Key Takeaways

- Accelerated shift to retail and SME deposits and digital banking is reducing funding costs and driving sustained outperformance in net interest margins and revenue growth.

- Market leadership in consumer and SME lending, plus BBVA support and tech investment, position Garanti for robust asset growth and new high-margin opportunities in Turkey.

- A combination of economic instability, regulatory risks, intense competition, asset quality concerns, and costly digital transformation threatens revenue growth and long-term profitability.

Catalysts

About Turkiye Garanti Bankasi- Provides various banking products and services in Turkey.

- While analysts broadly agree that increased deposit market share and retail focus will reduce funding costs, they could be underestimating the speed and magnitude of Garanti's structural shift to retail and SME deposits, which allows an even deeper and faster reduction in funding costs and drives sustained net interest margin outperformance and higher long-term earnings.

- Analyst consensus points to robust loan and asset growth aligned with GDP, but Garanti's market-leading position in consumer and SME lending-combined with the underpenetrated banking landscape-positions the bank for outsized asset growth well above sector averages, leading to a structurally higher revenue base over the next several years.

- Turkey's rapidly urbanizing, youthful middle class is accelerating the demand for consumer finance, mortgages, and digital banking, meaning Garanti is poised to drive superior loan and fee growth as it captures disproportionate wallet share from this expanding demographic, materially boosting revenue and earnings trajectory.

- Strategic investment in artificial intelligence and digital platforms is reducing Garanti's structural cost base and enabling industry-leading automation in customer acquisition and service delivery, driving a sustainable decline in cost/income ratio and supporting higher net margins over the long term.

- Backed by BBVA's international expertise, risk management, and capital resources, Garanti is uniquely positioned to capture share from cross-border trade and ESG finance opportunities arising from Turkey's deepening integration with European markets, further supporting above-average ROE growth and new, high-margin revenue pools.

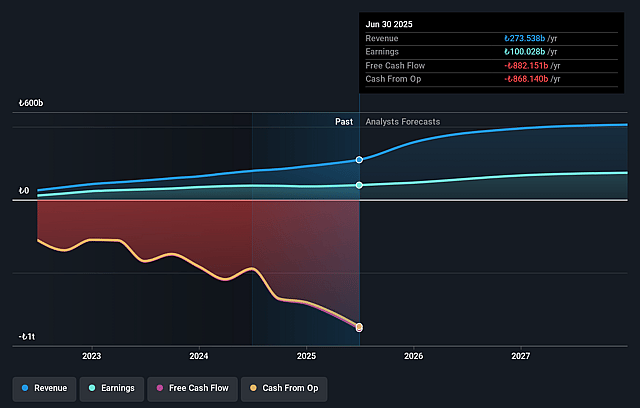

Turkiye Garanti Bankasi Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Turkiye Garanti Bankasi compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Turkiye Garanti Bankasi's revenue will grow by 35.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 36.6% today to 32.6% in 3 years time.

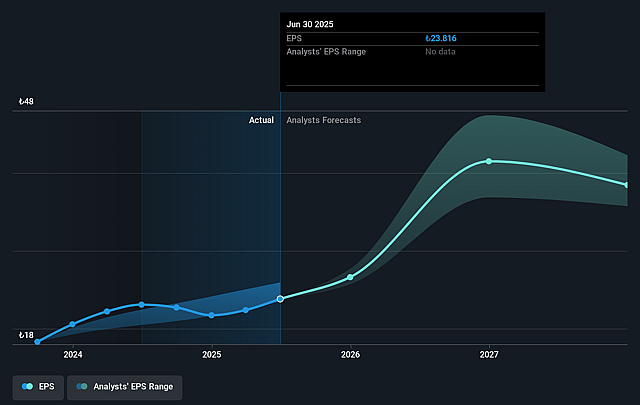

- The bullish analysts expect earnings to reach TRY 219.9 billion (and earnings per share of TRY 48.25) by about September 2028, up from TRY 100.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 9.2x on those 2028 earnings, up from 6.0x today. This future PE is greater than the current PE for the GB Banks industry at 7.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 32.17%, as per the Simply Wall St company report.

Turkiye Garanti Bankasi Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The bank is highly exposed to structural economic risks in Turkey, such as persistent high inflation, lira volatility, and a projected worsening of the current account deficit, which may erode capital adequacy and compress net margins over time.

- Intensifying margin pressures from a prolonged tight monetary policy and higher deposit costs, combined with competition for deposits and regulatory changes, are already causing delays in net interest margin expansion, threatening revenue growth and profitability.

- A large and increasing share of lending to unsecured retail, credit cards, and SME segments leaves the bank vulnerable to deterioration in asset quality, especially as there are signs of rising non-performing loans in SMEs and expectations for a higher cost of risk into next year, raising concerns for future earnings stability.

- Although digitalization is a focus, rapid fintech disruption and the increasing costs of technology investment and compliance could outpace fee growth and improvement in operational efficiency, ultimately putting pressure on the cost-to-income ratio and bottom-line earnings.

- Heavy concentration in the domestic market and sensitivity to local regulation put the bank at risk from potential government intervention or new banking policies, which could mandate unprofitable lending or limit flexibility, thereby undermining revenue predictability and medium-term return on equity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Turkiye Garanti Bankasi is TRY208.9, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Turkiye Garanti Bankasi's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of TRY208.9, and the most bearish reporting a price target of just TRY105.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be TRY673.9 billion, earnings will come to TRY219.9 billion, and it would be trading on a PE ratio of 9.2x, assuming you use a discount rate of 32.2%.

- Given the current share price of TRY141.9, the bullish analyst price target of TRY208.9 is 32.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.