Key Takeaways

- Urban growth and major property projects will enhance recurring earnings and support long-term top-line growth through increased ridership and high-margin property completions.

- Technology adoption, environmental alignment, and international expansion will drive efficiency, revenue diversification, and sustained pipeline growth beyond the core Hong Kong market.

- High capital spending, slow growth in transit demand, real estate volatility, and new mobility competition pose significant risks to profitability, revenue growth, and margin stability.

Catalysts

About MTR- Engages in railway design, construction, operation, maintenance, and investment in Hong Kong, Australia, Mainland China, Macao, Sweden, and the United Kingdom.

- Analyst consensus acknowledges the scale of MTR's rail expansion as a financial strain, but this outlook may underappreciate the potential for accelerated revenue growth and operating leverage as urbanization and population growth drive higher ridership across both new and existing lines, supporting robust long-term top-line growth.

- While the consensus narrative sees the rail plus property model as exposed to one-off property profits, analysts broadly agree on its stability and long-term value generation potential; however, this may understate the resilience and compounding effect as major upcoming property completions tied to multiple new station launches will drive sustained high-margin recurring earnings beyond initial development profits.

- MTR's rapid adoption of advanced digital technologies, AI-driven maintenance, and smart mobility solutions is poised to generate substantial improvements in operational efficiency, driving margin expansion and lowering cost growth relative to revenue over the next decade.

- The company's strong position as a leader in green mass transit and its alignment with government climate and transit investment initiatives are set to create a favorable regulatory tailwind and unlock new subsidized projects, further supporting revenue visibility and future pipeline growth.

- Strategic international expansion into Mainland China and new overseas rail markets, combined with the export of its highly profitable station commercial and retail business models, will diversify revenue streams and drive incremental earnings growth with lower correlation to the Hong Kong economy.

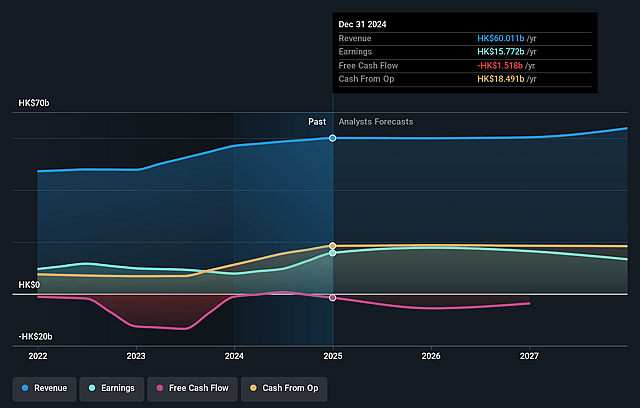

MTR Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on MTR compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming MTR's revenue will grow by 5.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 30.1% today to 18.4% in 3 years time.

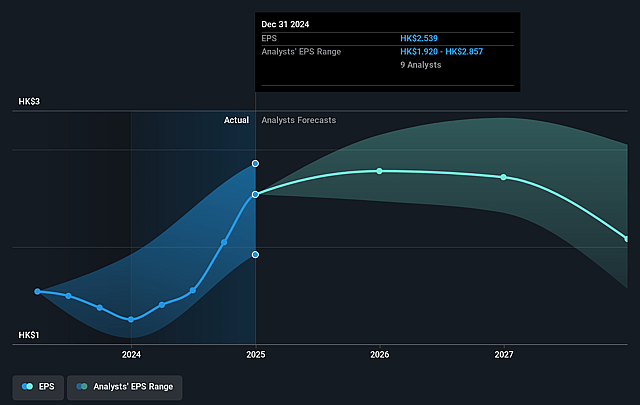

- The bullish analysts expect earnings to reach HK$12.4 billion (and earnings per share of HK$1.91) by about September 2028, down from HK$17.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 20.6x on those 2028 earnings, up from 9.5x today. This future PE is greater than the current PE for the HK Transportation industry at 13.9x.

- Analysts expect the number of shares outstanding to decline by 0.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.7%, as per the Simply Wall St company report.

MTR Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is embarking on an unprecedented investment cycle, with approximately HK$140 billion earmarked for new railway projects and HK$65 billion over five years for maintenance and upgrades, which exposes MTR to high capital expenditure, potential cost overruns and delays, and a risk of margin compression and elevated leverage that could weigh on future net profit margins and return on equity.

- Heavy reliance on the Hong Kong market and the ongoing challenges faced by Hong Kong's retail sector-as reflected by the drop in MTR mall valuations-may limit the company's ability to grow property development revenue and ancillary non-fare income, leading to greater earnings volatility and potential stagnation in total revenues.

- The normalization of flexible and hybrid work arrangements, alongside demographic headwinds such as Hong Kong's aging and slow-growing population, may structurally cap long-term ridership growth, resulting in subdued farebox revenue and dampening overall revenue growth trajectories.

- MTR's recurring profits are materially supported by property development projects whose timing and profitability are inherently volatile and subject to fluctuations in local real estate market conditions; this variability threatens earnings consistency and could create negative surprises for net profits in weaker property cycles.

- Intensifying competition from emerging urban mobility options such as ride-hailing and autonomous vehicles, coupled with rising maintenance and cybersecurity requirements for an aging network, threatens to erode market share and drive up operating costs, thereby putting sustained pressure on both system-wide revenues and operating margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for MTR is HK$32.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of MTR's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$32.0, and the most bearish reporting a price target of just HK$22.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be HK$67.4 billion, earnings will come to HK$12.4 billion, and it would be trading on a PE ratio of 20.6x, assuming you use a discount rate of 8.7%.

- Given the current share price of HK$26.66, the bullish analyst price target of HK$32.0 is 16.7% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on MTR?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.