Key Takeaways

- Lasting shifts in commuter behavior, demographics, and alternative transport threaten MTR's fare revenue, ridership growth, and ancillary income streams.

- Elevated costs and adverse policy and property trends put margin pressure on core operations, challenging the ability to offset expenses through traditional property development.

- Extensive project pipeline, innovative technologies, property income, and rising cross-boundary travel support long-term growth, diversification, and earnings resilience for MTR.

Catalysts

About MTR- Engages in railway design, construction, operation, maintenance, and investment in Hong Kong, Australia, Mainland China, Macao, Sweden, and the United Kingdom.

- The ongoing shift toward remote and hybrid work arrangements, combined with flexible schedules, threatens to fundamentally reduce daily commuter demand for MTR services, undermining the long-term sustainability of fare-revenue growth and weakening recurring cash flow.

- Accelerating adoption of electric vehicles and micromobility solutions in Hong Kong and across Asia may permanently erode MTR's mid-distance ridership base, leading to reduced passenger numbers and pressuring both transport revenue and ancillary income streams such as advertising, mall leasing, and fare integration services.

- An ageing demographic profile in core markets like Hong Kong will likely lead to a declining working-age population, capping regular ridership growth and making it increasingly difficult for MTR to achieve meaningful expansion in its core farebox revenue over the long run.

- Rising capital expenditure requirements for maintenance and asset upgrades (with HK$65 billion earmarked over five years and CapEx running at historically high levels) alongside simultaneous multi-line expansion will compress net margins and suppress future earnings, especially in a structurally slower-growth environment.

- Political, regulatory, and retail headwinds in Hong Kong-including adverse changes in fare regulation, increased government oversight, and persistent weakness in mall valuation-signal a risk of further profitability pressure, working against the property development model's ability to reliably offset rail operating costs and finance expansion, with negative implications for both earnings volatility and return on capital.

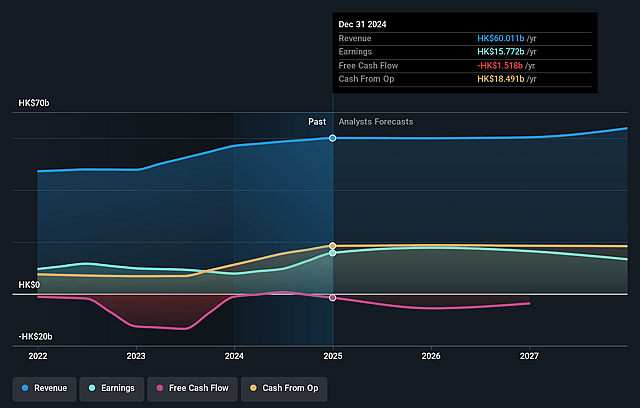

MTR Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on MTR compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming MTR's revenue will decrease by 1.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 30.1% today to 13.8% in 3 years time.

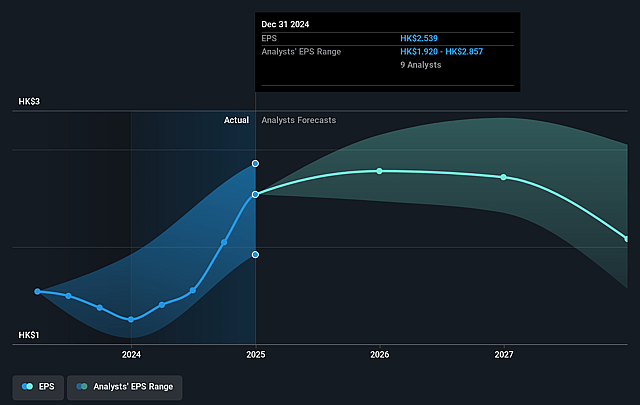

- The bearish analysts expect earnings to reach HK$7.7 billion (and earnings per share of HK$1.24) by about September 2028, down from HK$17.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 22.6x on those 2028 earnings, up from 9.5x today. This future PE is greater than the current PE for the HK Transportation industry at 13.9x.

- Analysts expect the number of shares outstanding to decline by 0.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.7%, as per the Simply Wall St company report.

MTR Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Robust pipeline of new railway projects both in Hong Kong and internationally, including the Northern Link and overseas expansions, positions MTR for long-term top-line revenue growth and geographic diversification of earnings, which may counter downward pressure on the share price.

- The integrated Rail plus Property (R+P) model continues to deliver substantial one-off property development profits and ongoing rental income, supporting higher net margins and recurring earnings over the long term, helping sustain shareholder value.

- Continued investment in innovative technologies and digital solutions, such as AI-driven maintenance, smart mobility upgrades, and new passenger services, is likely to drive efficiency gains and incremental revenue streams, thereby supporting earnings growth.

- Solid financial position with HK$90 billion in available cash and facilities and a healthy net debt-to-equity ratio of 18.8 percent provides MTR with resilience and access to low-cost capital for ongoing investment, which can help maintain profitability and weather economic cycles.

- Rising cross-boundary travel and integration between Hong Kong and Mainland China have already contributed to increased ridership and revenue growth, indicating secular demand tailwinds for MTR's core transport operations that could strengthen future revenues.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for MTR is HK$22.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of MTR's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$32.0, and the most bearish reporting a price target of just HK$22.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be HK$55.9 billion, earnings will come to HK$7.7 billion, and it would be trading on a PE ratio of 22.6x, assuming you use a discount rate of 8.7%.

- Given the current share price of HK$26.66, the bearish analyst price target of HK$22.0 is 21.2% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on MTR?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.