Last Update 18 Sep 25

Fair value Increased 1.04%MTR's consensus price target saw a marginal increase, supported by a slight improvement in net profit margin and a minor decline in future P/E, indicating marginally enhanced earnings quality and value, with fair value now at HK$27.86.

What's in the News

- Board meeting scheduled to consider unaudited interim results and potential interim dividend for H1 2025.

- Entered project agreement with Hong Kong Government for financing, design, and construction of Northern Link Project (Part 1), enabling phased delivery and future negotiations for full project implementation and related property development rights.

- Ms. Jeny Yeung Mei-chun appointed CEO effective January 2026, succeeding Dr. Jacob Kam, bringing extensive company and sector experience.

Valuation Changes

Summary of Valuation Changes for MTR

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from HK$27.57 to HK$27.86.

- The Net Profit Margin for MTR has risen slightly from 18.75% to 19.34%.

- The Future P/E for MTR has fallen slightly from 18.33x to 17.96x.

Key Takeaways

- Mounting capital investments and operational complexities may pressure profitability if passenger growth and fares fail to meet optimistic expectations.

- Heavy reliance on property development profits exposes earnings to volatility from Hong Kong's housing market and demographic shifts.

- Aggressive infrastructure and property investments, international expansion, and technology adoption, backed by financial strength and urbanization trends, position MTR for sustained, diversified growth.

Catalysts

About MTR- Engages in railway design, construction, operation, maintenance, and investment in Hong Kong, Australia, Mainland China, Macao, Sweden, and the United Kingdom.

- The planned HK$140 billion in new railway investments and HK$65 billion over 5 years for maintenance signal a major long-term CapEx cycle; if passenger growth disappoints due to remote/hybrid work or population trends, revenue growth may fail to keep pace with rising debt and funding costs, compressing net margins and dampening earnings.

- MTR's dependence on property development profits for funding and earnings exposes it to Hong Kong's volatile housing market; property profit streams are inherently lumpy and at risk from population decline and stricter policies, which could cause future earnings to fall short of current expectations.

- Despite green and digitalization initiatives, the shift to ESG and advanced technology requires heavy upfront and ongoing capital input-heightened by rising interest rates and inflation-which could erode profitability and weaken free cash flow if operating efficiency gains or regulatory incentives are overestimated.

- Significant construction and operational complexity in expanding and upgrading existing lines may result in project delays, cost overruns, or extended service disruptions, leading to higher operating expenses and possible reputational damage, which would negatively impact net margins.

- With increasing adoption of remote work and aging demographics in Hong Kong, there is a risk that transit demand and farebox revenue projections are too optimistic, resulting in long-term revenue growth below current market expectations.

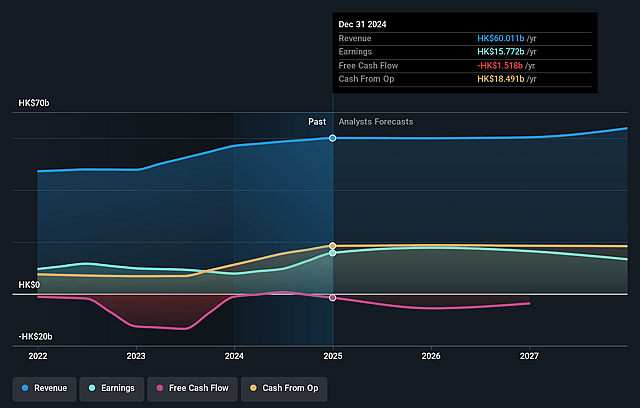

MTR Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MTR's revenue will grow by 3.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 30.1% today to 18.8% in 3 years time.

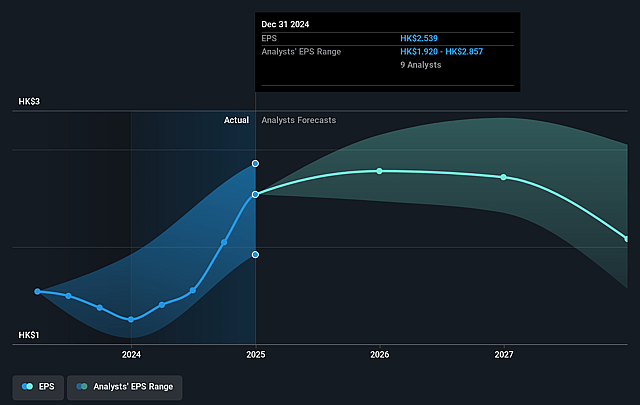

- Analysts expect earnings to reach HK$12.0 billion (and earnings per share of HK$1.9) by about September 2028, down from HK$17.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting HK$13.3 billion in earnings, and the most bearish expecting HK$8.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.3x on those 2028 earnings, up from 9.3x today. This future PE is greater than the current PE for the HK Transportation industry at 13.9x.

- Analysts expect the number of shares outstanding to decline by 0.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.81%, as per the Simply Wall St company report.

MTR Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Significant long-term investments in new rail lines (e.g., Northern Link, Tung Chung Line Extension) and ongoing property development projects are expected to increase recurring rental and farebox revenue streams, supporting higher operating margins and long-term revenue growth.

- Robust international expansion, including projects in Mainland China and Australia (e.g., Shenzhen Line 13, Beijing Line 17, Sydney Metro M1), diversifies earnings and reduces overreliance on Hong Kong, thereby improving earnings stability and growth potential.

- Continuous adoption and integration of innovative technologies (AI, digital delivery centers, drones for maintenance) are likely to improve operational efficiency, reduce maintenance costs, and enhance customer experiences, which may bolster net margins over time.

- Strong balance sheet with close to HK$90 billion in cash and undrawn facilities, a healthy net debt-to-equity ratio of 18.8%, and continued access to competitively priced capital markets provide ample financial flexibility to support future investments while controlling funding costs and safeguarding earnings.

- Supportive secular trends, such as increased urbanization, government-led infrastructure development, policies emphasizing ESG and sustainability, and rising cross-border travel between Hong Kong and Mainland China, will likely drive passenger growth and sustain long-term revenue and profit expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$27.571 for MTR based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$32.0, and the most bearish reporting a price target of just HK$22.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be HK$64.0 billion, earnings will come to HK$12.0 billion, and it would be trading on a PE ratio of 18.3x, assuming you use a discount rate of 8.8%.

- Given the current share price of HK$26.12, the analyst price target of HK$27.57 is 5.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on MTR?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.