Key Takeaways

- Growing e-commerce adoption and market saturation threaten Wilcon Depot's revenue growth and long-term sales performance.

- Margin pressures are rising from intense price competition, reliance on imports, and challenges absorbing higher input and logistics costs.

- Focus on smaller community stores, exclusive brands, and cost containment is driving resilience, margin protection, and long-term growth despite competitive pressures.

Catalysts

About Wilcon Depot- Wilcon Depot, Inc., doing business as WILCON DEPOT and WILCON HOME ESSENTIALS, operates as a home improvement and construction supplies retailer in the Philippines.

- The accelerating shift to digital commerce and proliferation of e-commerce platforms in the Philippines will likely erode Wilcon Depot's share of the home improvement market, putting sustained pressure on its brick-and-mortar revenues as more consumers bypass physical stores for online alternatives.

- There is a clear risk that urbanization and middle-class expansion are reaching maturity in Wilcon's core markets, which could cap future demand for residential construction and renovations, leading to prolonged stagnation in same-store sales growth and diminishing long-term top-line expansion.

- Industry-wide price competition is intensifying, both from traditional rivals and the influx of low-priced Chinese goods, driving Wilcon to adopt promotional pricing and aggressive discounts-this is already pulling down gross profit margins and threatens further margin erosion as competitors flood the market with substandard but cheaper alternatives.

- Wilcon's heavy reliance on imported goods exposes the company to ongoing foreign exchange risks and logistics cost volatility; any sustained increase in shipping rates or depreciation of the local currency will directly compress net margins due to higher input costs that may not be fully passed on to consumers.

- The move to rationalize and downsize underperforming store formats, combined with declining same-store sales in the core depot network, signals approaching store network saturation; this structurally constrains future earnings growth and could result in a meaningful deceleration in overall profitability even as operating expenses remain elevated.

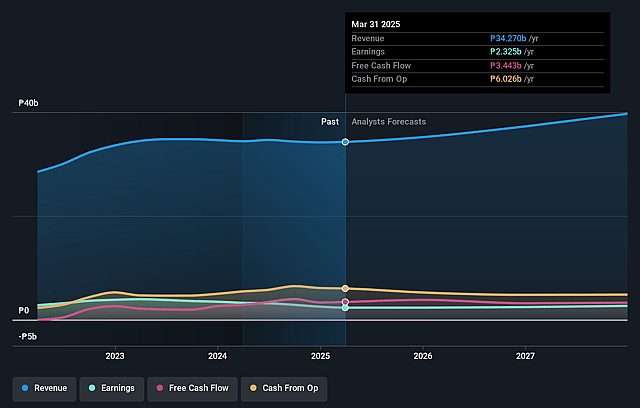

Wilcon Depot Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Wilcon Depot compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Wilcon Depot's revenue will grow by 3.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 6.4% today to 6.8% in 3 years time.

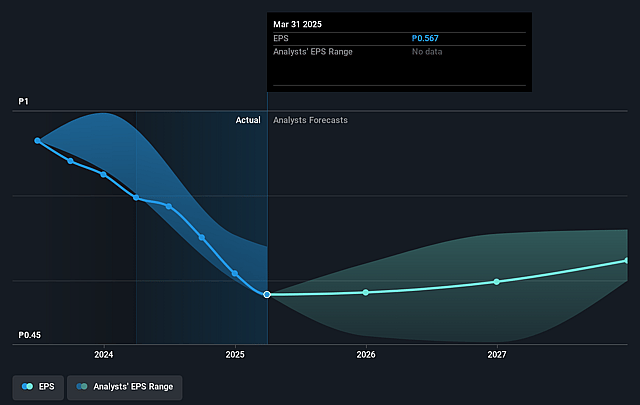

- The bearish analysts expect earnings to reach ₱2.6 billion (and earnings per share of ₱0.62) by about September 2028, up from ₱2.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.2x on those 2028 earnings, down from 17.9x today. This future PE is greater than the current PE for the PH Specialty Retail industry at 6.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.19%, as per the Simply Wall St company report.

Wilcon Depot Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's same-store sales growth turned positive in June and July, and management expects that if the mid-single digit growth trend continues throughout the second half, the annual figure could shift into positive territory, supporting a rebound in revenue growth.

- Wilcon Depot continues to expand its store network and has adapted its strategy to focus on smaller format, community-based stores that have exceeded targets and shown faster recovery compared to the traditional large store format, indicating resilience and new avenues for revenue growth.

- The leadership remains confident about maintaining and even growing its target market in the middle and high-end segment, underscored by strong brand equity and being regarded as the market leader, which helps protect margins against competitors resorting to aggressive price cutting.

- Exclusive and in-house brands now contribute over half of total sales, and management is enhancing their profitability while also benefiting from supplier-supported marketing and incentives, which bolsters gross margins and strengthens Wilcon's differentiated position.

- The company is actively implementing cost containment measures-including manpower optimization, rationalizing store sizes, and improving logistics efficiency-which are expected to drive operating expenses lower, supporting operating margins and earnings improvement in the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Wilcon Depot is ₱6.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Wilcon Depot's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₱11.3, and the most bearish reporting a price target of just ₱6.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₱38.0 billion, earnings will come to ₱2.6 billion, and it would be trading on a PE ratio of 15.2x, assuming you use a discount rate of 14.2%.

- Given the current share price of ₱9.5, the bearish analyst price target of ₱6.5 is 46.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.