Key Takeaways

- Store expansion, format innovation, and omni-channel investments position Wilcon to outpace revenue growth forecasts and gain share from weaker competitors.

- Cost discipline, supplier relationships, and logistics optimization drive margin expansion, with potential for accelerated earnings growth and improved valuation multiples.

- Declining same-store sales, margin compression, supply chain risks, costly expansion, and shifting consumer preferences threaten Wilcon Depot's profitability and long-term business model viability.

Catalysts

About Wilcon Depot- Wilcon Depot, Inc., doing business as WILCON DEPOT and WILCON HOME ESSENTIALS, operates as a home improvement and construction supplies retailer in the Philippines.

- While analyst consensus expects store expansions and construction activity to drive medium-term upside, encouraging transaction growth in both core and new markets-evidenced by a rebound to mid-single-digit same-store sales growth in July with further upside if seasonality and construction activity accelerate-could result in a much stronger full-year sales recovery and double-digit SSSG, fueling a sharp revenue and margin rebound.

- Analysts broadly agree margin normalization will follow a return to volume growth and better supplier pricing, but recent producer overcapacity in China and Wilcon's strong supplier relationships may enable cost of goods savings and price advantages beyond expectations, structurally increasing gross margins and boosting overall earnings faster than consensus implies.

- Successful format innovation, especially with smaller Do-It-Wilcon locations outperforming expectations and offering rapid payback in newly urbanizing communities, positions Wilcon to unlock higher returns on capital, accelerate network effects, and outperform revenue growth forecasts as the middle class continues to expand.

- Wilcon's cost discipline-through heavy rationalization of store footprints, further automation, and optimization of logistics-signals structural improvements in operating leverage, which can drive meaningful improvements in net margins and earnings quality, potentially re-rating the stock's valuation multiples.

- As digital adoption increases in the Philippines, Wilcon's ongoing omni-channel investments and direct-to-community sales teams are likely to enable it to capture incremental share from informal and low-quality competitors, greatly expanding its total addressable market and supporting top-line and margin growth as industry consolidation accelerates.

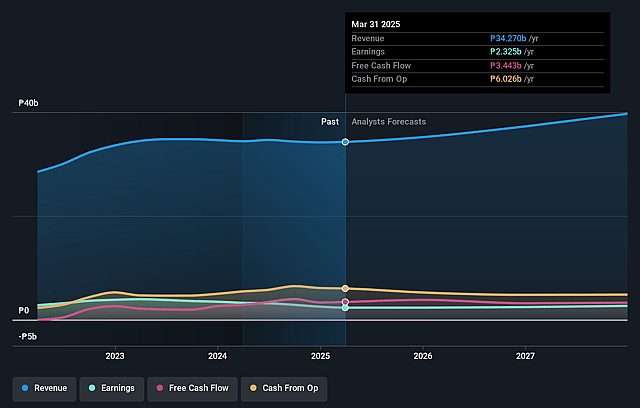

Wilcon Depot Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Wilcon Depot compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Wilcon Depot's revenue will grow by 11.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 6.4% today to 6.2% in 3 years time.

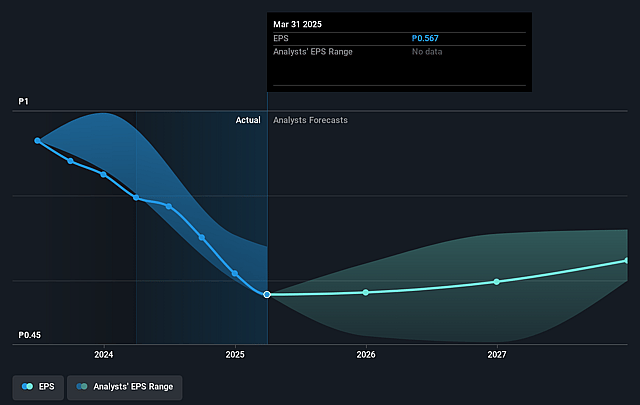

- The bullish analysts expect earnings to reach ₱2.9 billion (and earnings per share of ₱0.7) by about September 2028, up from ₱2.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 24.0x on those 2028 earnings, up from 18.7x today. This future PE is greater than the current PE for the PH Specialty Retail industry at 5.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.15%, as per the Simply Wall St company report.

Wilcon Depot Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Wilcon Depot continues to experience declining comparable sales in its traditional depot format, with first-half 2025 same-store sales down 4.9 percent and depot comparable sales declining 5.7 percent, which, if sustained in an environment of plateauing urbanization and slowing new household formation, signals ongoing revenue headwinds and structural risk to long-term top-line growth.

- The company's heavy reliance on imported inventory, with 85 percent to 90 percent of in-house brands sourced from China, exposes it to persistent FX volatility and potential supply chain disruptions, which could increase cost of goods sold and erode earnings if freight costs or geopolitical factors turn adverse.

- Intensifying competition, both from organized local players and the proliferation of low-cost Chinese imports and online sellers via social platforms, is leading to ongoing margin compression, as evidenced by Wilcon's reduced gross profit margin rate of 38.7 percent in first half 2025, down from 39.8 percent in 2024, with continuing discounting pressure and weak pricing power hurting profitability.

- Wilcon's aggressive store network expansion-including entry into lower-tier and saturated markets-has resulted in only marginal year-on-year total sales growth, while operating expenses continue to rise due to depreciation, amortization, and store rationalization costs, pressuring net margins and potentially leading to diminishing returns on invested capital over time.

- A shift in consumer preference toward smaller-format, community-accessible stores, and direct-to-consumer e-commerce channels, could make Wilcon's traditional big-box depot format less relevant, leaving its largest revenue segment vulnerable to long-term declines and posing a structural risk to both revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Wilcon Depot is ₱11.3, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Wilcon Depot's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₱11.3, and the most bearish reporting a price target of just ₱6.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₱46.6 billion, earnings will come to ₱2.9 billion, and it would be trading on a PE ratio of 24.0x, assuming you use a discount rate of 14.2%.

- Given the current share price of ₱9.94, the bullish analyst price target of ₱11.3 is 12.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.