Last Update 01 Aug 25

Fair value Decreased 9.72%The downward revision in Wilcon Depot’s price target is primarily driven by a lower forecasted Future P/E ratio, with the consensus fair value decreasing from ₱9.44 to ₱8.60.

What's in the News

- The board will meet to consider and approve the first half 2025 financial statements for the period ending June 30, 2025.

- The board held a meeting to approve the election of officers.

Valuation Changes

Summary of Valuation Changes for Wilcon Depot

- The Consensus Analyst Price Target has fallen from ₱9.44 to ₱8.60.

- The Future P/E for Wilcon Depot has fallen from 21.78x to 19.92x.

- The Discount Rate for Wilcon Depot remained effectively unchanged, moving only marginally from 13.82% to 13.98%.

Key Takeaways

- Weak store sales, margin pressures, and higher operating costs threaten long-term earnings amid shifting consumer demand and intensifying competition.

- Expansion efforts and increased promotions may raise expenses without adequately offsetting risks from market saturation and digital disruptors.

- Ongoing sales growth, successful smaller store formats, expansion, operational efficiencies, and favorable supplier dynamics collectively enhance revenue potential and margin resilience amid competitive pressures.

Catalysts

About Wilcon Depot- Wilcon Depot, Inc., doing business as WILCON DEPOT and WILCON HOME ESSENTIALS, operates as a home improvement and construction supplies retailer in the Philippines.

- The company is experiencing soft consumer demand in its core depot format, as evidenced by falling same-store sales, declining ticket size, and a product sales mix shift toward lower-margin categories. This suggests that current valuations may be assuming a quicker recovery in revenue growth than what long-term market dynamics or recent results actually support.

- The rise of online marketplaces and e-commerce platforms is making it easier for lower-cost, often untaxed or unregulated imports to enter the market. This increased digital and cross-border competition could further erode physical store traffic and put ongoing pressure on both revenues and gross margins.

- Competitive pressures are intensifying, with widespread discounting by rivals and an influx of cheaper Chinese goods driving price competition and dampening Wilcon Depot's ability to restore or expand gross profitability, potentially leading to sustained margin compression.

- A more fragmented and price-driven industry landscape is forcing Wilcon Depot to invest in more marketing and promotional activity, with suppliers often absorbing less of the cost than in prior years, which could add to operating expense growth and suppress future earnings expansion.

- Ongoing store expansion and smaller-format rollout are contributing to higher depreciation, amortization, and operating expenses at a time when like-for-like sales are weak and market saturation risks are rising, increasing the likelihood of operating leverage turning negative and long-term earnings underperformance.

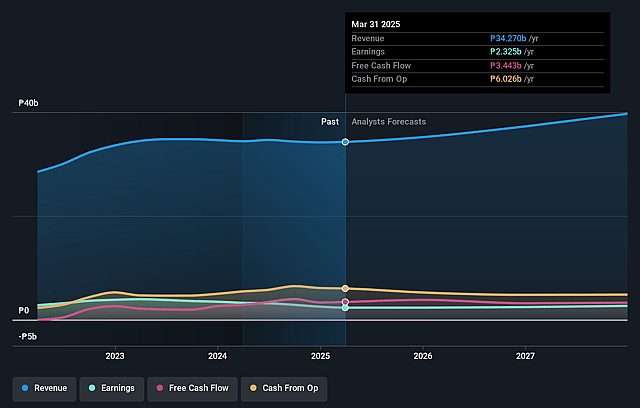

Wilcon Depot Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Wilcon Depot's revenue will grow by 6.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.4% today to 6.6% in 3 years time.

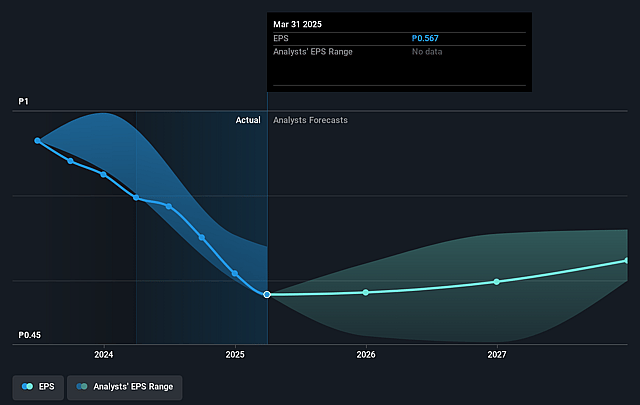

- Analysts expect earnings to reach ₱2.7 billion (and earnings per share of ₱0.64) by about September 2028, up from ₱2.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.5x on those 2028 earnings, up from 17.9x today. This future PE is greater than the current PE for the PH Specialty Retail industry at 5.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.19%, as per the Simply Wall St company report.

Wilcon Depot Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is seeing sustained improvement in same-store sales growth (SSSG), particularly in June and July, with mid-single digit growth in recent weeks despite weather disruptions; if this trend continues into the second half, it could reverse negative year-to-date SSSG, directly supporting higher revenue and potentially earnings.

- The Do-It-Wilcon (DIW) smaller format stores have been outperforming, posting 10–11% net sales growth and 6.6% same-store sales growth, attributed to better location selection and product mix, indicating successful market adaptation and providing a new lever for revenue and margin resilience.

- Store expansion remains a core strategy, with new depots and DIW formats often delivering incremental sales (new depots added 4.5% total sales year-on-year in 1H), suggesting that geographic growth and portfolio diversification could continue to offset competitive or macro-driven topline pressure.

- Cost containment and operational optimizations-such as workforce rationalization, reduced trucking and logistics expenses, and planned store resizing-are underway and expected to have enhancing effects on operating margins and net profit over the medium to long term.

- Supplier overcapacity and the influx of imported goods (especially from China) allow Wilcon Depot to negotiate better purchase prices and terms; this, combined with support from exclusive suppliers for marketing and promotions, could stabilize or improve gross margins, particularly if demand for higher-margin categories recovers, positively impacting profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₱8.522 for Wilcon Depot based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₱11.3, and the most bearish reporting a price target of just ₱6.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₱40.8 billion, earnings will come to ₱2.7 billion, and it would be trading on a PE ratio of 19.5x, assuming you use a discount rate of 14.2%.

- Given the current share price of ₱9.5, the analyst price target of ₱8.52 is 11.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.