Key Takeaways

- Heavy reliance on core legacy games and fragile user monetization strategies expose the company to risks from shifting platform policies, competition, and regulatory headwinds.

- Growing alternative digital entertainment options and rising user acquisition costs threaten engagement and profitability, despite success with direct sales channels and in-house development.

- Heavy dependence on aging core games, rising marketing costs, and major execution risks in new initiatives threaten revenue growth and margin stability amid regulatory and competitive pressures.

Catalysts

About G5 Entertainment- Develops and publishes free-to-play games for smartphones, tablets, and personal computers in Sweden.

- Although G5 Entertainment is rapidly growing its direct-to-consumer distribution channel through the G5 store-reaching 21 percent of revenues and showing sequential growth-global policy unpredictability from major platforms like Apple and Google still threatens the economics of mobile gaming, putting long-term pressure on both revenue take rates and user acquisition strategy.

- While the company benefits from a demographic shift toward an older and more affluent gaming population, the proliferation of alternative digital entertainment such as short-form video and new AR/VR apps risks further fragmenting user attention, potentially depressing engagement and active users, which would weigh on future bookings and top-line revenue.

- G5's increasing reliance on in-house development and use of AI-driven tools has helped reduce outsourcing costs and support gross margin, yet continued heavy dependence on a small set of core legacy titles means earnings resilience remains fragile should those specific games lose popularity or fail to maintain top-grossing status.

- Despite the secular growth in in-app purchases and the company's web shop initiative-which can bypass high platform fees-intensifying global privacy regulations are likely to limit targeted marketing effectiveness, leading to reduced monetization capabilities and increased user acquisition costs, ultimately eroding net margins.

- The push to scale the G5 store through third-party game distribution could increase revenue diversity over time, but G5 still faces the risk of rising competition where larger industry players leverage cross-promotion, making it costlier for independent studios to acquire users and possibly leading to market share losses that undermine long-term revenue growth.

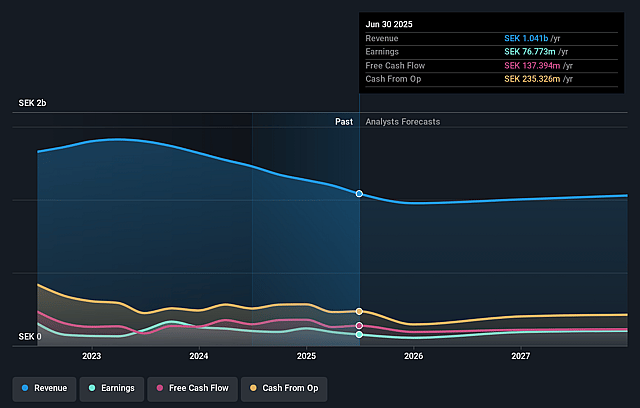

G5 Entertainment Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on G5 Entertainment compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming G5 Entertainment's revenue will decrease by 3.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 8.5% today to 10.8% in 3 years time.

- The bearish analysts expect earnings to reach SEK 107.4 million (and earnings per share of SEK 13.81) by about July 2028, up from SEK 93.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.8x on those 2028 earnings, up from 9.1x today. This future PE is lower than the current PE for the GB Entertainment industry at 20.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.96%, as per the Simply Wall St company report.

G5 Entertainment Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Reliance on a limited number of core legacy titles such as those in the Jewel family and Sherlock, which together comprise over half of net revenue, raises the risk that if these games experience saturation or user decline, the company could see weakened revenue growth and reduced earnings resilience.

- Recent quarterly results revealed a twelve percent decline in revenue year-over-year in SEK terms and a decline in operating profit and earnings per share, indicating that existing game improvements and pipeline additions may not fully offset midterm revenue pressure, thus raising the risk of lower future top line and net margins if portfolio revitalization efforts underperform.

- User acquisition was below the company's intended range during the latest quarter due to channel disruptions, and plans to ramp spending back to seventeen to twenty-two percent of revenue may drive up marketing costs amidst intensifying industry competition, which risks squeezing net margins and slowing net earnings growth.

- Although G5 is expanding direct-to-consumer channels like G5 store and web shop, these initiatives face potential hurdles from evolving platform policies and regulation, including possible resistance from Apple and Google or shifting global regulatory scrutiny on payment mechanisms, which could restrict monetization and limit revenue scalability.

- Management's reliance on new game launches or successful scaling of third-party titles to reignite growth introduces execution risk, as the company acknowledged that only a substantial success in its pipeline or store initiatives could offset declines in mature titles, thereby making revenue and earnings momentum heavily dependent on uncertain and competitive product cycles.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for G5 Entertainment is SEK135.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of G5 Entertainment's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK265.0, and the most bearish reporting a price target of just SEK135.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be SEK998.3 million, earnings will come to SEK107.4 million, and it would be trading on a PE ratio of 10.8x, assuming you use a discount rate of 7.0%.

- Given the current share price of SEK109.2, the bearish analyst price target of SEK135.0 is 19.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.