Provides various banking products and services in Turkey.

- Heightened and persistent geopolitical instability in Turkey and its neighboring regions could increase volatility across financial markets, leading to elevated risk premiums and restricting Garanti's access to affordable funding, which would directly threaten future lending growth and undermine net interest income.

- A structural shift toward higher global interest rates is likely to curtail capital inflows into emerging markets, driving up Garanti's funding costs and compressing its net interest margins further, eroding earnings and limiting loan portfolio expansion.

- Lingering Turkish lira weakness, coupled with the ongoing threat of high inflation, may continue to damage consumer and investor confidence, prompt increased dollarization, and reduce the value of lira-denominated assets-putting continuous pressure on the bank's real asset base and long-term profitability.

- Asset quality is becoming increasingly vulnerable as Garanti's exposure to volatile sectors and the heavy weighting of unsecured retail lending raises the risk of elevated non-performing loans, which would force sustained increases in provisions and drive down net earnings and return on equity.

- Escalating competition from digital-first banks and fintechs, combined with the accelerated adoption of open banking, threatens to erode Garanti's market share, reduce fee and commission income, and pressure already-tightened efficiency ratios, compromising the sustainability of revenue growth and margins.

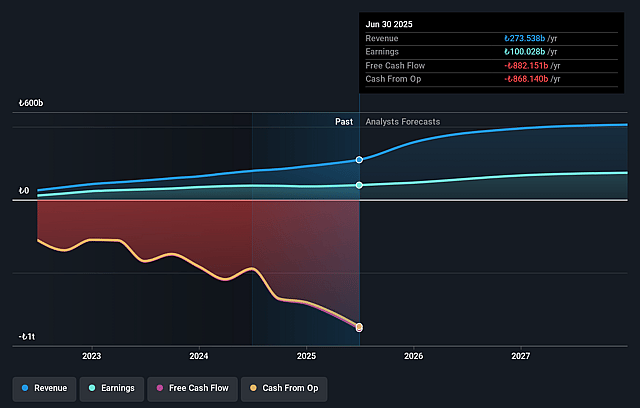

Turkiye Garanti Bankasi Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Turkiye Garanti Bankasi compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Turkiye Garanti Bankasi's revenue will grow by 23.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 36.6% today to 39.8% in 3 years time.

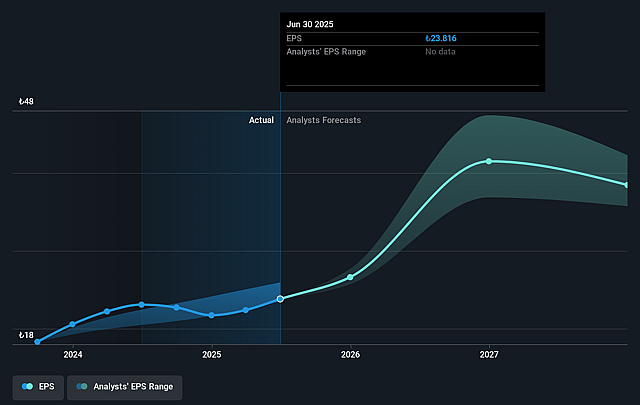

- The bearish analysts expect earnings to reach TRY 203.4 billion (and earnings per share of TRY 40.77) by about September 2028, up from TRY 100.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 5.2x on those 2028 earnings, down from 6.0x today. This future PE is lower than the current PE for the GB Banks industry at 7.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 32.17%, as per the Simply Wall St company report.

Turkiye Garanti Bankasi Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The bank's consistent investment in digitalization and artificial intelligence, as reflected in both its expanding digital customer base (over 17 million active users) and the fact that 99% of transactions are executed through digital channels, could lower cost-to-income ratios and boost net profit margins in the long run.

- Robust growth in core banking revenues, payment system fees, and consumer lending-supported by sustained market share gains in cards and SME lending-suggests strong underlying demand, raising the possibility of persistent top-line revenue growth and operating income expansion.

- Effective active balance sheet management and funding from sticky, low-cost deposits, along with a high share of Turkish Lira loans and agility in deposit pricing, provides flexibility to protect or improve net interest margins, ultimately supporting earnings.

- Solid capital adequacy, highlighted by a Common Equity Tier 1 ratio of 12.6% and a successful $500 million Tier 2 bond issuance, strengthens the bank's ability to absorb shocks and capitalize on growth opportunities, which may bolster long-term return on equity.

- Favorable trends in non-performing loan management, ongoing provision reversals, and supportive regulatory measures enabling retail loan restructuring may keep asset quality stable and contain credit losses, thereby underpinning future profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Turkiye Garanti Bankasi is TRY109.79, which represents two standard deviations below the consensus price target of TRY161.66. This valuation is based on what can be assumed as the expectations of Turkiye Garanti Bankasi's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of TRY208.9, and the most bearish reporting a price target of just TRY105.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be TRY510.6 billion, earnings will come to TRY203.4 billion, and it would be trading on a PE ratio of 5.2x, assuming you use a discount rate of 32.2%.

- Given the current share price of TRY141.9, the bearish analyst price target of TRY109.79 is 29.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.