Key Takeaways

- G5 Store's evolution into a third-party platform and aggressive user acquisition could unlock substantial revenue and margin expansion, outpacing current expectations.

- Strategic cost efficiencies, strong cash reserves, and targeted reinvestment support long-term earnings growth and tap into emerging demographic and regional opportunities.

- Heavy reliance on a few aging franchises, rising user acquisition costs, and regulatory headwinds threaten margins and revenue stability amid uncertain diversification efforts.

Catalysts

About G5 Entertainment- Develops and publishes free-to-play games for smartphones, tablets, and personal computers in Sweden.

- Analysts broadly agree that the G5 Store's lower processing fees will drive margin expansion, but this overlooks the store's transformative potential as a third-party distribution platform; onboarding successful external mobile games could make G5 Store a dominant hub for casual and puzzle gaming, unlocking accelerated revenue and margin growth far above expectations.

- While consensus believes G5's operational efficiencies, including AI integration, will optimize costs, the scale of ongoing headcount reductions, AI-powered in-house content and localization, and next-generation design tool adoption point to step-function improvements in cost structure-enabling sustained double-digit net margins even as the company scales.

- G5's strong cash position and zero debt not only enable opportunistic M&A, but also strategic reinvestment in proprietary live-ops, first-party IP, and global marketing, setting the stage for outsized long-term earnings growth as in-house franchises capture an expanding global mobile audience.

- The continuing surge in global mobile device penetration is expanding the company's addressable market faster than perceived, positioning G5 to unlock significant top-line growth by ramping user acquisition spending and deepening monetization in high-growth regions such as Latin America and Southeast Asia.

- Rapid demographic shifts toward older and more diverse casual gamers, combined with G5's unique focus on portfolio cross-promotion and user retention, will drive increasing average revenue per user and recurring revenues, supporting a re-rating of its future earnings profile.

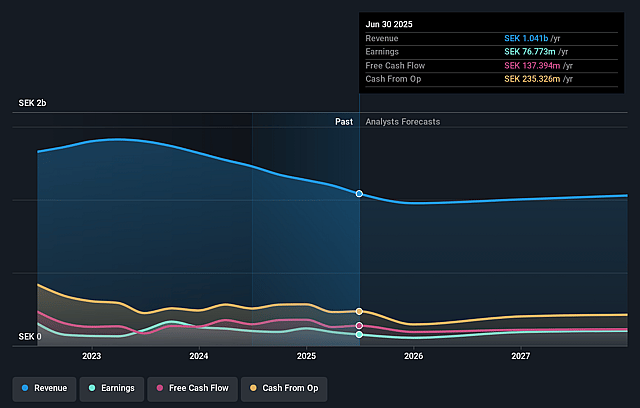

G5 Entertainment Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on G5 Entertainment compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming G5 Entertainment's revenue will grow by 2.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 8.5% today to 10.2% in 3 years time.

- The bullish analysts expect earnings to reach SEK 121.0 million (and earnings per share of SEK 15.55) by about July 2028, up from SEK 93.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.8x on those 2028 earnings, up from 9.1x today. This future PE is lower than the current PE for the GB Entertainment industry at 20.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.96%, as per the Simply Wall St company report.

G5 Entertainment Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- G5 Entertainment's revenue has declined year-over-year in both Swedish krona and US dollar terms, with ongoing sequential decreases, indicating potential difficulty in sustaining top line revenue growth as existing games mature and consumer interest shifts.

- The company remains heavily reliant on a small number of titles, notably the Jewel family and Sherlock, which together constitute the majority of net revenue; this concentration heightens vulnerability to changing player tastes and could lead to significant volatility in both revenue and future earnings if these franchises lose popularity.

- The company's stated plans to ramp up user acquisition spending back to the 17 to 22 percent range of revenue suggest rising user acquisition costs and potentially less efficient marketing, which over time may compress net margins as global competition in mobile advertising and gaming intensifies.

- G5's ambitions to scale the G5 store by licensing third-party titles introduces execution and integration risks, especially as the company is untested in attracting and retaining sizeable external developer partnerships at scale, which could result in slower revenue diversification and profit improvement than anticipated.

- The broader mobile gaming market faces increased regulatory focus on data privacy, app store payments, screen time, and in-app purchases; such tightening restrictions and changing consumer behavior may shrink user engagement and payment opportunities, placing long-term pressure on company-wide revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for G5 Entertainment is SEK265.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of G5 Entertainment's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK265.0, and the most bearish reporting a price target of just SEK135.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be SEK1.2 billion, earnings will come to SEK121.0 million, and it would be trading on a PE ratio of 18.8x, assuming you use a discount rate of 7.0%.

- Given the current share price of SEK109.2, the bullish analyst price target of SEK265.0 is 58.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.